The cryptocurrency market has taken a hit, total market capitalization fell by 3.64% since January 22, 2025. Altcoins experienced a decrease of 2.72%, and market capitalization excluding the ten most high dropped 5.2%. In the past 24 hours, the main cryptos have been in the red: Bitcoin and Ethereum are down 3%each, XRP by 2%, Solana by 2.5%, BNB of 1.9%, Dogecoin of 3, 5% and cardano of 3.5%.

Let us explore the key factors of this market crisis.

Key reasons behind the last sale of crypto

No Trump crypto speeches

The cryptographic community had high expectations for the inaugural speech of former president Trump, hoping that he would reveal plans for a bitcoin reserve. Instead, Trump avoided any cryptocurrency mention, leaving disappointed amateurs.

On a brighter note, the American Commission for Securities and Exchange (SEC) announced a cryptographic working group. This decision aims to create a clearer regulatory framework for industry, offering a small but important not forward.

Impact of the rise in rates of the Banque of Japan

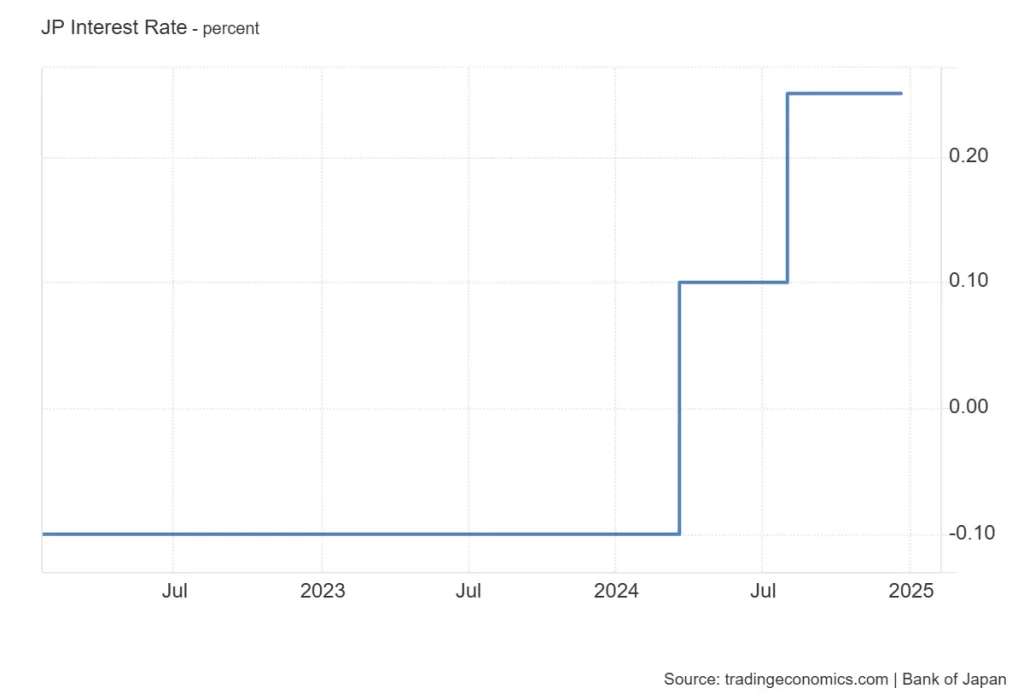

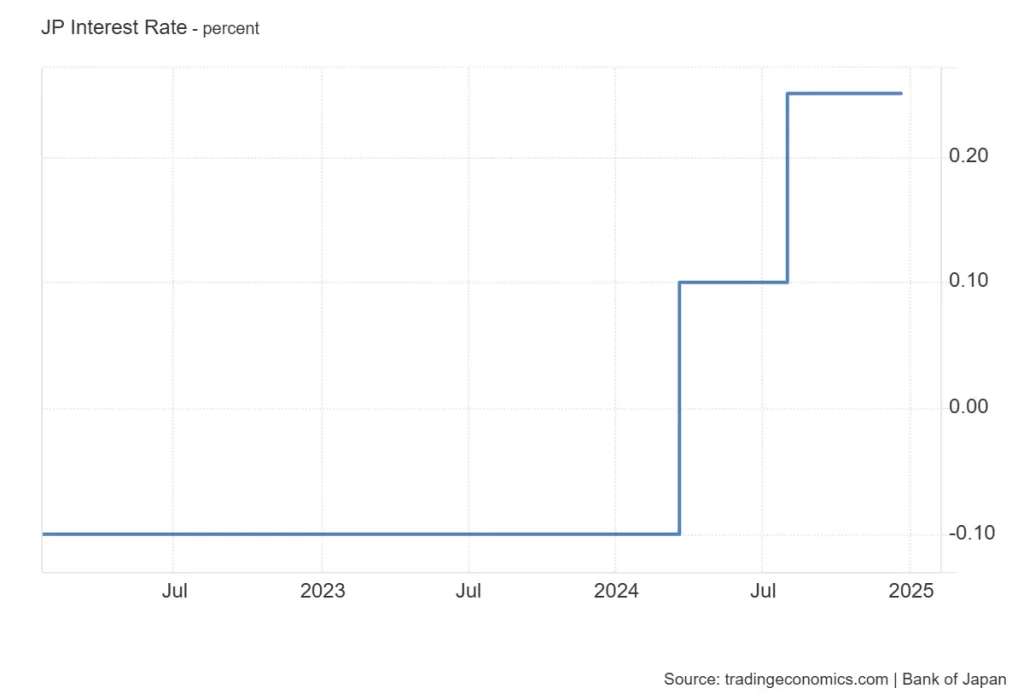

The Bank of Japan could increase interest rates by 25 basic points to 0.5% – a significant leap compared to its current 0.25%. This would mark the highest rate in almost two decades. Japan started 2024 with rates of -0.1%, increased them to 0.1% in March and 0.25% in July. If the expected hike materializes, it could have implications on the world market.

Meeting of the American Federal Reserve

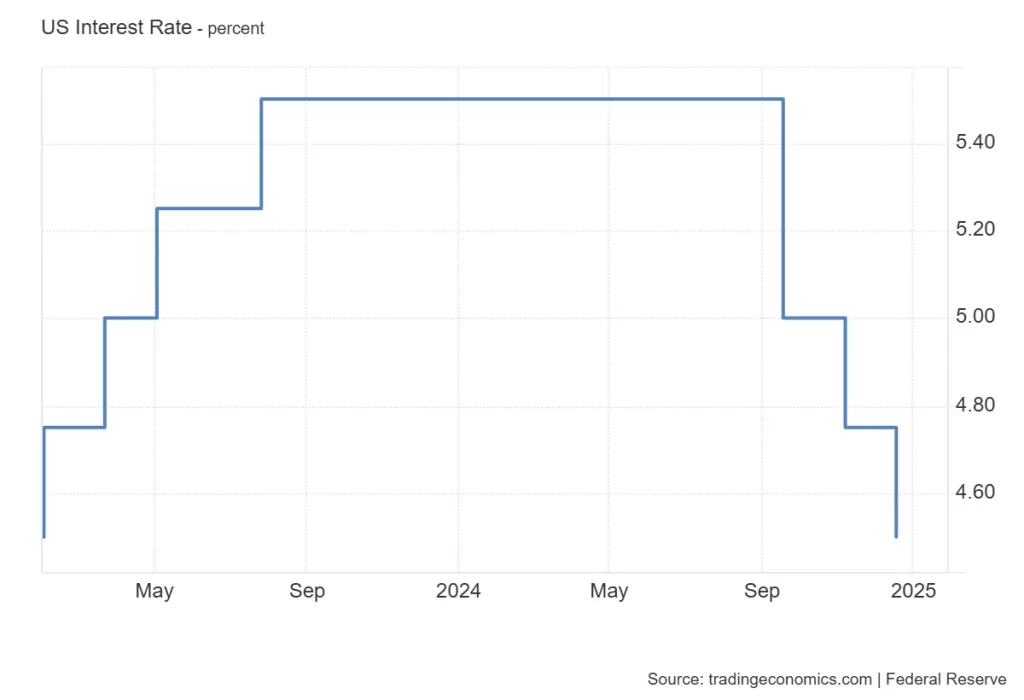

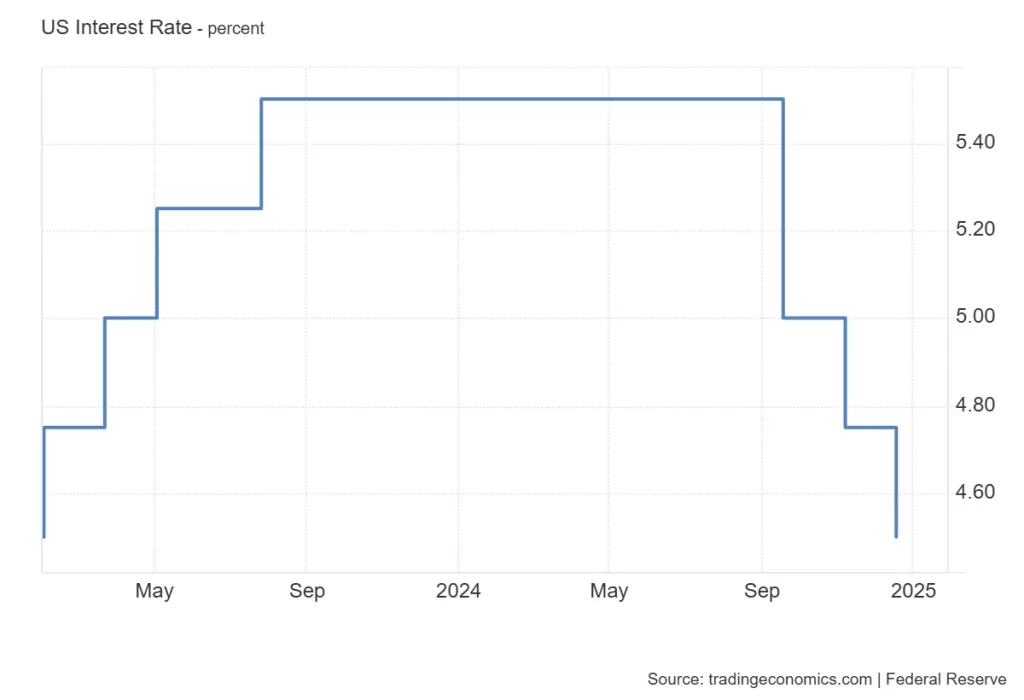

It is unlikely that the American federal reserve reduces interest rates at its meeting on January 29, despite the signaling of two potential reductions in 2025. Last December, the Fed reduced the 25 basis points to a Fork from 4.25% to 4.5%. However, with the American economy showing signs of weakness, additional cuts this year seem outside the table.

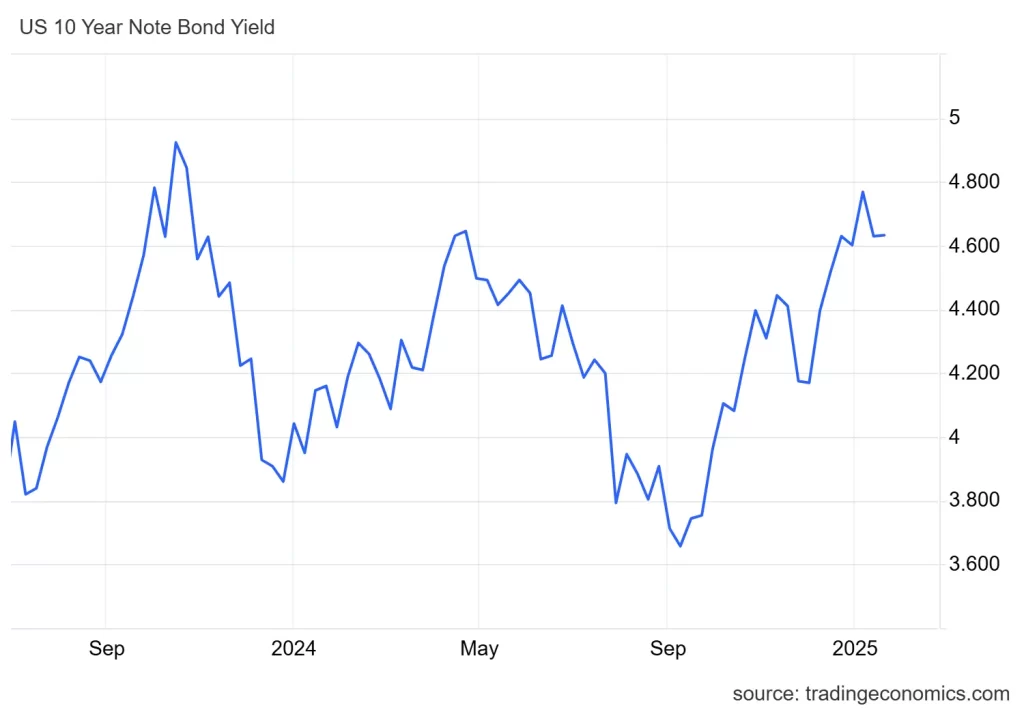

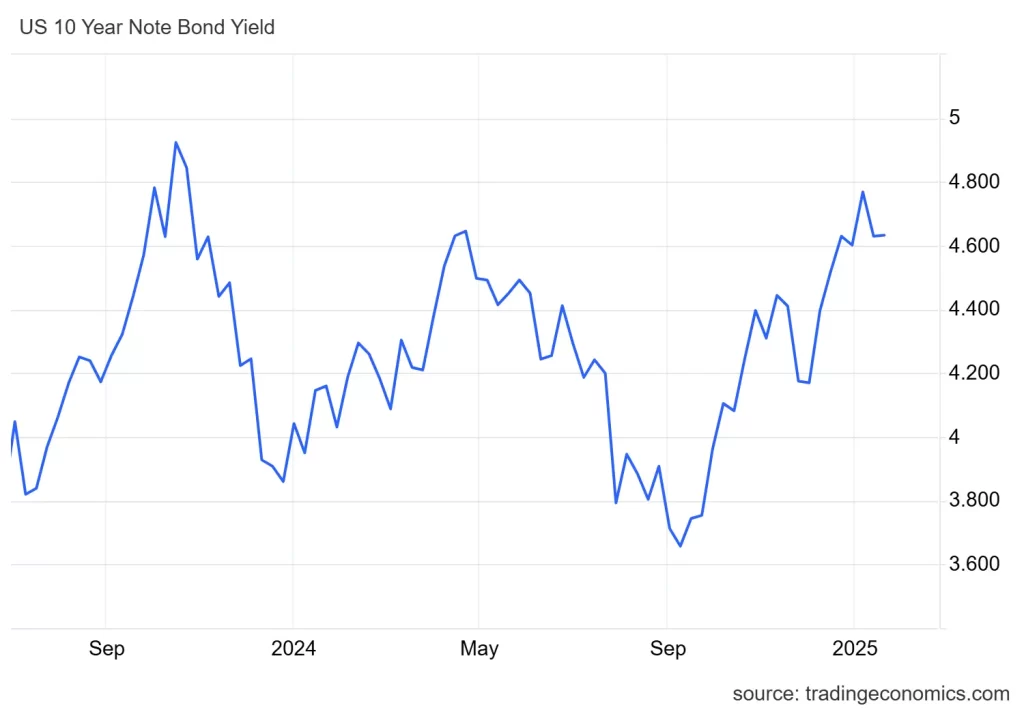

US dollar index and treasury yields

The US dollar index has climbed 4.16% since November 5, from 103.901 to 108.227.

Likewise, the performance of the bonds of the treasure at 10 years reached 4.6357% on January 6, the highest level since April 2024. Although it has faced some pressure earlier in January, the yields tend In the increase since mid-house, the additional subsequent markets.

- Read also:

- Donald Trump’s executive order to come and come soon: here is what to expect

- ,,

Expiration of BTC and ETH options

The expirations of future options add to the instability of the market. A total of 29,000 Bitcoin options (worth $ 3 billion) and 169,000 Ethereum options (worth $ 0.5 billion) should soon be expired, which expresses additional pressures on prices .

Difficult time for crypto?

The recent sale of crypto reflects a mixture of macroeconomic challenges, political and pressures specific to the market such as the expiration of options. While Bitcoin, Ethereum and other cryptos are fighting in the middle of these uncertainties, investors must closely monitor regulatory updates, interest rate decisions and market trends.

Stability can only come back with improved macro-waonditions or renewed institutional confidence.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends