Bitcoin has won more than 28% from its bottom of April 7, marking a strong recovery which changed the feeling of the market in favor of the Bulls. The main cryptocurrency is now held firmly above the level of $ 90,000, a key psychological and technical area which suggests that the momentum is back from buyers. However, risks remain, because a final push above the $ 100,000 mark is necessary to confirm a complete increased continuation and enter into new peaks of all time.

Despite the current macroeconomic uncertainty and global trade tensions, Bitcoin seems to show resilience. Analysts watch carefully to see if the current structure is held, especially since volatility remains high.

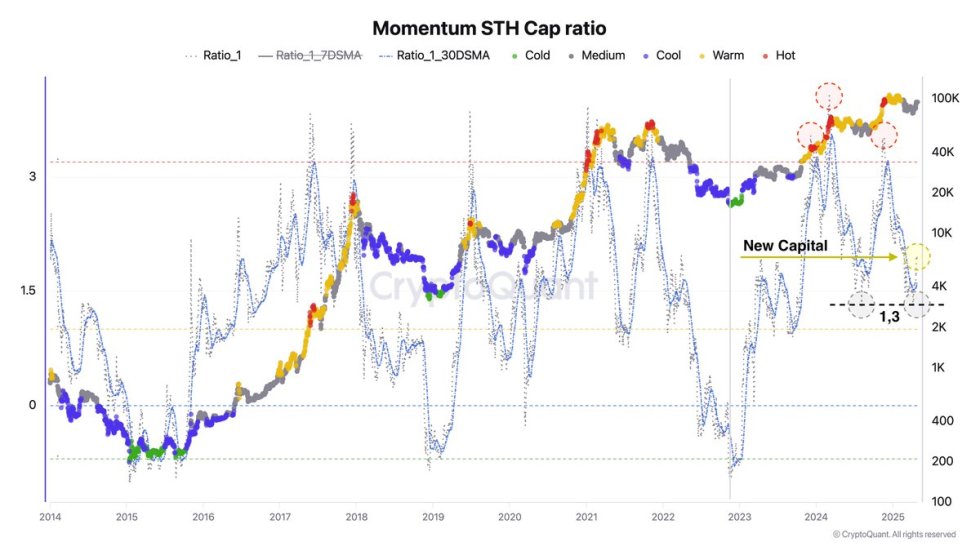

Adding to the upward perspectives, recent cryptocurrency data reveal a notable trend: after weeks of recharge and market correction, a new wave of new capital flows on the market. This renewal of money indicates increased confidence among investors and could feed the next leg.

If this wave of accumulation persists, it could serve as a basis for a wider rise – that which potentially pushes the BTC beyond $ 100,000 and in an unexplored territory.

Bitcoin takes momentum during uncertainty

Bitcoin seems to have finally broken its short -term correlation with American actions. While the stock market spread last week under the pressure of mixed income and the increase in macroeconomic concerns, BTC jumped, winning a strong bullish momentum. This divergence can mark the beginning of a new trend – a new trend where bitcoin and the wider market of cryptography put assets at risk in a higher territory. However, traders and investors remain cautious, as macroeconomic risks continue to take place, in particular by surrounding the intensification of the trade conflict between the United States and China.

The coming weeks are probably essential for the management of Bitcoin. While the price continues to consolidate in a narrow range between $ 92,000 and $ 96,000, the market provides an escape. Whether this break is higher or lower will largely depend on the change in liquidity and global financial developments.

Support the optimistic case, Axel Adler Analyst Axel Adler shared information on the channel stressing that the Momentum STH CAPROIO – A metric designed to follow the changes in the behavior of short -term investors – shows that a new wave of capital has entered the market after the April correction. According to Adler, this influx of renewed money suggests an increasing speculative interest and a sustained increase potential.

This new capital in capital could be the key trigger that Bitcoin must push to new heights of all time, provided that the bulls maintain control and the global economic conditions do not worsen considerably. The next decision will probably define the feeling of the market for the coming months.

The BTC price struggles below $ 96,000, but the bulls hold the line

Bitcoin is currently negotiated at $ 95,000 after several days of consolidation near the resistance. While the bulls had trouble recovering higher ground above the $ 96,000 mark, there are encouraging signs. BTC has held the level of support of $ 92,000 with a significant force since last week, exceeded $ 90,000 – a key psychological and technical step.

This sustained support zone indicates a strong underlying demand, in particular after weeks of sales pressure and macroeconomic uncertainty. However, for the bullish momentum to continue, BTC must exceed the barrier of $ 96,000. A clean movement above this level would prepare the field for a potential race to $ 100,000 – a level that many analysts consider the next critical escape zone.

However, downward risks remain. If BTC fails to take momentum over $ 96,000 soon, the market could go to a prolonged consolidation phase. In this scenario, maintaining $ 90,000 becomes essential to avoid triggering deeper corrections.

While the global financial markets continue to navigate tensions between the United States and China, the action of Bitcoin prices this week can provide key signals on the confidence of investors and the strength of the current trend. For the moment, the range of $ 90,000 to $ 96,000 remains the battlefield.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.