Este Artículo También is respondable in Español.

Ethereum has a hard time below the $ 2,800 mark for weeks, unable to recover it as a support and to trigger a recovery gathering. This level of critical resistance maintained the bulls at a distance, leaving the action of stagnant prices and fueling negative feeling on the market. Analysts call for a downward continuation, citing Ethereum’s inability to unravel the key supply areas. The broader uncertainty of the market and the persistent sales pressure have only added to concerns, which makes investors more and more cautious about the short -term prospects of Ethereum.

Related reading

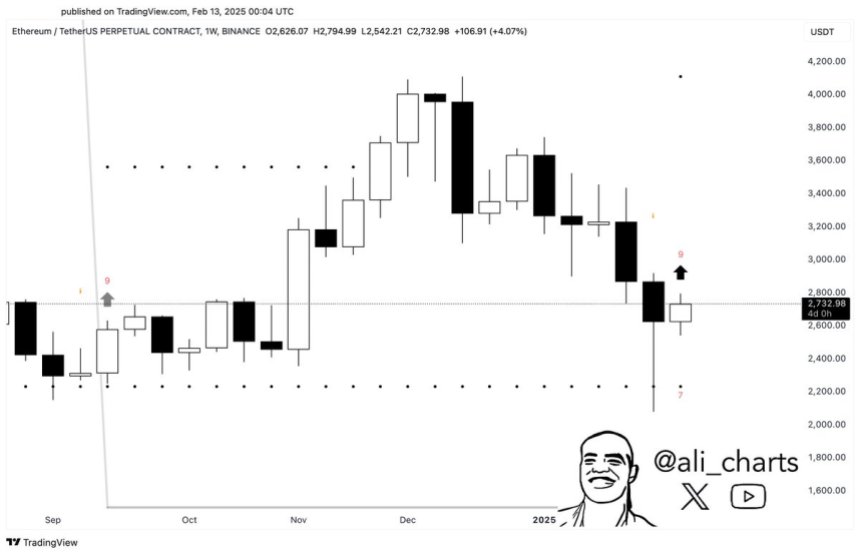

However, not everyone is lower. Some investors remain optimistic that Ethereum could soon enter a recovery phase. High -level analyst Ali Martinez recently shared a technical analysis revealing that Ethereum could show signs of a potential rebound. Martinez noted that the TD sequential indicator – A tool widely used to identify potential trend reversals – has flashed a purchase signal on the weekly graphic. This indicator, known for its precision in the moments of exhaustion of trends, suggests that Ethereum could approach a turning point.

While Ethereum is consolidated at the current levels, the coming weeks will be crucial to determine its next movement. Will the purchase signal lead to a rally, or will the lower feeling dominate? For the moment, all eyes are on the $ 2,800 mark and Si Ethereum can recover it.

Ethereum is preparing for a rebound

After the spectacular sale of last week, Ethereum went from $ 3,150 to $ 2,150 in less than two days, shaking the confidence of investors and leaving the agitation market. Although the price has since been awarded, raised in the range of $ 2,600 to $ 2,700, Ethereum had trouble recovering the levels of key offer, keeping the alive feeling. The path to recovery remains difficult, the ETH needs to exceed the $ 3,000 mark to report a reversal of the current downward trend.

The superior analyst Ali Martinez gave a certain hope to the Ethereum bulls, sharing positive data on X which suggest that a potential rebound could be on the horizon. According to Martinez’s technical analysis, Ethereum shows recovery signs because the TD sequential indicator flashes a purchase signal on the weekly graph.

The TD Sequential, a very respected tool in technical analysis, is specifically designed to identify the moments of trend of trends and the price reversals of the signal potential. A purchase signal on the weekly graph is a particularly strong indicator, which suggests that the ETH could approach a critical turning point.

Related reading

If Ethereum manages to exceed the $ 3,000 mark and recover it as a support, it would confirm a trend reversal and could trigger a rally at higher price levels. However, until this key level is violated, the uncertainty remains and that the downward pressure could still dominate. For the moment, the market is looking closely to see if Ethereum can capitalize on these positive signals and regain its place. The coming weeks will be crucial to determine if the ETH can shake its downward trend and go back to recovery.

Eth Prix of the Crucial Offer

Ethereum is currently negotiating at $ 2,695, consolidating after days between $ 2,525 and $ 2,795. The market remains undecided, with bulls and bears awaiting a break in both directions. The bulls face the critical challenge to recover the level of $ 2,800 as a support to gain momentum and push the price to $ 3,000. A move above $ 3,000 would confirm a recovery rally and potentially mark the start of a bullish phase for Ethereum.

However, current price levels are crucial to maintain a recovery phase. Supporting the level of support of $ 2,600 is essential for bulls to strengthen confidence and attract more purchase pressure. The loss of this level could disrupt the recovery momentum and trigger a deeper correction, pushing the ETH in lower demand zones which could see it retests the levels of less than $ 2,500.

Related reading

The next few days will be essential for the short -term management of Ethereum because it continues to hover key levels. If the bulls succeed in recovering $ 2,800 and pushing over $ 3,000, this could arouse a renewal of buyers’ interests and fuel a rally in higher supply areas. Conversely, non-compliance with current levels could give bears the upper hand, resulting in an increase in sales pressure and new price reductions. For the moment, Ethereum remains in a phase of critical consolidation.

Dall-e star image, tradingview graphic