After a new all-time high (ATH) of $126,199 on Binance, Bitcoin (BTC) is now consolidating in the low $120,000 range. The latest exchange data – such as the Cumulative Volume Delta (CVD) confirmation score – suggests that BTC benefits from strong underlying demand.

CVD Confirmation Shows Strong Demand for Bitcoin

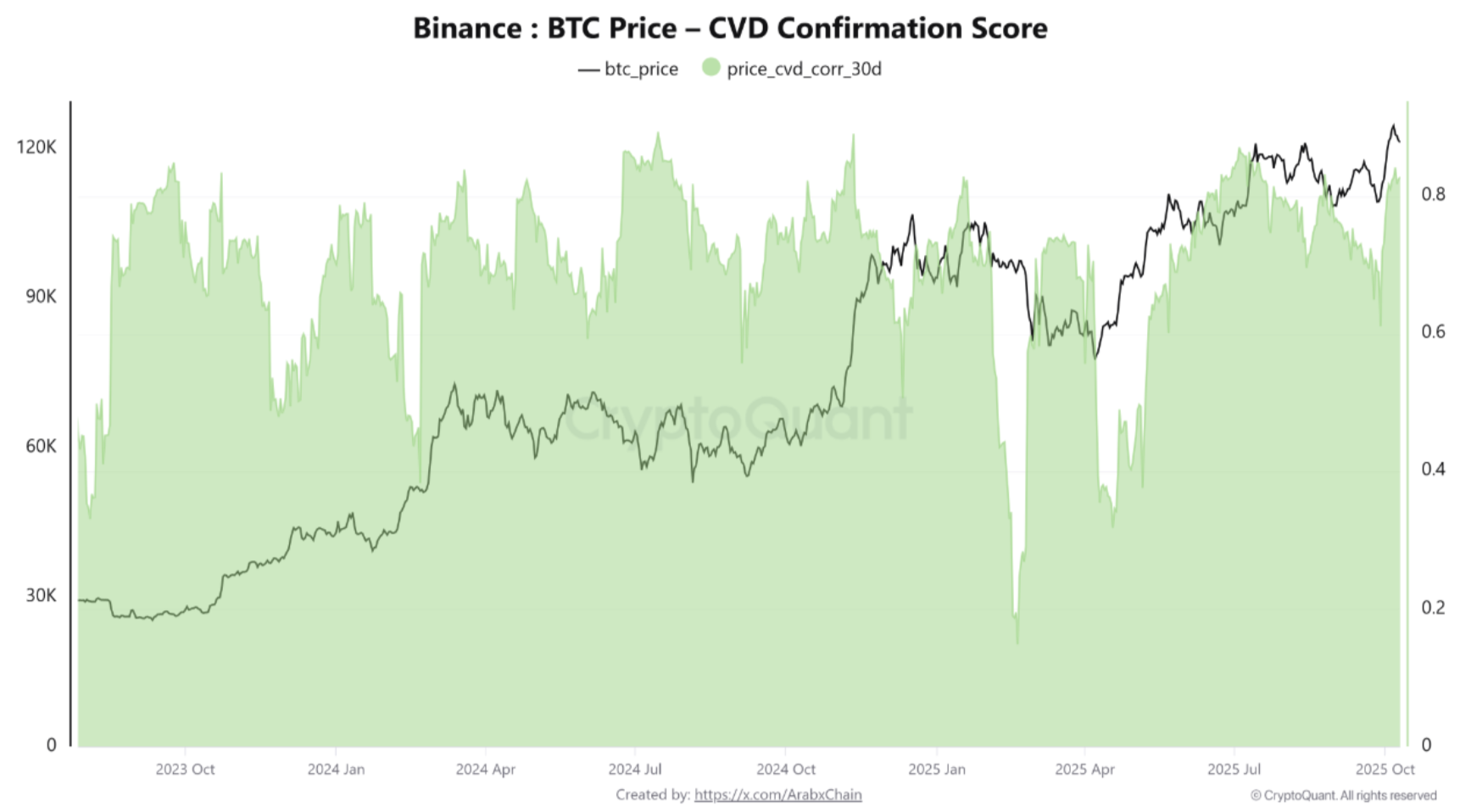

According to a CryptoQuant Quicktake article from contributor Arab Chain, Bitcoin’s CVD confirmation score – a 30-day rolling correlation between Bitcoin price and CVD – suggests a strong resynchronization of the trend.

Related reading

For the uninitiated, the CVD Confirmation Score measures the 30-day correlation between Bitcoin price and CVD, which tracks the net difference between taker buying and selling volumes on exchanges. A high score (above 0.7) indicates that price increases are supported by real buying pressure, while a low or negative score suggests weak or speculative momentum.

The latest data from Binance shows that the CVD confirmation score is currently hovering between 0.8 and 0.9, indicating that the current price surge is largely due to buying by real takers rather than a technical bounce or short squeeze.

Past data also suggests that whenever this data point stays around 0.7 for an extended period of time, price corrections tend to be relatively shallow and short-lived. Indeed, the new liquidity in the market quickly absorbs any incoming supply of BTC.

The CryptoQuant analyst noted that if the CVD confirmation score continues to hover above 0.7 – coupled with a decisive breakout above the $124,000 to $126,000 resistance zone – then it could be on its way to a potential target up to $135,000.

However, any negative divergence between a rise in the BTC price and a drop in the CVD confirmation score below 0.4 should be considered a warning sign, as it increases the likelihood of distribution or liquidation pressure.

Conversely, the $112,000-$115,000 and $108,000-$110,000 levels stand out as strong support levels for BTC. At these price levels, the CVD confirmation score should remain stable to ensure the uptrend remains intact. Arabic channel added:

The underlying trend is bullish and supported by actual inflows on Binance, the world’s largest exchange. Watch for three confirmation signals: CVD confirmation remains high, open interest remains moderate, and funding does not become excessive. Any obvious imbalance between these indicators will be the first warning of a change in dynamics.

Should BTC be subject to a correction?

As bulls hope for an extended rally for BTC, some analysts I’m not entirely convinced on the digital asset reaching new highs in the short term. For example, crypto analyst ZVN recently declared that BTC could see a pullback before its next rise to $150,000.

Related reading

Similarly, Dick Dandy, another crypto analyst, recently predicted that BTC could see a massive 60% price correction, falling as low as $43,900. At press time, BTC is trading at $118,791, down 1.8% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com