- Less than 24 hours after sparking a loss of $ 4 million in the HLP Hyperliquidal jump, the same whale merchant reappeared

- If whales can handle liquidation engines, small traders can feel disadvantaged.

The whale merchant responsible for the loss of hyperliquidal safe of $ 4 million yesterday is back in action, performing another series of leverages high on several platforms.

This time, the merchant deposited $ 4.08 million USDC in GMX. He first shortened Ethereum (ETH), but quickly closed the position and went to a long benefit of $ 177,000.

After closing the profitable GMX trade, the whale moved $ 2.3 million USDC in the hyperliquid (hype), opening a position of 25 times on ETH and a short 40x position on BTC.

The return of the same whale in such a short time raises critical questions – is it just intelligent trading or another attempt to exploit the liquidation mechanisms?

Channel data reveal a high -risk game book

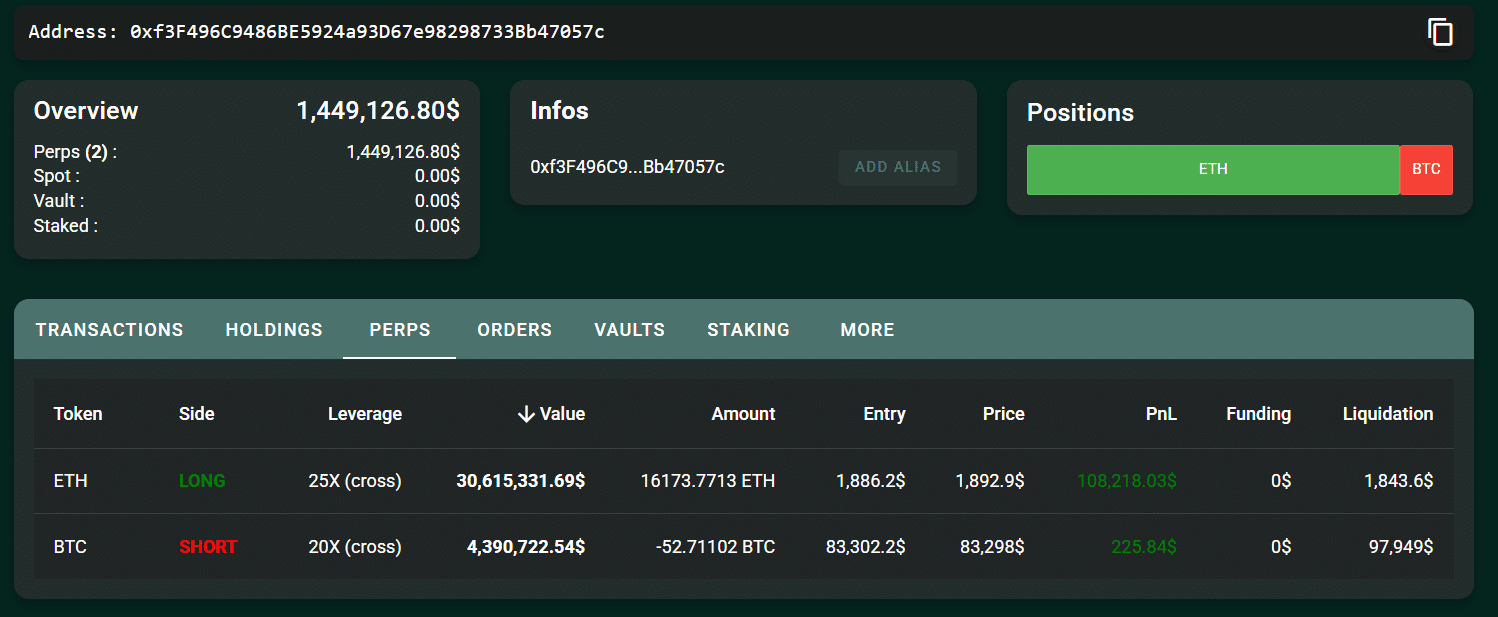

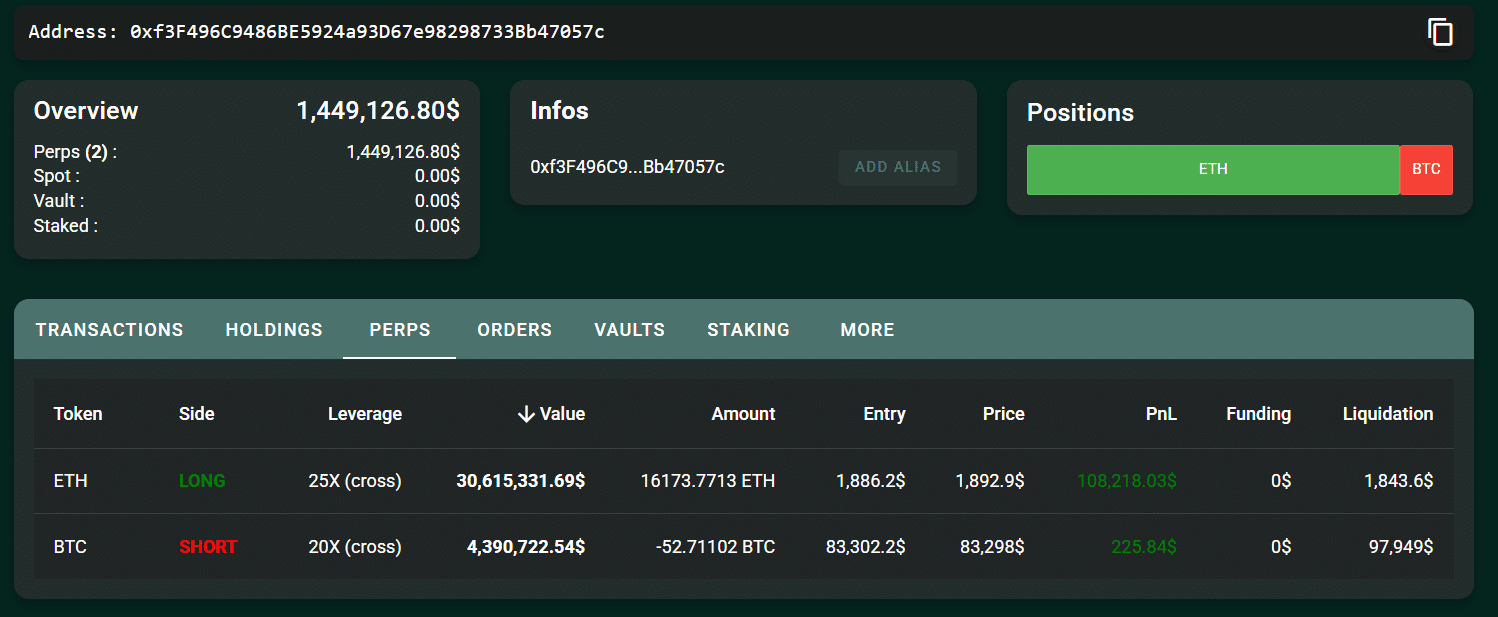

The data on the Lookonchain chain revealed the latest positions of a cryptocurrency.

The merchant recently made strategic movements on GMX and hyperliquid, taking advantage of the significant sums to capitalize on price fluctuations.

Source: GMX

On GMX, the whale initially short-circuited ETH / USD with $ 4.08 million USDC. Later, they switched to a long position, obtaining profits of $ 177,000.

In addition, on the hyperliquid, the whale opened a long ethp position with a 25x lever effect.

The size of the position is $ 30.54 million, with an entry price of $ 1,886.20. Their liquidation price is set at $ 1,804, and the profit and the press of press time was $ 35,436.05.

Source: Morurrscan

For Bitcoin (BTC), the whale took a short position with a 40x lever effect with a position size being $ 19.09 million, with an entry price of $ 83,156.45. Their liquidation price is $ 88,844 and their press time profit was $ 13,880.49.

The aggressive use by the lever merchant indicates a high -risk and high reward approach. Millions of USDCs are actively moving between GMX and hyperliquid.

Apparently, this is a sign of an optimized liquidity strategy, allowing them to quickly deploy capital and take advantage of low -cost movements.

Already seen? Same tactics, larger positions

The similarities between today’s professions and yesterday’s liquidation event cannot be ignored.

One day there is one day, this same whale withdrew the margin of the hyperliquid before the liquidation, forcing the Vault HLP to absorb the losses. The time of these withdrawals allowed the merchant to move the risk on the scholarship while going out with a minimum of damage.

Now the merchant has returned with even more important positions. This time, taking advantage of the precise input and output points.

The rapid short-to-date transitions on GMX and Hyperliquids suggest an awareness of the behavior of the liquidation engine, perhaps taking advantage of ineffectiveness in automated risk management systems.

Market analysts are now debating if it is a reproducible model.

Hyperliquid’s response to yesterday’s liquidation event included reduced lever limits – BTC transactions were capped at 40x and ETH at 25x. However, these modifications did not prevent today’s whale trades, which still reached the new authorized maximum lever effect.

Cex vs the Dex lever – who manages it better?

The CEO of Bybit, Ben Zhou, weighed on the liquidation of hyperliquid whales, highlighting a critical problem in liquidation mechanics.

“For me, it finally leads to the discussion on the lever effect, the capabilities of VS CEX to offer a low or high lever effect.”

Zhou stressed that this problem was not exclusive to hyperliquid. In fact, CEX and DEX exchanges face the same challenge during large -scale liquidation management. Although the drop in leverage can be an effective solution, Zhou said it could be bad for business.

“CEX or DEX In this case is faced with the same challenge, our liquidation engine also takes control of the entire position when the whales are liquidated. I see that HP has already lowered their overall lever effect; It is a way of doing so and probably the most effective, however, this will harm activities because users would like a higher lever effect. »»

Source: X

Chain analysts have joined the discussion, agreeing that reducing the lever effect is an easy short -term corrective while highlighting the greater image problem.

“The real question is whether a DEX can never support a high lever effect in a sustainable way without implementing CEX surveillance and risk monitoring controls. The limits of open interest, market surveillance and innovation of liquidation mechanisms could help, but each of these hyperliquid (or all DEX) movements closer to the centralized risk management book. »»

The confidence of the hyperliquid shook?

The impact of whale liquidations is already felt through the hyperliquid ecosystem.

Dune Analytics data revealed that hyperliquid experienced net outings of $ 166 million on March 12, the same day, the whale position was liquidated.

The merchants and the chiefs of the industry now discussing the future of the Levier Dex, Hyperliquid effect faces a critical decision.

As Ben Zhou said,

“It would be interesting to see how it develops, perhaps a new innovation on the liquidation mechanism?”