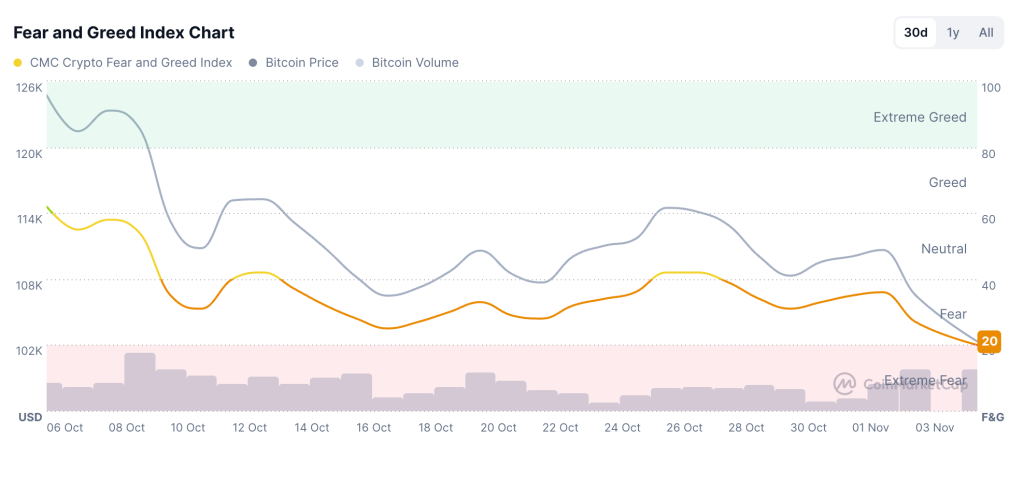

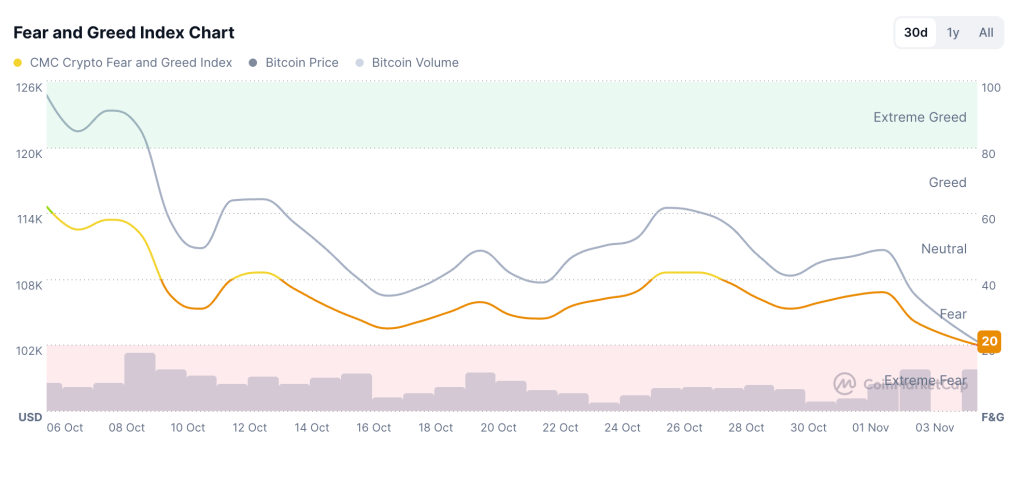

Altcoin sentiment showed partial signs of recovery today, even with a Crypto Greed and Fear Index of 20, while a few liquid names stand out from a broader, quiet market.

ZKsync, Zcash, and Astar all traded higher, supported by distinct narratives showing how the tokens can evolve beyond speculation. The moves come as the Altcoin Season Index remains subdued, near 25, indicating a selective market still shaped by Bitcoin’s dominance.

This cycle of activity shows how tokens with scalable use cases can still attract high participation even in low liquidity conditions. Traders are increasingly differentiating between assets whose economic design has been updated and those that have yet to adapt, a trend that could shape the next phase of the market.

Crypton Fear and Greed Index (Source: CoinMarketCap)

ZKsync rewrites its economic model

ZKsync’s token is up about 45% in the past 24 hours to $0.0745, thanks to a detailed proposal that would transform it from a pure governance token to one with direct economic utility.

The plan introduces on-chain interoperability fee and off-chain business licensing mechanisms, linking network activity to value accumulation via ZK redemptions, staking rewards, and controlled supply reduction.

This proposal marks a key transition for the ZKsync ecosystem, which has spent the last year maturing its Elastic Network architecture and preparing for institutional-grade deployments via its Prividium framework.

The concept connects future adoption of the network by financial institutions to the token-level economy, providing a sustainable loop where usage supports system development.

Market data indicates that the announcement led to a large increase in trading volume and social engagement. Community responses show optimism about moving from participation solely focused on governance to a model that rewards usage.

This fundamental change could be seen as a practical example of how decentralized networks can integrate real-world demand into symbolic value without deviating from open source principles.

“Thanks to governance, it can now become the heart of an incorruptible economy,” the press release reads. “Together we have the chance to define what a truly empowered community financial network looks like. »

Zcash Expands Privacy Commerce Dynamics

Zcash (ZEC) is currently trading near $461, up 13% over the past day, extending previous gains. The move is part of a broader pattern in which privacy-related tokens have attracted capital amid renewed debates over data access and financial transparency.

Recent trading shows a balanced two-way flow with stable depth, suggesting continued interest rather than short-term positioning.

Privacy assets tend to outperform during periods where regulatory discussions dominate crypto policy coverage, positioning Zcash as a hedge against stricter compliance frameworks.

Aster benefits from CZ investment

Aster (ASTER) is trading near $1.02, up about 11% in 24 hours, with the price moving away from levels from earlier in the week and falling into a short-term range that traders continue to test during business hours in Europe and the United States.

On November 2, Binance co-founder Changpeng “CZ” Zhao announced that he had acquired ASTER with his own money, sparking community interest and sparking speculation about ASTER’s potential.

For now, ASTER operates primarily in this band as a liquid altcoin with enough history and trade coverage to attract tactical flows as traders look beyond the largest pairs, while its latest move looks more like an example of how mid-cap names can capture bids once attention shifts away from strictly large-cap leaders than a case of a single stock breakout.

Market reading: selectivity defines the current cycle

The Altcoin Season Index near 25 indicates limited breadth despite the isolated strength of single tokens. Most of the sector remains secondary to Bitcoin, but selective rallies like ZKsync’s show how structural change can still disrupt and drive localized activity.

Under current conditions, traders tend to reward tokens that evolve in design or show institutional alignment rather than those that rely solely on momentum. The rise of ZKsync aligns with this shift: its tokenomics update introduces an observable framework in which company fees and activity are linked to ecosystem economics.

Projects exploring the expansion of governance or real economic loops could receive increased attention once their plans are formalized. The market is filled with fear and remains cautious, but value-backed updates, like ZKsync’s proposal, continue to shape how the next altcoin cycle could play out.

The post ZKsync Tokenomics Shift Leads Altcoin Season Pockets With Zcash and Astar In Tow appeared first on Cryptonews.