Ethena (ENA) delivered a remarkable performance of 21% of a day, with a negotiation activity extending from a minimum session of $ 0.465 to reach a six -month peak of $ 0.5885.

This explosive decision pushed the monthly gains of the token beyond 113%, increasing its market capitalization to around $ 3.6 billion and guaranteeing a position among the 32 cryptocurrencies per market value.

Price overvoltage occurs in response to the announcement of Stablecoinx include a financing session of $ 360 million aimed at acquiring ENA tokens, as well as plans to include its ordinary class A actions on the world Nasdaq market under the symbol of “USDE” Ticker.

What is Ethena Usde? The 7B synthetic dollar revolution

Ethena works as a protocol for asset management and asset management built on Ethereum blockchain, offering a crypto-native monetary solution independent of conventional banking infrastructure.

The flagship offer of the protocol, USDE, represents a mechanism of synthetic dollars which draws its stability not from the traditional reserves of the bank but thanks to a sophisticated combination of assets of cryptocurrency and derivative instruments.

In a recent regulatory development, Crypto Investment Platform Anchorage Digital trained a strategic partnership with Ethena to introduce the USDTB on the American markets, positioning it as the first stablecoin to establish a clear regulatory path to the complete compliance of the American engineering law.

Despite the regulatory environment welcoming in the United States, Ethena is faced with growing challenges in European markets under the development of a developing mica regulatory framework, obvious in her recent withdrawal of German operations following regulatory disputes with Bafin.

Nevertheless, the main cryptocurrency protocols continue to adopt the methodology of the Synthetic Dollar of Ethena.

On July 22, Ledger, the famous manufacturer of cryptographic equipment portfolio, incorporated the Stablecoin USDE functionality in its platform, allowing millions of users to send, receive and generate a transparent return on their digital positions.

The Ton Blockchain network integrated into Telegram has adopted USDE integration, offering users attractive yields up to 19% APY on their stablecoin operations via your wallet services.

Cryptocurrency Exchange bybit also added the USDE to its trading platform, offering users zero conversion services between USDE and USDT and USDC, while offering competitive 10% APR gain opportunities.

Only protocol with 10% + yields – prediction in $ 1 of Ansem

The generalized adoption and utility have brought the circulating offer of the USDE to record summits, exceeding 7 billion dollars, which has led many analysts to suggest that the evaluation of the ENA market should reflect this fundamental growth.

The influencer of Crypto Prominent Ansem presented his analysis, indicating that the graphic model $ ENA confirms a weekly escape from a period of consolidation of several prolonged months.

As the only protocol operating a stablecoin which generates yields of 10% + on billions of assets under management, it provides that ENA is negotiated above the threshold of $ 1 in the medium term.

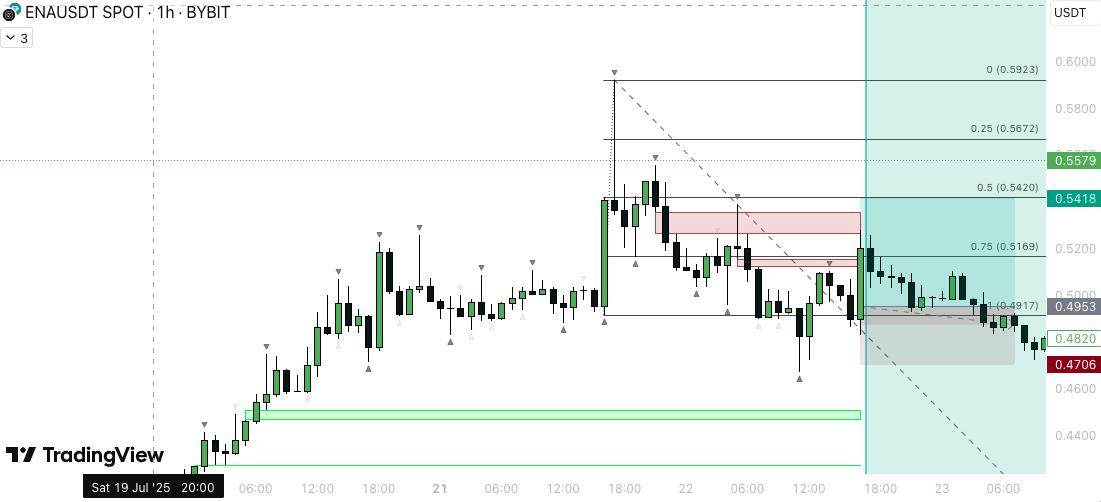

Technical analyst Ali Charts has identified that $ ENA requires a daily closing price greater than $ 0.54 to establish sufficient momentum for the next ascending leg targeting the level of $ 1.

ENA BRISE $ 0.54 Resistance: Technical target at $ 1 activated

On the technical front, the Binance daily ENA / USDT table suggests a bullish continuation

After a prolonged downward trend that started in February, ENA entered a prolonged accumulation phase between $ 0.25 and $ 0.46.

This lateral movement indicated a break in the down momentum, the accumulations gradually accumulating the positions.

A significant escape occurred recently because the price has exceeded the key resistance area at $ 0.5433, which is now treated as a potential level of input.

If the bullish structure holds, the following targets are clearly defined. The first level of resistance and for -profit taking is set at $ 0.8225, while the second target and more ambitious is at $ 1.0045.

Unpipening, the invalidation of the increased configuration would occur if ENA closes below the support area from $ 0.5,350 to $ 0.4940, with a stop-loss marked at $ 0.3930.

Such a decision would point out a failed break and may resume downward trend.

Post Ethena increased by 21% after $ 360 million USDE – ENA reach $ 1? appeared first on Cryptonews.