Blackrock is one of the four horsemen of the American economy, as well as the giants of investment Vanguard, Fidelity and State Street. And now there is a Moody recession prediction creepy All these institutions.

All of these investment institutions are gloomy on the American economy – here is why.

Moody recession prediction: two more weeks

The risks of recession increase, according to the chief economist of Moody’s Analytics, Mark Zandi. In a recent article on X, he warned that the growth of the United States vacillates in mounting policy pressures.

Zandi later said that he does not believe that the economy is still in an official recession, but said that some sectors had already slipped into one.

In an interview with Business Insider, Zandi underlined the prices, immigration restrictions and the federal reserve policy as the main front wind. Together, he said, they created unusually high uncertainty, blocking investments and hiring.

Breaking: Moody’s Rating warns that the American economy is approaching the recession, citing 3 key factors:

– Payroll use

– Job levels

– Coherent decrease in work

Q: When will voters learn? pic.twitter.com/p9wvpqurbr

–

Dr. Memenstein votes

BLUE

(@ Coste1costello) August 12, 2025

All this has BlackRock, which manages more than 12.5 billions of dollars of assets under management, or about 40% of the GDP of the United States, nervous and already selling its assets.

September is always a bad month for actions. Historically, September was the S&P 500 cemetery, with an average loss of 1.1% dating from 1928. Two more weeks could be the start.

Without forgetting, in a recent report, Blackrock cited these economic concerns:

- Aging shortage: Developed countries have record birth rates (Google “number of 2045 sperm”). This can lead to high inflation over time and a change of demand to the industries aimed at the elderly, such as health care, real estate and leisure.

- A fragmenting world: According to Blackrock, “we believe that the war of Ukraine and relations with the United States-China inaugurated a new era of global fragmentation and competing defense and economic blocks.” Blackrock believes that global economic growth will be more volatile, but opens up the possibilities on emerging markets.

DISCOVER: 9+ Best High Risk Crypto and Reward to Buy in July 2025

Jackson Hole: crush the economy without survivors

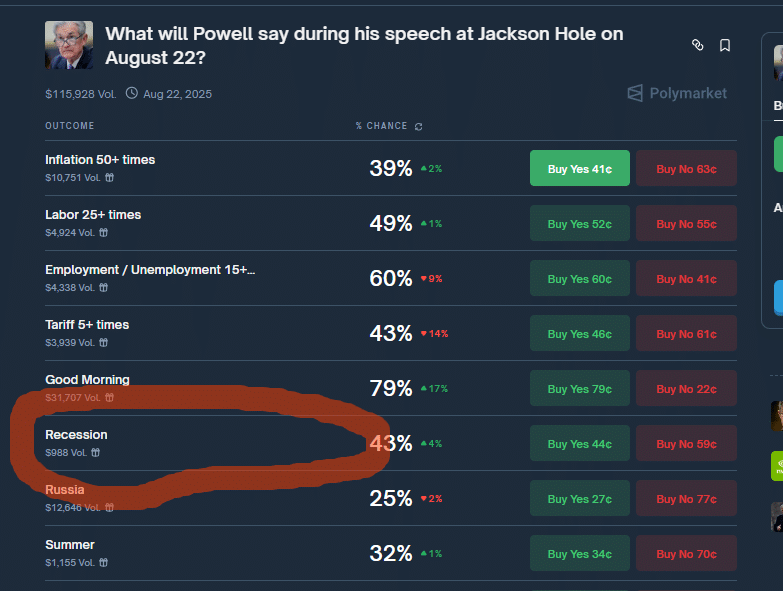

The latest piece of terrifying investors is the Fed meeting today in Jackson Hole, Wyoming.

Wall Street is largely expected to lower the federal reserve rate this fall, indicating September as the most likely start. However, the underestimation of these hopes is prices introduced by President Donald Trump, who added economic pressure, and the administration was strongly based on Fed policy to change policy.

Unlike the past meetings of Jackson Hole, many experts think that Powell will probably not offer strong clues.

Inflation remains sticky above the target and has been pushed higher by prices, blurring the case of the cuts. Some analysts argue that the central bank will want more evidence before moving.

In reality, the American economy feels away from something bad:

- Student loan debt Reached an alarming of 2 billions of dollars, while the credit card debt is increasing.

- Banks tighten consumer credit. When this happens, consumption expenses, which have remained solid but have passed to credit, will be jostled.

DISCOVER: Next crypto 1000x: 10+ Crypto tokens which can strike 1000x in 2025

Are things so bad?

The hour is getting closer now. The bell was finally penetrated for you, America, finally. Food will be a luxury at the beginning of 2026. Will things happen?

No. Although things are not this bad, All the signals highlight a slowdown, if not to crash, an economy after a new period for the actions and the crypto that many see from the fourth quarter from rate drops. But stay calm. Things will be better. Drink abundant quantities of regal chivas. Joke. Partially.

Hang on to your long-term investments with solid foundations, sell what you need for immediate money and believe that everything will go well. Get fresh air, touch the grass.

Explore: CEO of Tether Paolo Ardoino hopes that the positive net of the American elections, says that Bitcoin, the strategic reserve is an excellent idea: 99Bitcoins exclusive

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

Blackrock is one of the four riders in the American economy, as well as the giants of the Vanguard, Fidelity and State Street investment giants – and now they are all terrified.

-

All eyes are on Powell today in Jackson Hole. While inflation persists and labor metrics soften.

The post BlackRock and Wall St. Exit Us Markets, the bracing for the recession appeared first on 99Bitcoins.

Q: When will voters learn?

Q: When will voters learn?  Dr. Memenstein votes

Dr. Memenstein votes

(@ Coste1costello)

(@ Coste1costello)