Ethereum has officially fallen below key support levels and market sentiment is rapidly deteriorating as major assets across the crypto landscape continue to decline. Analysts are increasingly calling for the arrival of a new bear market, noting that Bitcoin and major altcoins have lost critical technical zones that previously held the broader structure. ETH, now trading at multi-month lows, is feeling the full brunt of cascading liquidations, heavy selling volume, and loss of investor confidence.

Related reading

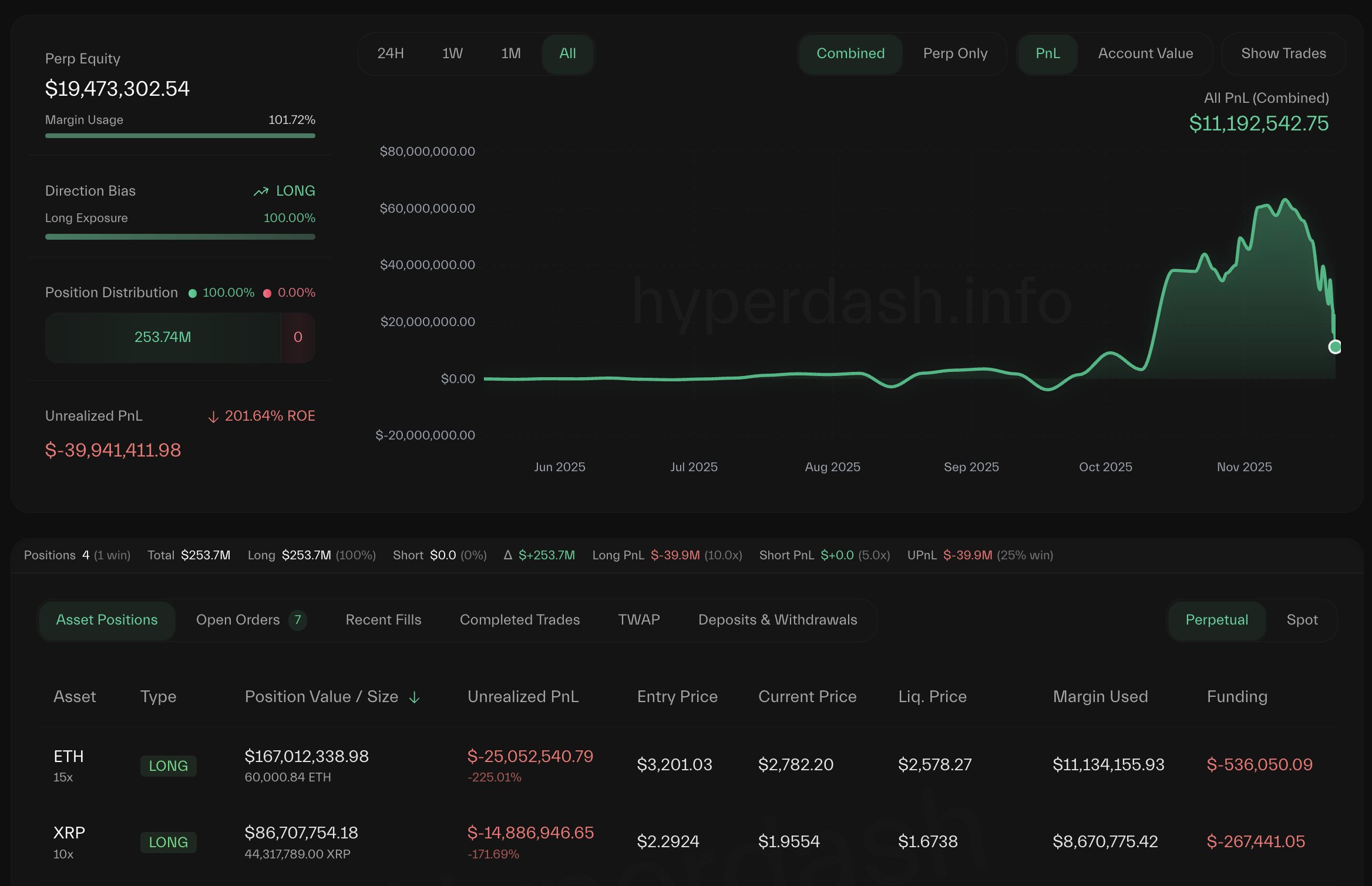

Adding to the growing uncertainty, Lookonchain reports a striking development: in just 10 days, more than $61 million in profits disappeared for a well-known market player, often referred to as the Anti-CZ whale.

This trader had previously gained attention for aggressively opening shorts immediately after CZ purchased ASTER – a move that largely paid off until the recent violent downturn reversed his fortunes.

Collapse of unrealized profits from anti-CZ whale adds pressure

According to Lookonchain, the trader known as Anti-CZ whale took a major hit during the latest market downturn – and Ethereum is at the center of the damage. Just 10 days ago, this whale had racked up nearly $100 million in total profits on Hyperliquide, largely fueled by aggressive positions built during periods of high volatility.

However, as the crypto market corrected sharply, his oversized long positions in ETH and XRP backfired. The result was a sharp fall: its total profit is now down to just $38.4 million, erasing more than 60% of the gains in less than two weeks.

This spectacular reversal reflects the misfortune of more than one trader: it signals the extent of the pressure weighing on Ethereum. As ETH continues to fall and investor confidence deteriorates, even the most experienced players are struggling to deal with the volatility. The rapid erosion of whale profits highlights how quickly bullish conviction can change when key support levels fail.

For Ethereum, maintaining the current zone is crucial. The price action has already inflicted considerable pain on long-term security holders, short-term security holders and leveraged players. If ETH permanently loses this support, the next wave of forced selling could compound losses and accelerate the broader market capitulation.

Related reading

ETH Price Analysis: Testing a Major Weekly Support Zone

Ethereum entered a critical phase on the weekly timeframe, with the price retreating sharply towards the $2,680 region – a level that now constitutes the last significant support before a deeper market collapse. The chart shows a strong rejection from the $4,500 area at the start of this quarter, followed by a sustained series of lower highs and lower lows, confirming a medium-term downtrend.

The 50-week moving average has been decisively lost, and ETH is now directly above the 100-week moving average, a level that has historically acted as a key pivot during major market corrections.

Volume increased during the recent decline, highlighting an environment driven by fear and forced selling rather than controlled profit-taking. This is consistent with broader market conditions, where liquidity is low and volatility remains high among the majors. A clear break below $2,650 would open the door to a retest of the $2,300-$2,400 zone, which has served as a strong buildup in previous cycles.

Related reading

However, the weekly chart also shows ETH entering a historically oversold zone, similar to mid-2022 and late 2023, where reversals finally formed after weeks of squeeze. For now, Ethereum must hold above this weekly support to avoid a deeper retracement and preserve the structure necessary for a possible recovery.

Featured image from ChatGPT, chart from TradingView.com