Under the previous UK Conservative government, it was expected that regulations relating to stablecoins and cryptocurrency staking would now be in place. The new Labor government wants to give more space to innovation and is therefore not prioritizing stablecoin legislation. This is according to a speech delivered this week by the Economic Secretary to the Treasury, Tulip Siddiq. All crypto regulations will happen in one phase. Today the Financial Conduct Authority (FCA) published a consultation roadmap which indicates the legislation will come into force in 2026, likely later that year. The FCA also published the results of a recent crypto survey.

Despite a single goal of commissioning, consultations are divided into four groups. Discussion papers on admission, disclosure and market abuse are expected this term, with a consultation in the third quarter of next year.

As part of a blog post, the FCA raised the challenge of how decentralized issuers are supposed to disclose data. It is likely that crypto exchanges will have to provide information to their customers based on publicly available data. It’s not a bad plan. Since tokens will want to be listed on exchanges and exchanges will not want to do a lot of work, there is a good chance that decentralized projects will ensure adequate data is available.

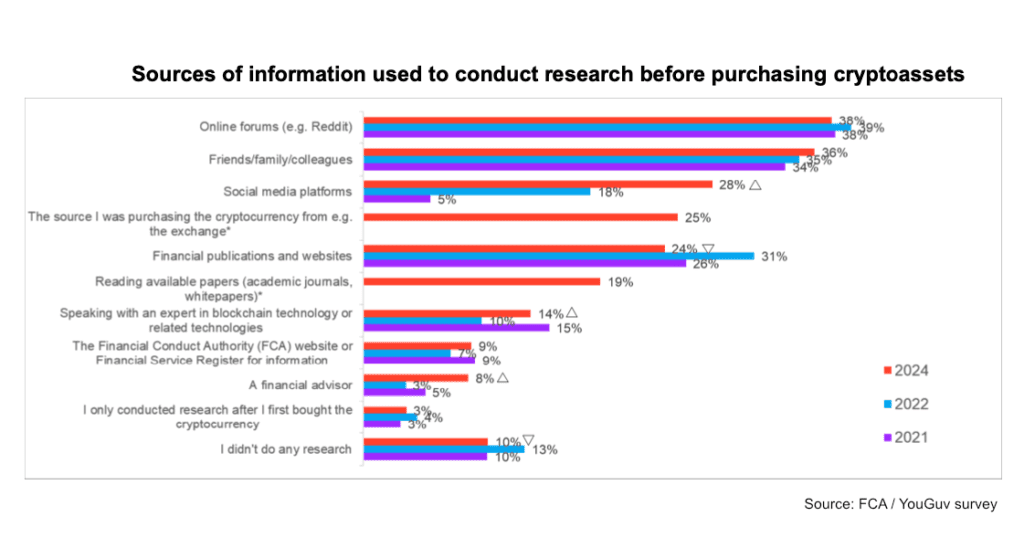

That said, the crypto survey found that exchanges are only the fourth largest source of research. Online forums come first, then friends and family, followed by social media.

The other three sets of discussion and consultation documents are intended to:

- Trading platforms, intermediation, lending, staking and prudential exposures

- Stablecoins, custody and prudential (capital, liquidity, risk management)

- Firm conduct and standards for regulated activities.

Crypto Survey Results

The YouGuv survey found that 12% of UK adults now hold cryptocurrencies, up from 10% in 2022. The average value of cryptocurrencies held by investors increased from £1,595 to £1,842. Around a third of people believe they can complain to the FCA if something goes wrong, even though crypto is unregulated.

Advertising is moderately effective. 60% of those who saw an ad said it had no impact. Only 2% who had not previously considered purchasing subsequently purchased, and another 10% were already thinking about it. The ad managed to discourage 9% of viewers.

Bitcoin was recognized by 78% of people, Ethereum by 31% and Dogecoin by 30%. There is then a big drop with Solana at 11% and TRON at 10%. This includes people who are not crypto investors. When the sample only takes into account those who already hold cryptoassets, Ethereum and Dogecoin fell only slightly behind Bitcoin.