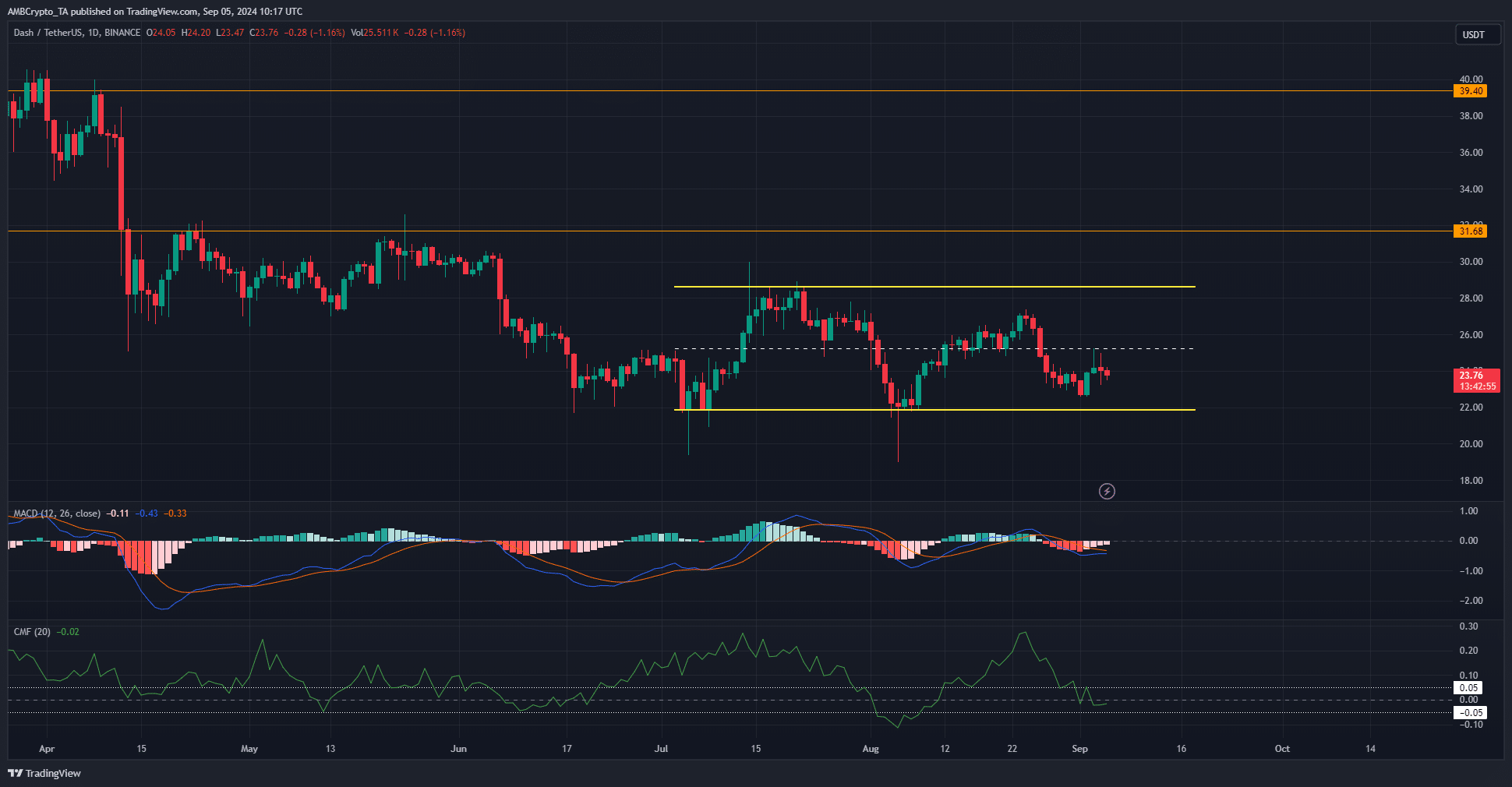

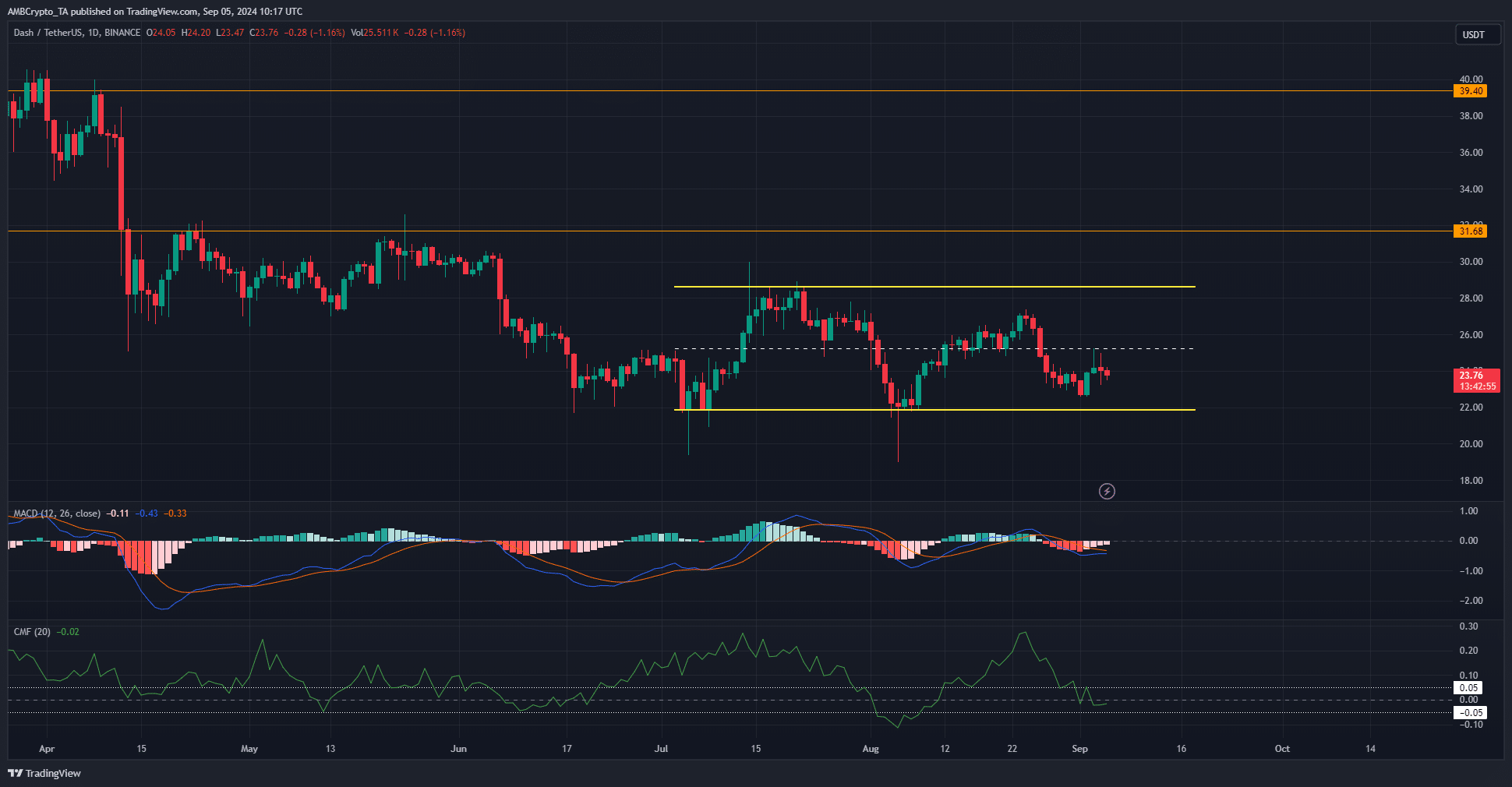

- Dash has stabilized the downtrend of April by forming a range since July.

- DASH was unable to reverse the average level to support and sustain it.

Over the past two months, Dash (DASH) has been trading in a range. According to CoinMarketCap, its 24-hour trading volume was $36 million, and the price action did not suggest an imminent trend change.

The overall market sentiment was pessimistic after Bitcoin (BTC) fell below the $60,000 mark. This short-term bearish momentum could push DASH lower in the coming days.

Low frequencies invite you

Source: DASH/USDT on TradingView

Since the first week of August, DASH has been trading in a range (yellow) that extends from $21.85 to $28.64. On September 3, the mid-level at $25.26 was tested as resistance and the bulls were pushed back.

The CMF was at -0.02 and did not show any significant capital flows in either direction. On the other hand, the MACD on the daily chart indicated that the momentum was bearish. This suggested that the range lows could be revisited.

The lower time horizon market structure also supports this idea, after the rejection from the $25 resistance zone.

Over the past two months, each return to the range lows has caused the price to drop momentarily below $20. Traders should be prepared for this type of volatility should the price decline further.

Hopes of price recovery dashed

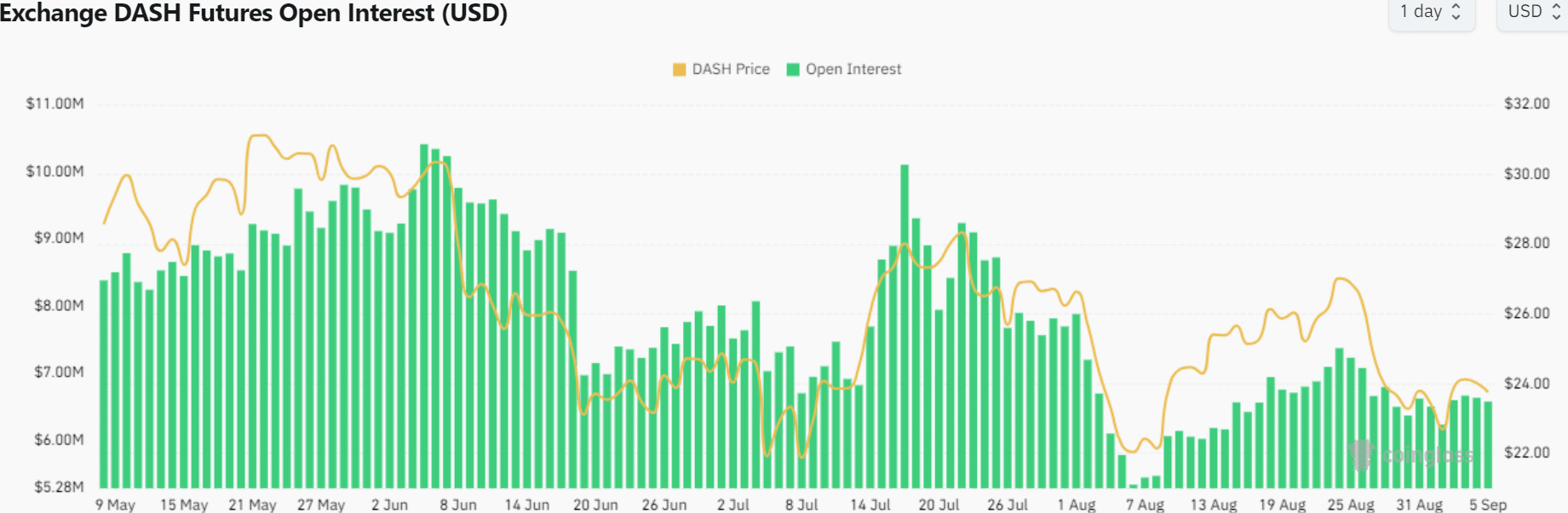

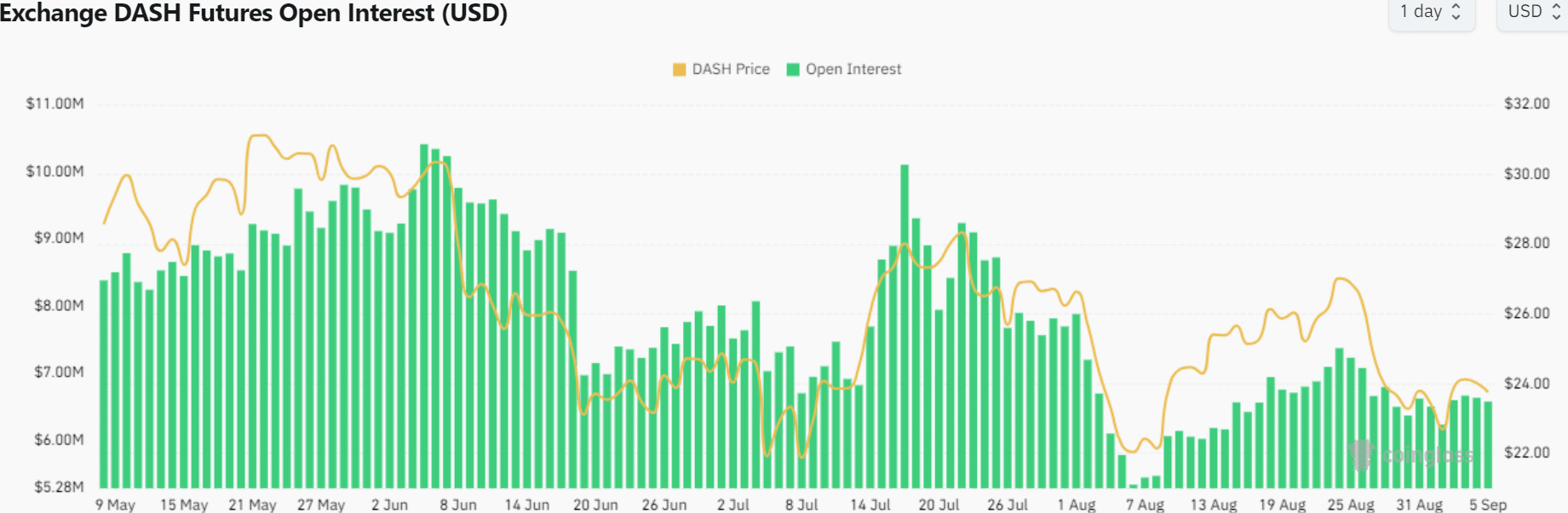

Source: Coinglass

Read Dash (DASH) Price Prediction for 2024-25

During the last week of August, the Open Interest uptrend started to reverse. The price also reversed its short-term uptrend at the $27 level and quickly dropped to $22.

This was a sign that speculators were not confident that they could make sustainable gains. Combined with the decline in the CMF indicator, the market was not ready to bid up and DASH was likely to register further losses in the coming days.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.