Is Bitcoin ready to reach $ 110,000? With 16 billion dollars in leverages in danger of liquidation and strong institutional purchases, BTCUSDT could move to new heights of all time.

Earlier this week, Changpeng Zhao, the founder of Binance, urged retail investors to buy Bitcoin now, saying that they were 15 years old to invest.

In an interview, Zhao predicted that the room could rise to $ 500,000 by the end of the year. Who knows? If the momentum remains, by the end of next year, BTCUSDT could double from $ 500,000 to $ 1 million.

Discover: Top 20 crypto to buy in May 2025

Short compression at $ 110,000?

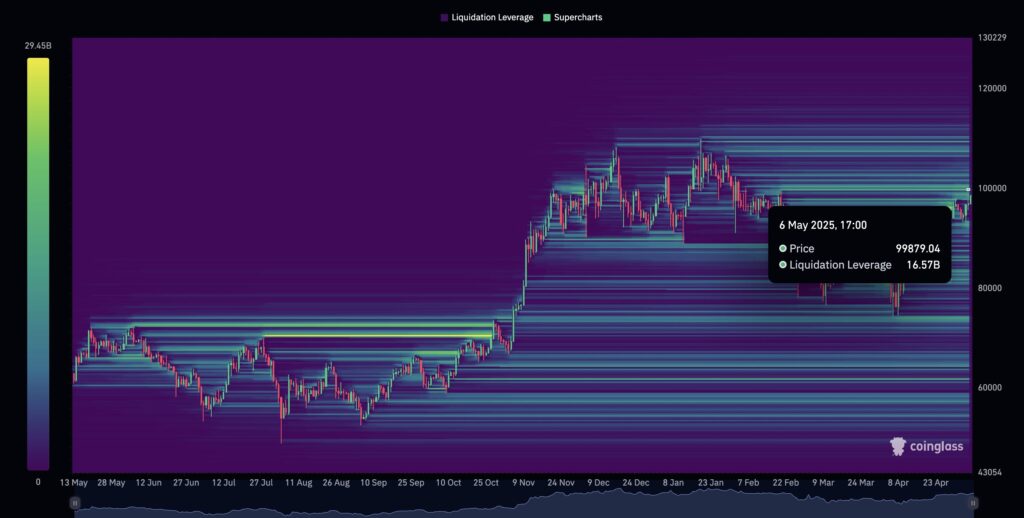

The exchange data suggest that the bulls are preparing for this cycle. An analyst on X noted that $ 16 billion in leverage shorts will be liquidated by force if the bitcoin closes above $ 99,900.

(Source))

It is not a small sum.

With the bulls in control and the arrows of the Bitcoin, the short pressure planned could exceed prices of $ 100,000 and, later, $ 110,000 in a continuous upward trend. In turn, part of the Best Ico of Coin Even In May 2025 could benefit.

This movement up can be the beginning. In T1 2025, prices crushed after reaching $ 110,000, falling at $ 74,500 and retest of peaks of 2021. If BTCUSDT retains $ 110,000, the bulls could lead the part to new peaks of all time, a step towards $ 500,000.

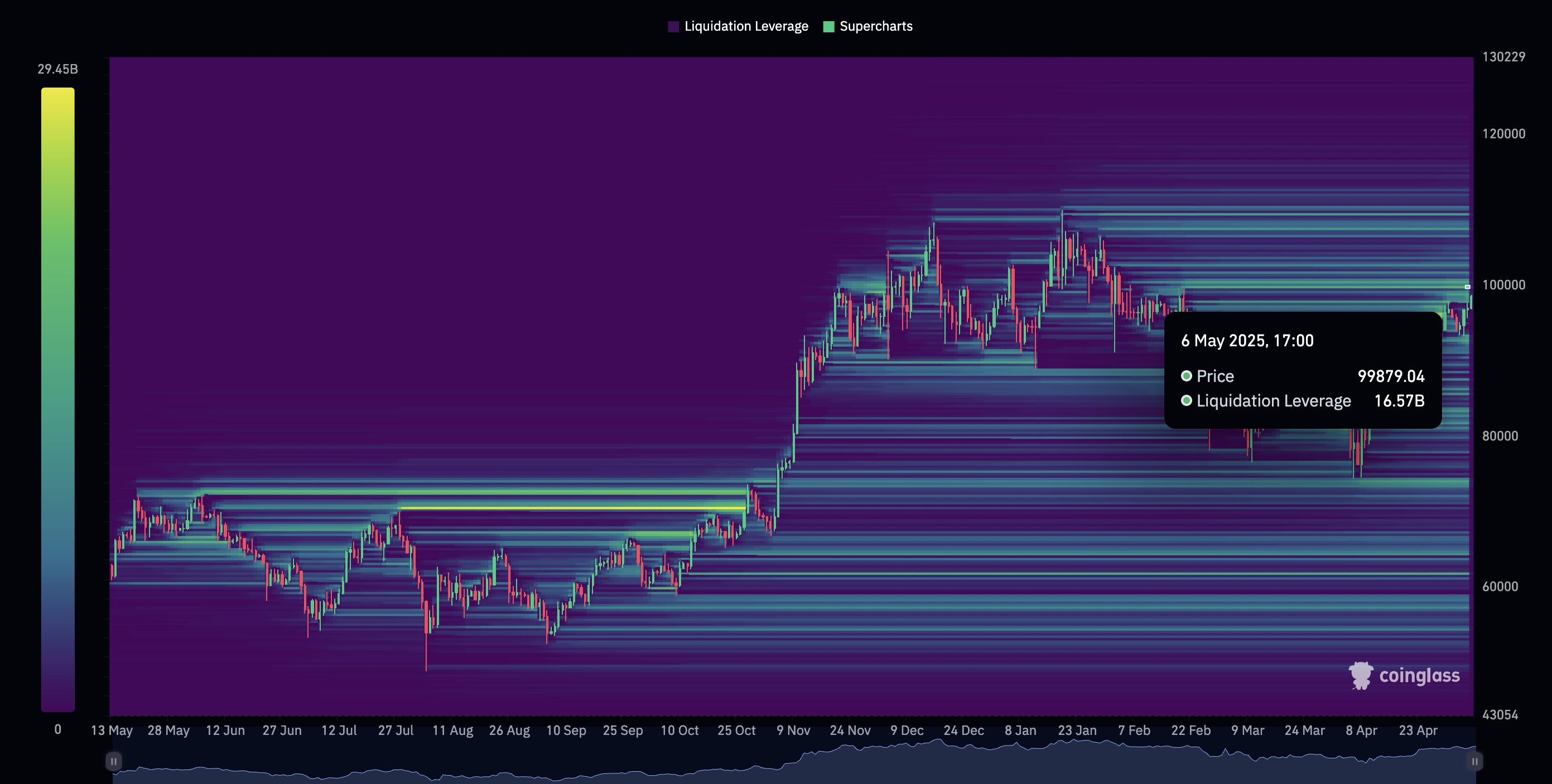

Historical data support these forecasts. Bitcoin generally takes 211 days to recover a new summit of all time after a previous peak.

(Source))

This has been around 145 days since the last summit in January, which means that Bitcoin could reach new heights in the next two months.

Bitcoin bull

Some analysts expect BTCUSDT to burst earlier, pumping the Best high -risk cryptos and high rewards.

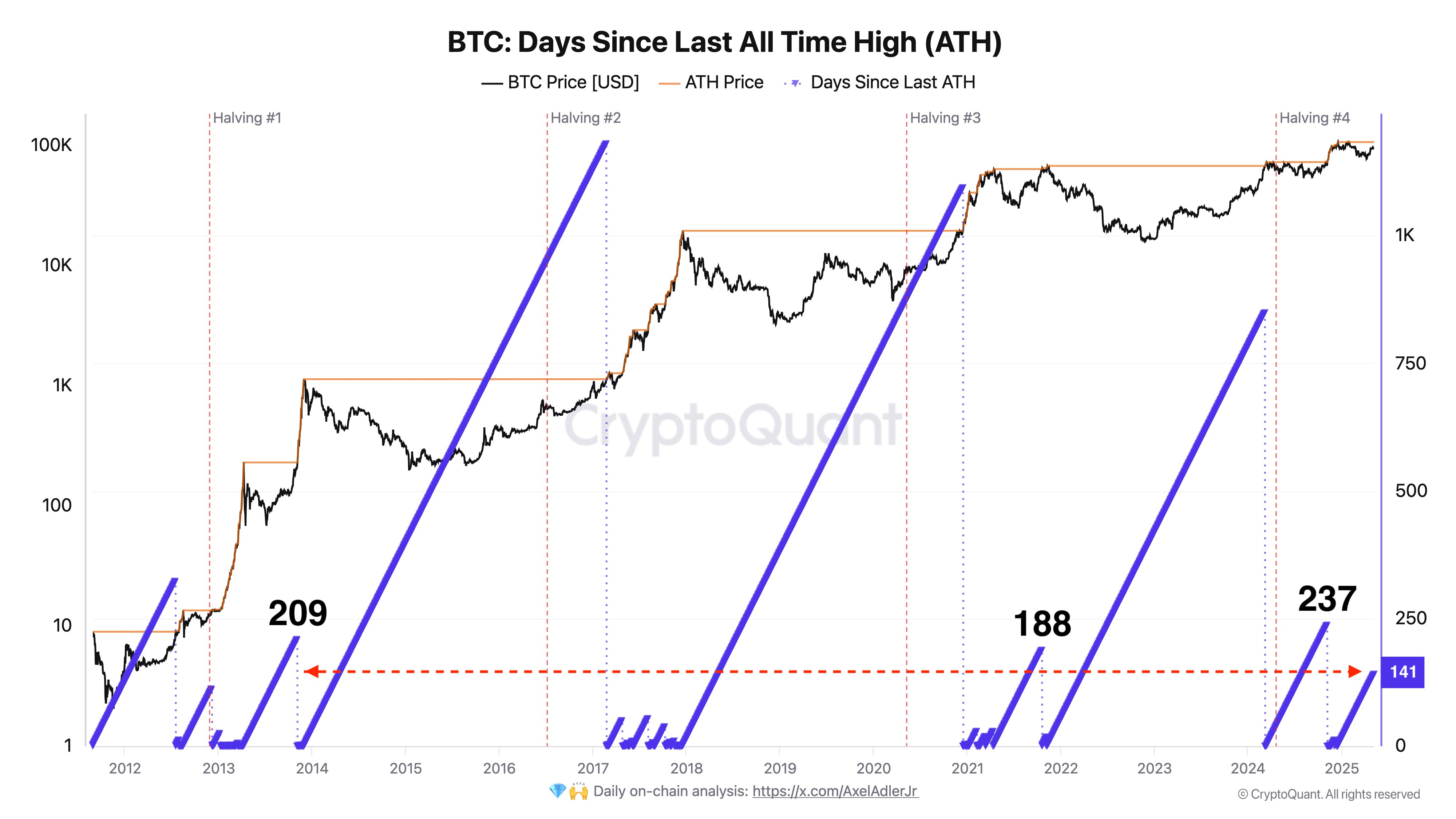

Sosovalue data shows American institutions bought $ 142 million in Etf Bitcoin Spot, which are directly supported by BTC. Despite the action of the jerky prices, there were no outings. Most institutions have favored FBTC FBTC FBTC Bitcoin FBELITY.

(Source)

As indicated by 99Bitcoins, BlackRock, a global asset management giant, has increased its exposure to Bitcoin. Meanwhile, more American states and public companies allocate billions to accumulate Bitcoin.

Although the federal reserve did not reduce rates yesterday, economists expect a drop in rates at the June 2025 meeting. President Donald Trump urged Jerome Powell and the FOMC to reduce rates, citing inflation of cooling and reduces the need for high borrowing costs.

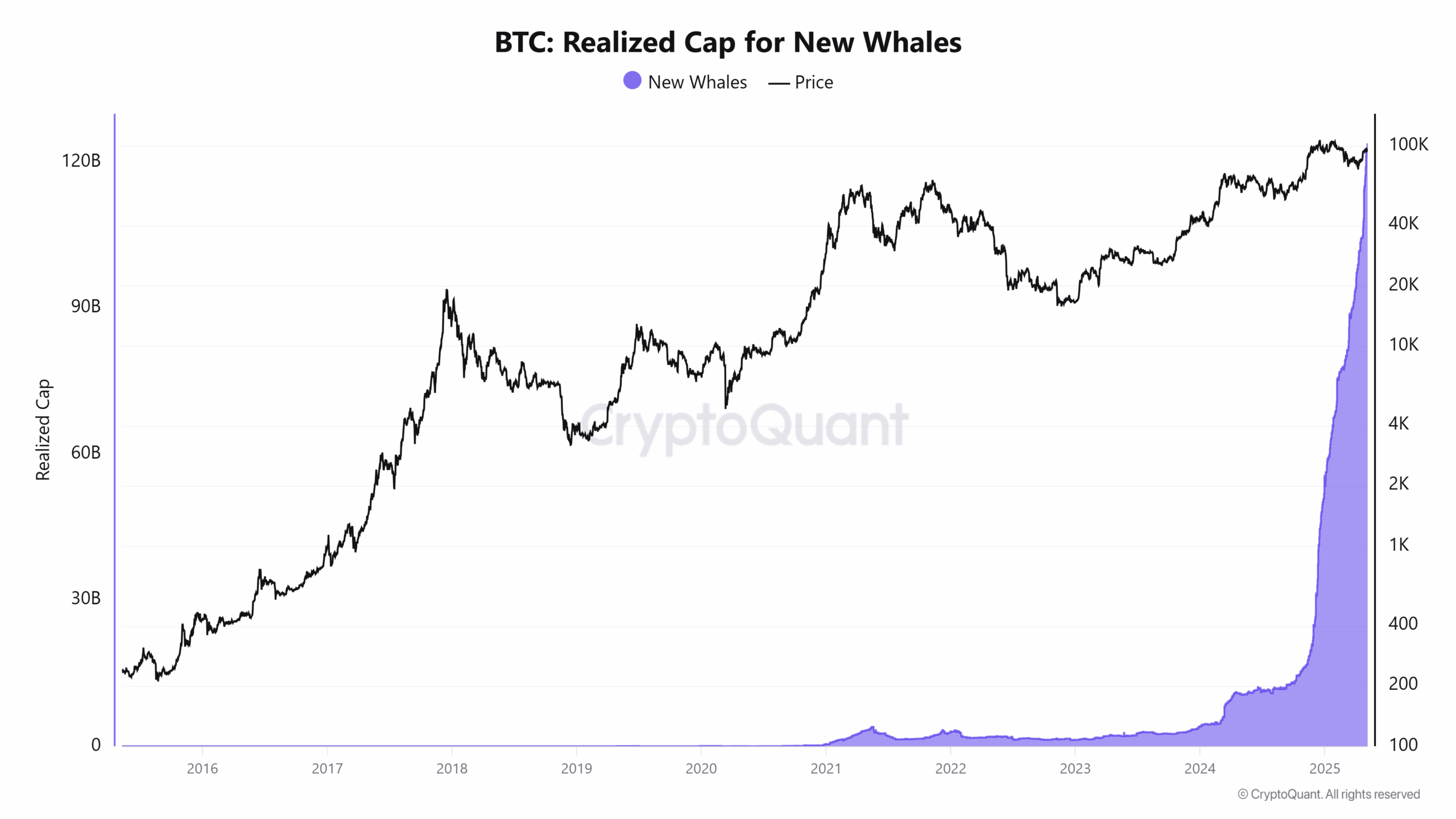

Onchain’s data also strengthen the bullish case. The new whales accumulate rapidly, containing more BTC than long -term holders for the first time.

According to CryptocurrencyThe ceiling made of new whales represents 52.4% of all the parts of the whales. Their average entry price is $ 91,922, about three times that of older whales, which bought $ 31,765.

(Source)

The growing domination of new whales signals an influx of massive capital in Bitcoin.

DISCOVER: Next crypto 1000x – 12 pieces that can 1000x in 2025

Will Bitcoin reach $ 110,000, $ 16 billion in liquidation faced liquidation

- More than $ 16 billion in leverage shorts could be liquidated if BTC breaks $ 99,900

- US institutions paid $ 142 million in Bitcoin Spot ETF in 24 hours. Blackrock also buy

- The new Bitcoin whales are dominant as the new capital flows

- Will BTCUSDT print new heights of all time above $ 110,000?

The Bitcoin post at $ 110,000 inevitable? More than $ 16 billion in leverage shorts which should be liquidated at $ 99,900 appeared first on 99Bitcoins.