Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

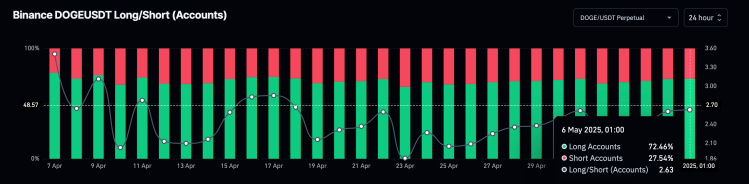

Despite the price of Dogecoin in difficulty and recently falling, it seems that investors are always very optimistic on the memes piece. This is attested by the fact that there are now a large majority of crypto traders who choose to bet on a resumption of the medal of the same rather than decline more. This is mainly visible in Binance, which is the largest exchange in the world, seeing a sharp drop in short accounts in favor of traders who are long on Dogecoin.

72% of binance merchants are optimistic

According to Coringlass data, there are currently more bulls with regard to the price of Dogecoin compared to bears. The long / short ratio on the website helps to trace where cryptography traders look at and how they place their bets. Using percentages, it shows how the vast majority bets with regard to any coin and exchange, and for binance, the results have shown more long than shorts.

Related reading

Currently, of all the bets open on Dogecoin on the Binance Crypto Exchange, 72.46% are long when writing this article. This leaves only a percentage smaller by 27.54% of merchants who are short. On this account, it shows that the increase is increasing from the medal of the same.

Interestingly, this feeling of feeling seems to be mainly located in the exchange of Binance. Looking at the broader long / short ratio for Dogecoin, there are even more shorts than long. Total exchanges figures amounts to 51.86% of all bets opened on the market currently short, reaching more than $ 1.15 billion at the time of writing this. On the other hand, only 48.19% of open bets are in favor of long, reaching less than $ 1.1 billion.

This gap, although it is quite small, shows that the sellers still dominate the market now. This would explain the drop in the price of Dogecoin despite the daily volume of negotiations exceeding $ 700 million.

Can the price of Dogecoin recover?

The interest opened with regard to Dogecoin is still quite low, because traders are more carefully negotiated at the moment. This has followed the drop in prices and the feeling of fear that has grasped the market. However, times like these are generally when inversions begin, many do not expect it.

Related reading

A crypto analyst also pointed out that the Dogecoin price is formed a strong ascending corner model. Now, if this model is finished, it could put the same piece on the path of a sustainable rally. The objective of this was placed at $ 1,161, which means that the analyst expects the price of Dogecoin to explode more than 580% here.

Dall.e star image, tradingView.com graphic