Most inexperienced investors make the mistake of believing that they are late in the game with Bitcoin. No. Fake!

Although Bitcoin is the best dog, there is still a lot of room so that it pushes and destroys the Gold market capitalization (it is a 10x gain when it happens elsewhere).

Let’s discuss two reasons why you are still an early investor in Bitcoin.

Reason # 1 Bitcoin is Gold 2.0

Bitcoin is Gold 2.0 – Its redefined currency – and everyone is trying to get a piece of pie.

Satoshi Nakamoto, the person or the group of developers who created Bitcoin envisaged the active one day by dethroning precious metals and other conventional fiduciary currencies:

“”The root problem of conventional currency is all the confidence necessary to make it work. The central bank must trust not to degrade the currency, but the history of fiduciary currencies is full of violations of this trust.“”. – Satoshi Nakamoto

Although it has increased considerably, Bitcoin remains relatively cheap, analysts predicting that it will reach more than $ 200,000 in 2025.

Reason n ° 2: a generational change in wealth now occurs

In the coming decades, millennials will become the richest generation in history. Baby-boomers are expected to transmit 68 billions of massive dollars to their children, the largest generational wealth transfer of all time.

Everyone is excited – except banks.

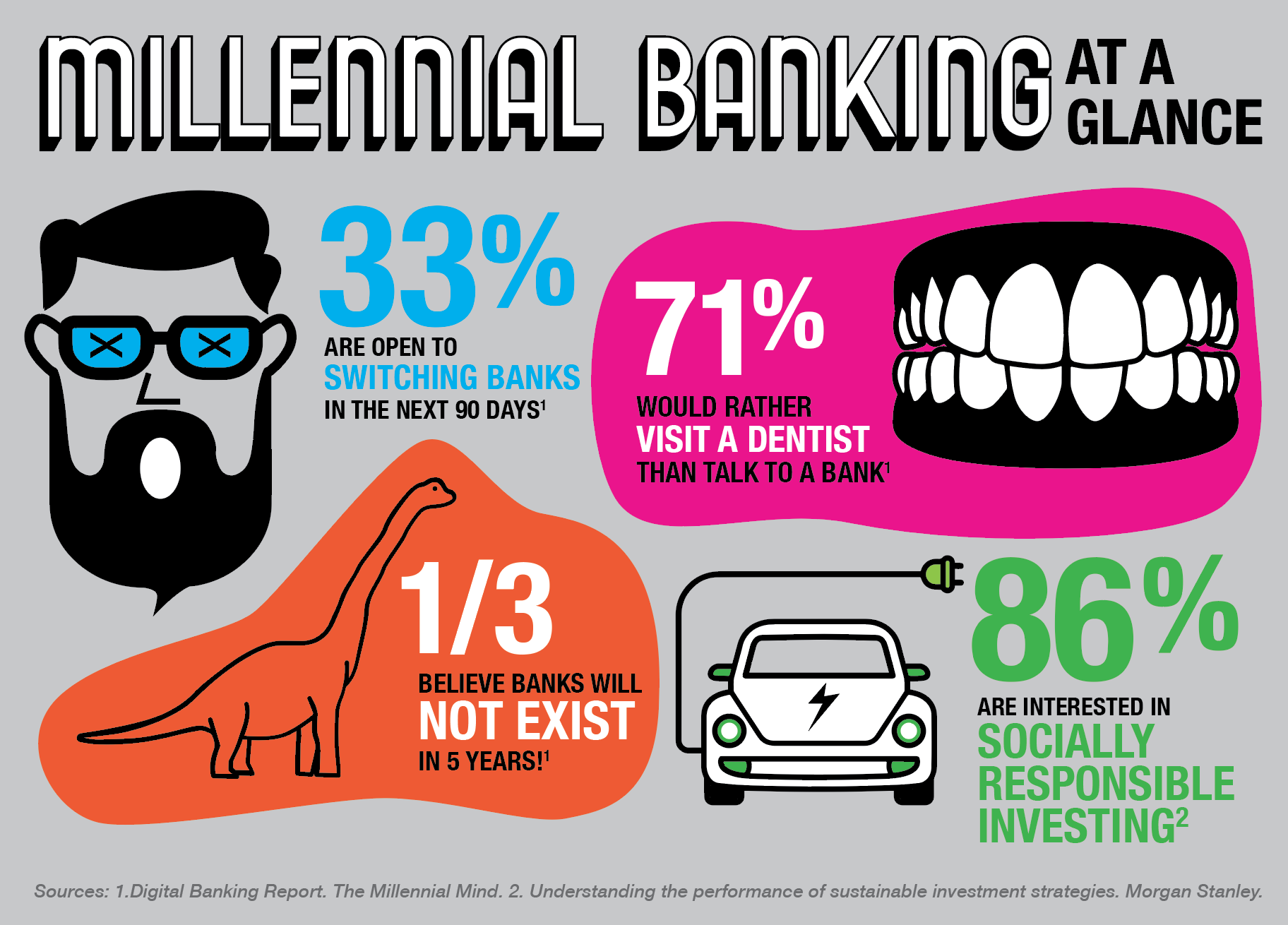

Bitcoin was created after the 2008 financial crisis due to serious mistrust in banks. Meanwhile, the millennials, the generation probably the most injured by the banks, follow suit in their distrust. According to the disturbance index of the millennium – a study of 3 years of 10,000 millennials, the majority (71%) of millennials indicated that they prefer to go to the dentist rather than listening to everything that banks have to say.

As cited in this study: “The 2008 financial crisis has been the worst financial disaster since the great depression, inflicting generalized and devastating costs for millions of American families. All in all, more than 13 billions of dollars of household wealth have disappeared, 11 million people were moved from their home and nine million Americans have lost their jobs. »»

Sorry, don’t cut it for generation Y or Gen Z. This is why a quarter of American millennials earning $ 100,000 as an individual or having $ 50,000 in investable assets hold or use cryptocurrencies.

When the generational change in wealth occurs, banks slowly incorporate cryptocurrency to appease young generations or evaporate. It may seem absurd at the moment, but the data indicate the opposite.

Here are some key questions to think about the future of Bitcoin:

- Do more cryptocurrencies get a fund checked on the stock market, which facilitates people to invest?

- Can BTC even exceed a quarter of the gold market?

- What if BTC replaces the currency of nations plagued by hyperinflation?

Final reflections on the adoption of bitcoin

The first investors of Bitcoin Tyler and Cameron Winklevoss have recently said that about the crypto: “We think it will be the most efficient asset of the current decade,” said Tyler Winklevoss in an interview with CNBC.

“”Our thesis is that Bitcoin is Gold 2.0 and will disturb gold. If he does it, he must have a market capitalization of 9 billions of dollars. We therefore think that Bitcoin could one day evaluate $ 500,000 per Bitcoin. »»

The Bitcoin growth market is massive. We are still in the days of Far West of the crypto and the blockchain.

Explore: the XRP price jumps 11% after the progression of dry crypto unit tease xrp etf

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

Most inexperienced investors make the mistake of believing that they are late in the game with Bitcoin. No. Fake!

-

An American bitcoin reserve is on the way. Michael Saylor, the fierce Bitcoin Advocate from Microstrategy, wants the United States to have the crypto game.

-

For the moment, the debate on the place of cryptocurrency in the American financial future has only just begun.

The 2 other reasons why you are an early Bitcoin investor appeared first on 99Bitcoins.