This article is also available in Spanish.

Bitcoin hit new all-time highs on election night, reaching a staggering $75,300 as market excitement reached fever pitch. This step pushed Bitcoin towards price discovery, triggering large liquidations on trading platforms.

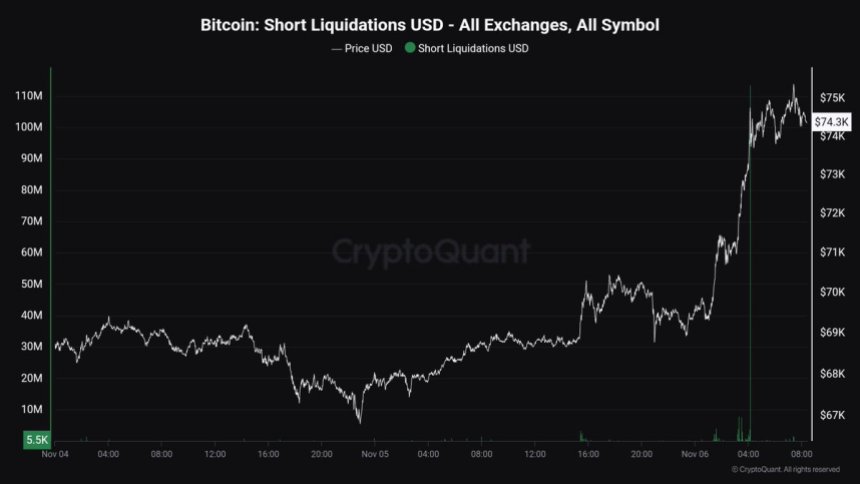

Data from CryptoQuant reveals an unprecedented surge in short-term liquidations, surpassing $100 million in a single one-minute candle, marking a historic moment for BTC.

This explosive price action was fueled by Trump’s surprise victory in the US election, which appears to have sparked renewed enthusiasm for crypto assets as investors react to potential upcoming economic policies. The election result sent shockwaves through the market, with Bitcoin leading a new rally in the crypto space.

Related reading

Now in uncharted territory, Bitcoin’s move above $75,000 represents a powerful statement of investor confidence despite broader economic uncertainties. As BTC enters price discovery mode, traders and investors are bracing for greater volatility, while many predict this momentum could extend to even higher highs.

The next few days will be critical as Bitcoin price action continues to cause selloffs and shape the outlook for the market as a whole.

Bitcoin’s bullish phase begins

Bitcoin has officially entered a bullish phase, setting new all-time highs following Donald Trump’s election victory. As a known crypto supporter, Trump’s victory boosted market optimism, pushing the price of BTC above previous ATHs in a surge that began as election results favored his lead.

This bullish breakout was accompanied by a dramatic liquidation spike, signaling strong buying pressure as bearish bets were quickly unwound. Data from CryptoQuant analyst Maartunn shows that short-term liquidations surpassed $100 million in a single one-minute candle – an unprecedented event that highlights the power behind this rally and suggests that momentum Bitcoin bullishness is only just beginning.

In the coming days, volatility will remain high as global markets digest the election result and prepare for the Federal Reserve’s upcoming interest rate decision on Thursday. Investors expect a dynamic market response, with possible ripple effects across traditional and crypto markets.

If the Fed keeps rates steady or makes dovish adjustments, it could further strengthen Bitcoin’s rally and strengthen the broader crypto market.

Related reading

The outlook remains optimistic as market sentiment shifts positively with the new phase of Bitcoin price discovery. Although short-term fluctuations are likely amid these major events, the long-term view favors an uptrend as Bitcoin leads the crypto market higher in this new post-election environment.

BTC visits uncharted territory

Bitcoin is trading at $73,800 after breaking its previous all-time highs and hitting a new high of $75,300. This breakout pushed BTC into uncharted territory, a phase that historically signals massive gains as bullish momentum builds.

At stake is whether Bitcoin can sustain its momentum above the previous ATH of $73,800, a critical support level that could propel it to new highs if successfully sustained. However, the timing of this decision corresponds to a particularly volatile week, as the market anticipates the next meeting of the Federal Reserve.

The Fed’s interest rate decision could introduce significant unpredictability, potentially moderating BTC’s rise or even pushing it below $70,000 if the outcome deviates from market expectations. As BTC goes through this price discovery phase, investors are closely watching key levels.

Related reading

A hold above $73,800 would reinforce the bullish narrative, while any pullback would test support levels and investor resilience amid broader market uncertainty. With the expected volatility, this week could be crucial for Bitcoin’s trajectory in the months to come.

Featured image of Dall-E, chart by TradingView