Join our Telegram channel to stay up to date with the latest news

Bitcoin’s price rose more than 1% in the past 24 hours, trading at $111,331 as of 4 a.m. EST, on a 31% decline in daily trading volume to $50.47 billion.

This increase in the price of BTC occurred even as Tom Lee, the well-known president of BitMine, stated that even as Bitcoin becomes more popular with large investment companies, large declines of 50% or more are still possible.

“Simply holding cryptocurrencies on a balance sheet does not guarantee long-term performance,” he explained, reminding everyone of Bitcoin’s checkered past.

⚡️TOM LEE: BITCOIN NO IMMUNITY AGAINST A 50% CRASH

He warns that even with Wall Street’s support, $BTC could still face steep declines, just like the stock market. pic.twitter.com/xOgzIb6YY0

– Coinbureau (@coinbureau) October 24, 2025

Over the past few weeks, Bitcoin has faced wild fluctuations. It initially climbed to nearly $126,000, then fell below $110,000 before rebounding. Despite the pullbacks, Bitcoin’s position above $110,000 shows that the market still has confidence, for now.

Still, large investors have pumped more than $1.2 trillion into Bitcoin through major exchanges over the past year, making it the world’s largest crypto entry point. Even as other cryptocurrencies gain ground, Bitcoin remains the first choice for traditional investors, especially in the United States.

On-Chain Bitcoin Data: Activity Remains High Despite Warnings

On-chain signals give a clearer picture of what is happening behind the price. Bitcoin remains the leader in terms of network activity and overall demand.

The trading volume of on-chain perpetuals (crypto derivatives traded directly on the blockchain) reached all-time highs in October, with over $1 trillion in notional value traded this month alone. This suggests strong interest from institutional and retail traders, even as prices fluctuate up and down.

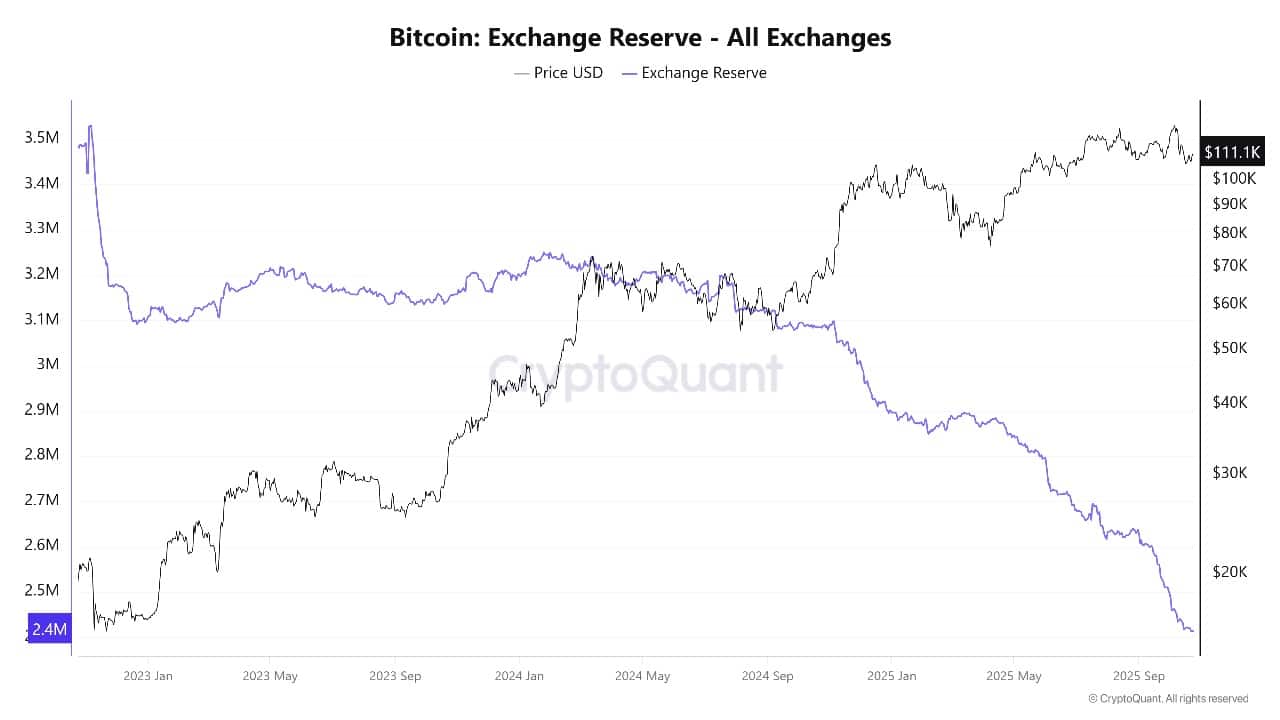

However, some warning signs are emerging. The number of Bitcoin transfers between wallets and exchanges has increased during price declines, usually a sign that some holders are looking to take profits or limit their losses.

Bitcoin Exchange Reserve Source: CryptoQuant

While many long-term holders stay put, new buyers step in every time Bitcoin drops below major support levels. This suggests that the market remains active, with buyers and sellers reacting quickly to price fluctuations.

Bitcoin technical analysis: BTC shows bearish tilt

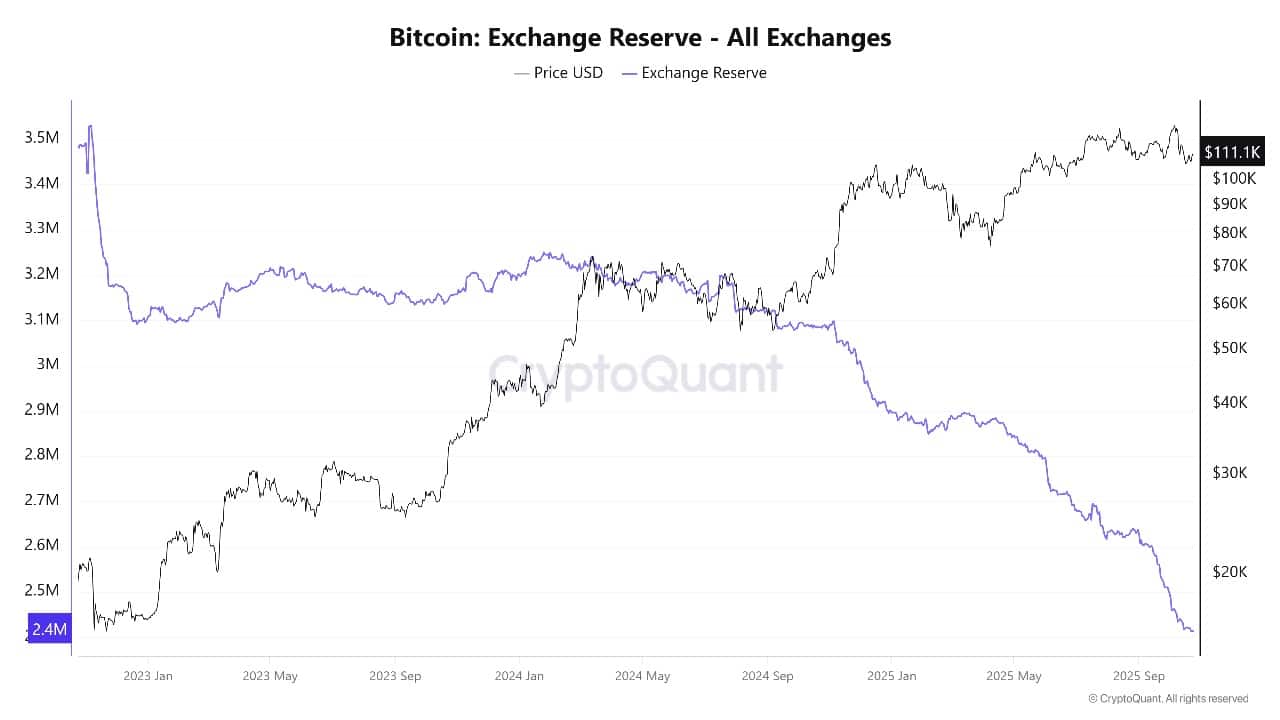

Looking at the charts, Bitcoin is currently in a consolidation zone after a sharp decline from its recent highs near $126,000. Price is holding above the 200-day simple moving average (SMA) at $108,445.78, which is a key support level. The 50-day SMA is at $114,194.62, now just above the last price, creating a “resistance zone”.

BTCUSD analysis source: Tradingview

Technical indicators provide mixed signals. The relative strength index (RSI) is at 47.34, which shows that the market is neutral, meaning buyers and sellers are evenly matched at the moment.

The Moving Average Convergence Divergence (MACD) remains below the signal line, a sign that bearish momentum could continue if buyers do not intervene.

Meanwhile, the average directional index (ADX) is at 25.47, indicating that the trend is present but not overwhelming, and that the market could easily swing one way or the other.

The chart also shows clear horizontal areas of support and resistance. Sellers have repeatedly pushed Bitcoin down from the $125,000 to $126,000 zone, as indicated by the red arrows. On the downside, strong support can be found just above $108,000 and around $105,000, close to the 200-day SMA.

A fall below these levels would be a warning of deeper corrections and, as Lee says, sharp corrections should never be ruled out, even in bullish cycles.

Conversely, if price breaks above resistance at $114,200 and then $118,000, Bitcoin could attempt to retest recent highs. But without a powerful catalyst, the path to higher levels seems difficult.

For now, technical and on-chain data show Bitcoin holding up, but bulls face a tough road ahead. As the market waits for its next big catalyst, staying above $108,000 is critical. Otherwise, even Wall Street’s favorite crypto could see a sharp decline before rebounding.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news