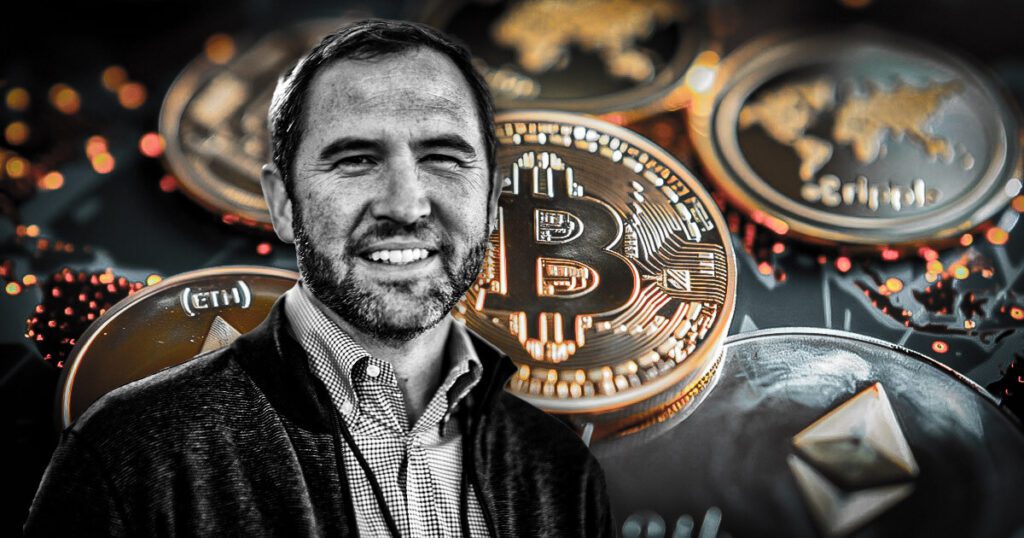

The CEO of Ripple, Brad Garlinghouse, is optimistic about the progression of cryptographic regulations in the United States after having engaged with legislators in Washington, DC

In an article of February 13 on X, Garlinghouse shared that he had met several decision -makers in Washington, DC, including the Senators Tim Scott and Chuck Schumer and FRENCH Hill, Ritchie Torres and Bill Huizega.

According to him, Reunion highlighted a rare opportunity to advance bipartite law which could create a well -defined regulatory framework for digital assets.

Garlinghouse has described discussions as promising, noting that legislators seem more open to regulations that support innovation while ensuring market stability.

Growing push for regulatory clarity

Garlinghouse’s declaration echoes the general feelings of the cryptography industry, where the main stakeholders believe that the administration of President Donald Trump will inaugurate a new era of development and progress in the emerging sector.

In addition, legislative efforts to establish simpler cryptography laws have grown, recent political movements indicating an evolution towards structured surveillance.

Congress has already taken measures to cryptographic regulations, in particular in the stable sector. The House of Representatives advances the transparency and responsibility of the stablescoin for a better law on the economy of the big book (stable), while the Senate works on the law on guidance and the establishment of national innovation for American stables (genius).

These bills offer license granting requirements, risk management strategies and asset reserve rules for stable issuers. However, the final result remains uncertain.

Meanwhile, regulatory organizations such as the American Commission for Securities and Exchange (SEC) and the Commodity Futures Trading Commission (CFTC) also work on executives to balance economic growth with market integrity.

This is highlighted by the main nominations of Trump staff of pro-Crypto individuals to direct the agencies. Former Commissioner Paul Atkins was exploited to direct the dry, while Brian Quintenz was selected to direct the CFTC.

Mentioned in this article