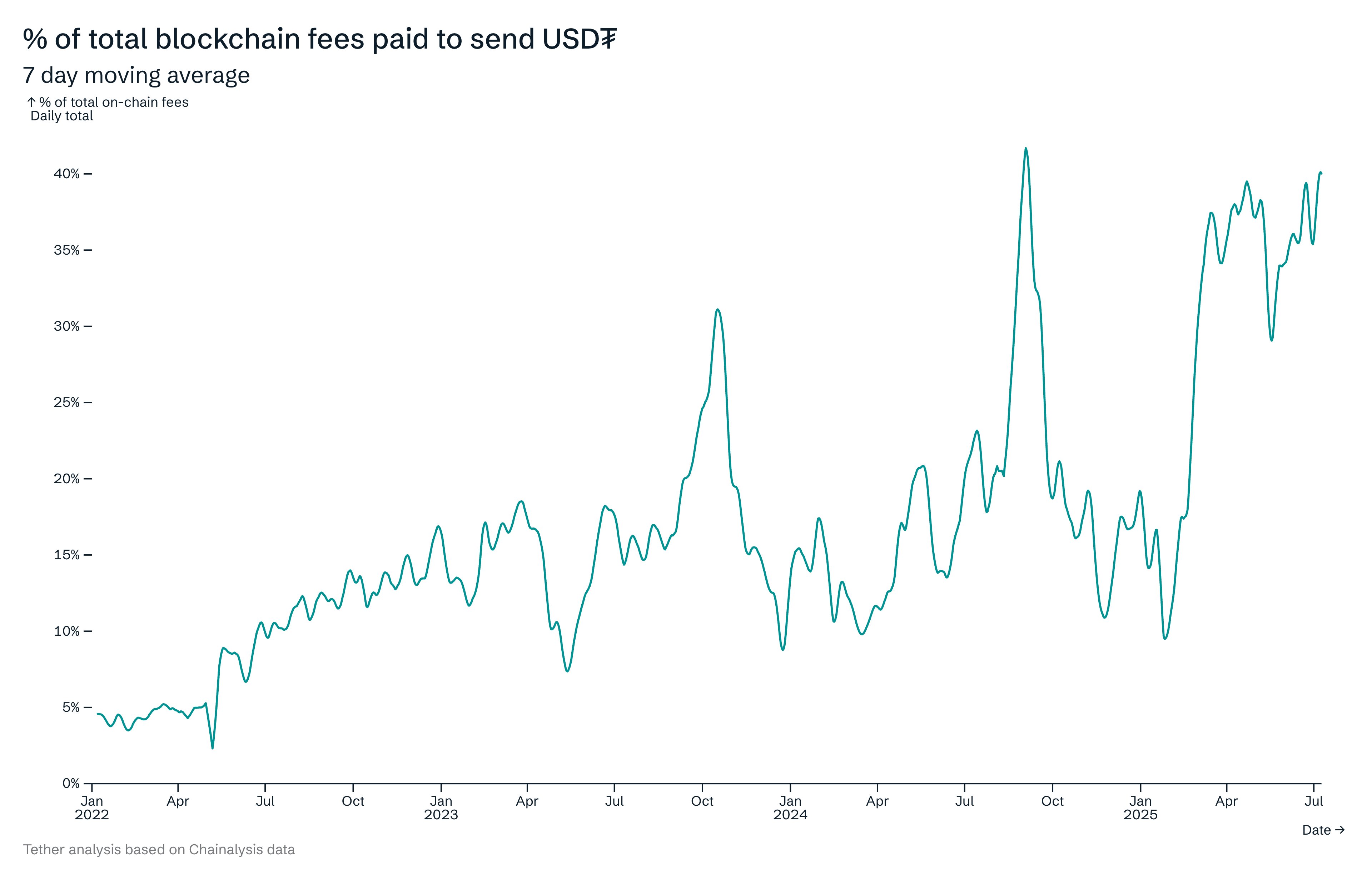

The CEO of Tether, Paolo Ardodino, revealed 40% of all the costs that users pay on large blockchains are spent to move USDT.

USDT transfers compensate for a significant part of network fees

In an article on X, Paolo Ardoino shared the latest data related to USDT’s transfer costs on the main block channels. The transfer costs here naturally refer to the amount that sender must attach with their network transactions as a reward for validators.

You will find below the graphic shared by the CEO of Tether which shows the trend of the percentage of these transfer costs that users on the main networks pay to make USDT transfers.

The 7-day moving average value of the metric appears to have climbed up in recent months | Source: @paoloardoino on X

Nine networks are included here: Ethereum, Tron, Toncoin, Solana, BSC, Avalanche, Arbitrum, Polygon and Optimism. According to the graph, it is visible that the share of the average mobile costs of 7 days of USDT transfers through these channels recently reached the 40%mark.

The use of costs can be used as a proxy for transaction activity, so this high share would indicate a strong interest of users in the stablecoin of Tether. “Hundreds of millions of people on emerging markets use Tether’s digital dollar daily to protect their families against local inflation and the devaluation of their national currencies,” notes Ardoino.

On most networks, the transfer costs are paid using the native token of the chain, even when the transaction involves a secondary part. For example, ETH is necessary to perform any type of transaction on the Ethereum network.

Since stablecoins like USDT operate on blockchains like these, sender must also have the main token of the network to participate in transfers related to them. Among the channels included in the above data, however, there is an exception: Tron.

This year, the blockchain has launched a feature that allows users to pay gas fees in other tokens, including USDT. Consequently, Tron has established itself as the dominant network with regard to the supply of the number one stablecoin.

“Blockchains that will focus on lower gas costs, allowing them in the USDT takes control of the world,” said Tether CEO.

In related news, the volume on chain associated with all stablecoins recently set a new record, as the supplier of institutional challenge solutions Sentora in a post X pointed out.

The trend in the volume associated with the different stablecoins | Source: Sentora on X

As displayed in the above graph, the combined monthly transaction volume of Stablecoins crossed 1.5 billion of dollars last month, which is a new summit of all time (ATH).

Ethn price

At the time of writing this document, Ethereum is negotiated about $ 3,600, down more than 4% in last week.

The price of the coin appears to have recovered a bit since its low | Source: ETHUSDT on TradingView

Dall-e star image, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.