ETH price is testing a crucial support level after creating a bullish reversal trend. Could a rebound from here put it back on track for a strong upward move?

Summary

- ETH price is testing the $4,100 support level after falling from its high on Monday.

- A double bottom pattern has formed on the 4-hour chart.

- Technical indicators signaled the first signs of a reversal.

After rebounding 10% to a weekly high of $4,232 on Monday, Ethereum (ETH) retreated as profit-taking began, closing in on psychological support at $4,100, a level it must hold to avoid deeper losses.

Ethereum’s collapse follows after forming a double bottom pattern on the 4-hour chart, a pattern that often leads to a reversal of an uptrend. In the case of Ethereum, the two trend lows formed near the $3,713 level, with a neckline coming in around $4,100, which now acts as a key resistance zone.

A breakout of this type of structure can lead to a lasting trend reversal for several days. For Ethereum, a confirmed move above the neckline opens the door for a rally towards $4,491, up 10% from current levels. The target is calculated by adding the depth of the double bottom formed at the escape point.

Some caution is required, however, with momentum indicators sending mixed signals. The MACD line appears to be approaching a bearish crossover with the signal line, while the RSI has formed a bearish divergence. These two signs indicate that the bullish momentum could fade in the short term.

For now, $4,100 is the immediate resistance zone, while downside support lies near $4,000, a psychological level that Ethereum must maintain if it wants to stay on its upward trajectory.

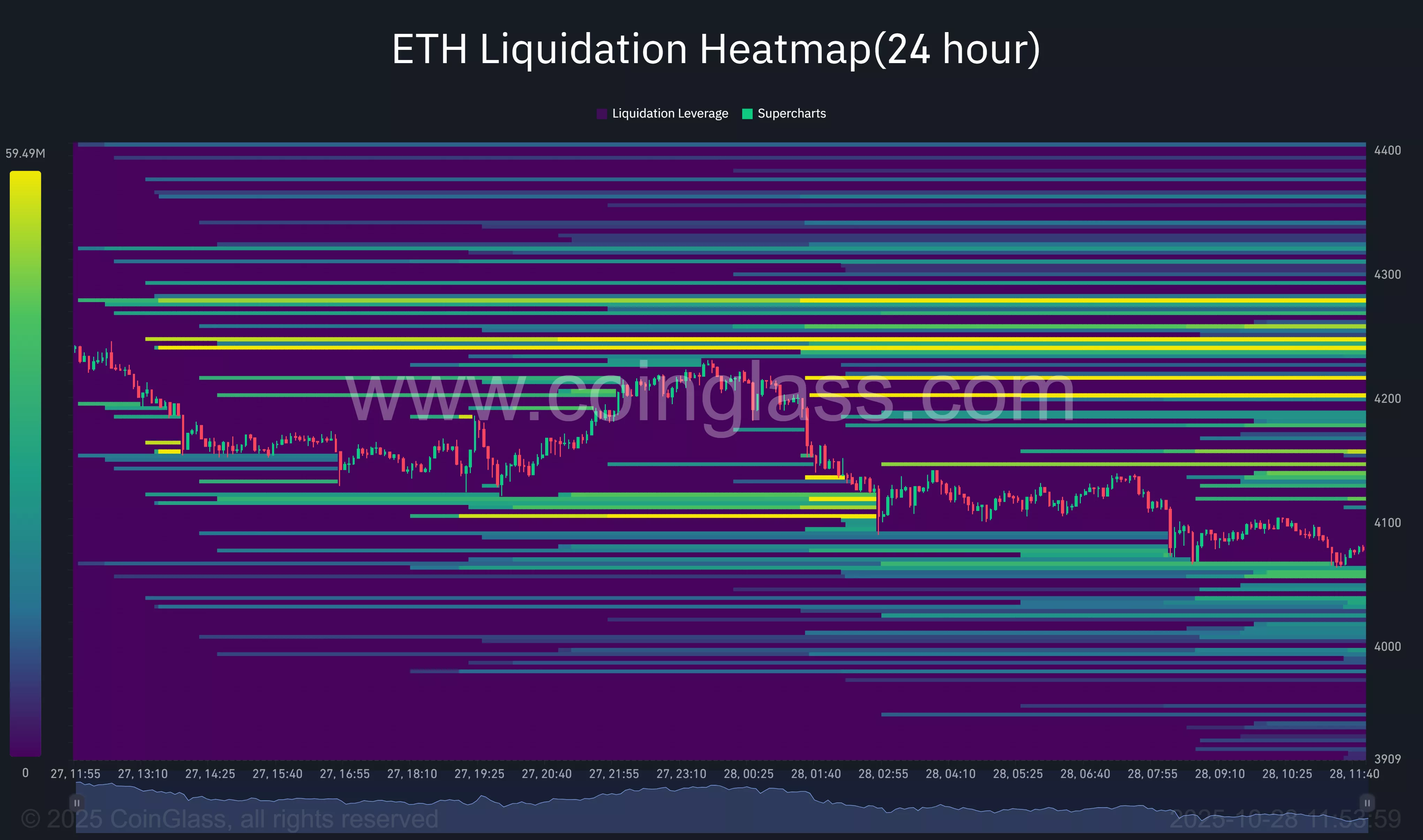

According to CoinGlass’ 24-hour liquidation heatmap, a notable group of short liquidations are visible between $4,100 and $4,200, aligning with the neckline of the double bottom pattern and the upper boundary of the falling wedge identified earlier.

A sharp break above this band could trigger a short squeeze, forcing the liquidation of overleveraged positions and accelerating the price rally. With so much liquidity piled up in this zone, bulls could find the momentum needed to push ETH towards the $4,400-$4,500 target range.

In contrast, the heat map shows considerable liquidation interest between $4,000 and $3,900, suggesting that this area could be a strong demand area in the near term.

If Ethereum dips into this region, buyers could move aggressively to defend key support. However, if ETH breaks below $3,900, the chart begins to brighten, indicating lower liquidity and limited buying interest, which could expose the token to increased volatility and larger losses, possibly driving it towards the $3,700-$3,650 region.

Disclosure: This article does not represent investment advice. The content and materials presented on this page are intended for educational purposes only.