Before the highly anticipated meeting of the FOMC later during the day, the total market capitalization of cryptography is up 0.5% more to $ 4.1 t $. The price of Bitcoin is stable greater than $ 116,000, and traders are generally optimistic, expecting BTC USD to explode above $ 118,000 and to summits of all time set in mid-August.

Although confidence is high, the pace at which the price of Bitcoin will largely depends largely depends on the macro-factors. This time, the eyes are on Jerome Powell and the FOMC. In addition to the rate reduction decision, their comments on the economy and monetary policy in the coming months before the end of the year will have a huge impact on capital entries, not only to Bitcoin Crypto but also to others Best cryptos to buy.

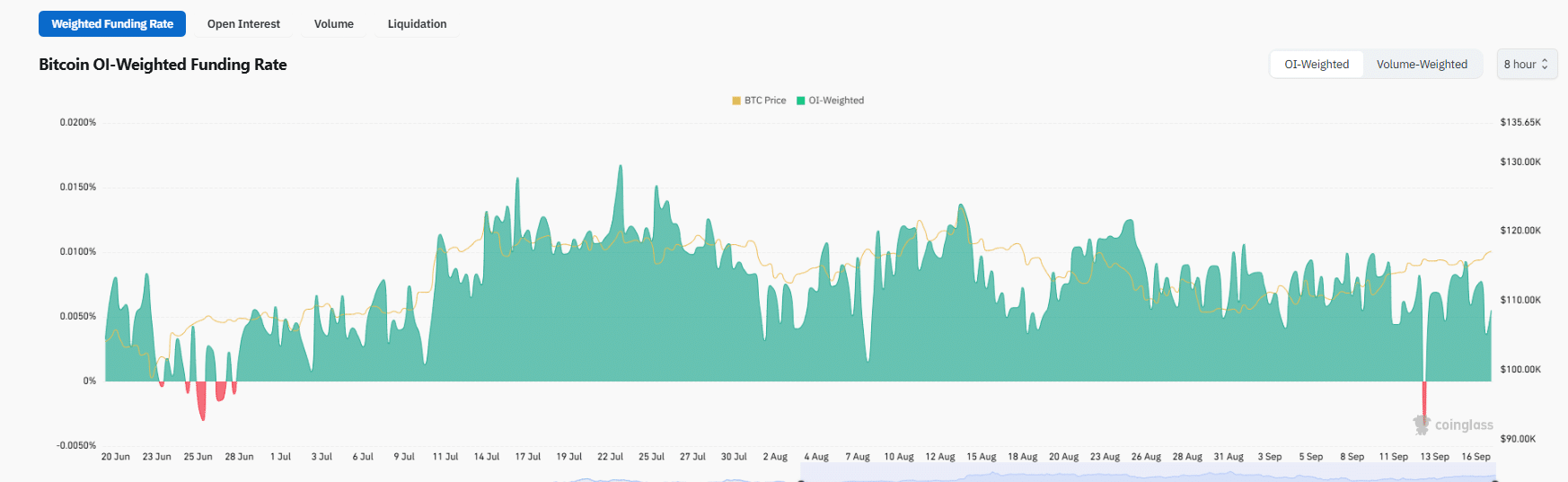

Since September 17, the most precious crypto in the world has increased by almost 4% last week, per Flirtatious. On Quince, the BTC USDT trading activity is decent. More than $ 21 million in BTC USD Short lever were closed on the last day. At the same time, the The financing rate is positive, which means that the general feeling is optimistic because longs pay shorts to occupy their positions.

(Source: Rinsing))

DISCOVER: 9+ Best High Risk Crypto and high reward to buy in 2025

More than $ 9 billion in trade in Floody Crypto of Stablecoins

Looking at the data on the chain, it is likely that BTC ▼ -0.75%Top altcoins, and even some of the Top Solana same corners Go higher, pushing more financing rates in the positive territory.

The latest data on the chain show that during the last 36 hours before the FOMC meeting, around $ 9 billion in the best stablescoins, including USDT and USDC, was transferred to crypto exchanges.

In the last 1.5 days, before the Fed meeting, around $ 9 billion in stablescoins have passed in exchanges. pic.twitter.com/dd1wwk2tlv

– Axel

Adler Jr (@Axeladlerjr) September 17, 2025

Stablecoins play a key role in the cryptography ecosystem, allowing traders to obtain exposure to the best coins and act as a safe refuge during periods of turbulence. Whenever stablecoins are moved to crypto exchanges like Binance, Coinbase and Bybit, this could suggest that holders want to buy, a net positive for holders.

On the other hand, when altcoins, including ETH or BNB, move to exchanges, it is lower. If there are bulk entries to exchanges, the prices of the tokens can crash a few days later.

In the past 1.5 days, there have been a single transfer of $ 2 billion to the Binance, the largest movement in more than a year.

$ 2 billion in stables have just been thrown into Binance.

Just before FOMC.

Incoming volatility. pic.twitter.com/yijeyrv1tt

– Kyle chased / dd

(@kyle_chasse) September 17, 2025

An analyst on X said that these entries are a clear sign of intention to buy and “fresh powder” which could ignite the crypto fireworks.

2 billion dollars in stablecoins have just struck Binance – the largest entrance in more than a year.

And it happens just before the FOMC.

You do not move this kind of size without intention.

It’s fresh powder and he is now sitting on the exchange.– Alex Soh (@ alexsoh14) September 17, 2025

DISCOVER: The best new cryptocurrencies to invest in 2025

Will the USD BTC explode for new heights every time over $ 130,000?

Merchants can only wait and see what the FOMC will decide interest rates. If they reduce rates and project even more rate drops by the end of the year, the USD BTC could easily reach more than $ 124,500 to reach new heights of all time.

On X, an analyst already notes that the price of bitcoin is negotiated at a bonus of + 7% compared to its short -term cost base, traders aimed at $ 130,000.

The price is currently negotiated at a premium of 7% to a short -term cost base, target = $ 130,000 pic.twitter.com/w2oes62cs1

– Axel

Adler Jr (@Axeladlerjr) September 17, 2025

At this rate, BTC USD is up + 7% compared to short -term holders of the average price. Short -term holders are all addresses that bought BTC in the last 155 days. Currently, this cohort of Bitcoin holders is in money.

Meanwhile, the Bitcoin risk index, which assesses market vulnerability, is + 23%, which is low compared to historical standards. This reading shows that the market is calm, reducing the probability of unwanted net withdrawals or liquids.

Bitcoin risk index – the higher the value, the more dangerous the configuration of the current market compared to the last 3 years, with an increased probability of rapid withdrawals / liquidations.

Currently, the index is at a low level of 23%, the environment is calm, probability of net … pic.twitter.com/rdsjxftwvg

– Axel

Adler Jr (@Axeladlerjr) September 16, 2025

If the story guides, the BTC USD could surrender by + 40%, placing the price of Bitcoin greater than $ 150,000 by the end of the year.

DISCOVER: 9+ Best High Risk Crypto and high reward to buy in 2025

More than $ 9 billion in stablecoins have gone to scholarships, USD BTC at $ 130,000?

- Bitcoin Price Firm before the FOMC meeting

- $ 9 billion in stablecoins have moved to cryptography exchanges

- FOMC likely to reduce prices

- Will BTC USD reach $ 130,000 in the coming weeks

The message of more than $ 9 billion in USDT, USDC Flood Crypto exchange before FOMC: USD BTC at $ 130,000? appeared first on 99Bitcoins.

Adler Jr (@Axeladlerjr)

Adler Jr (@Axeladlerjr)

(@kyle_chasse)

(@kyle_chasse)  2 billion dollars in stablecoins have just struck Binance – the largest entrance in more than a year.

2 billion dollars in stablecoins have just struck Binance – the largest entrance in more than a year.