Stablecoin issuer Tether has become the largest shareholder of Nasdaq-listed technology advisory services firm VCI Global following a $100 million digital asset transaction involving OOBIT’s native token OOB.

Summary

- Tether is set to become VCI Global’s largest shareholder thanks to a $100 million digital asset transaction involving OOBIT’s OOB token.

- VCI Global set to acquire $100 million worth of OOB tokens.

Tether will be entitled to shares of VCI Global as part of the company’s $50 million restricted stock issuance to the OOB Foundation, where it will gain an indirect stake through its existing stake in OOBIT.

VCI Global is a developer of cross-industry technology platforms and hopes to position itself as a key player in the digital assets space by integrating OOBIT’s token utility into its AI, fintech and sovereign data platforms.

OOBIT is a crypto mobile payments platform backed by Tether, CMCC Global and Solana co-founder Anatoly Yakovenko. Tether led OOBIT’s $25 million Series A funding round in February 2024.

VCI Global has already acquired $50 million worth of OOB tokens through the issuance of restricted stock and will purchase an additional $50 million using cash purchases following the public launch of OOB tokens.

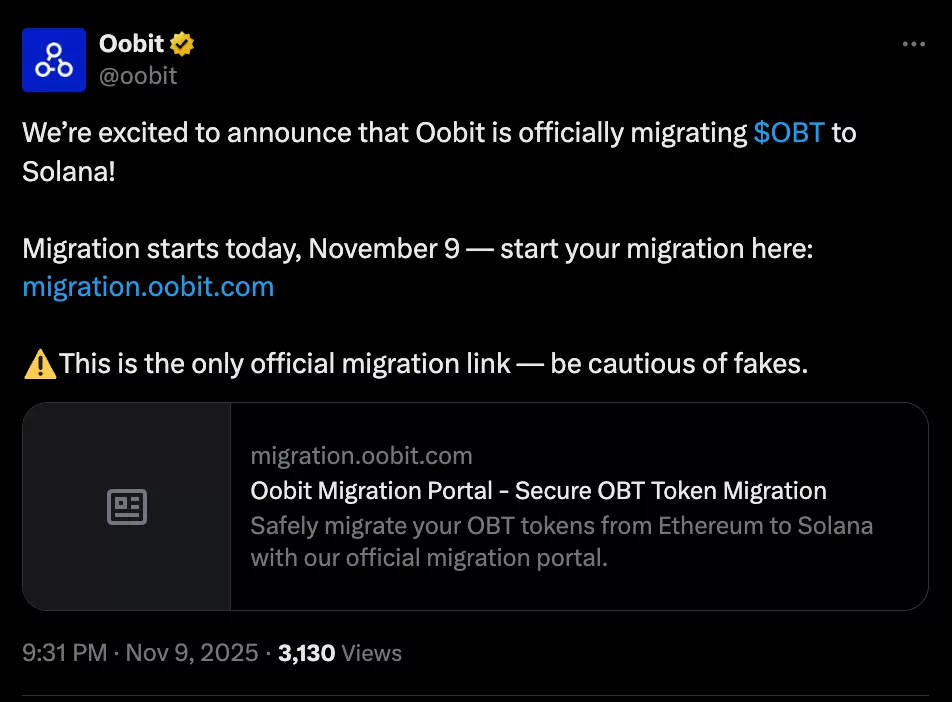

OOBIT is currently in the process of renaming the token and migrating it from Ethereum to Solana. According to the official announcement, the process is expected to be completed by November 12. See below.

As Tether is already the largest shareholder of OOBIT, it will indirectly receive a notable portion of the newly issued VCI Global shares through the OOB Foundation, effectively making it the largest shareholder of the Nasdaq-listed company.

Tether has long used strategic investments to expand its presence outside of the stablecoin market, where its flagship stablecoin USDT has the largest market share with a total market capitalization of $183 billion.

Just a day ago, Rumble, the Tether-backed video platform, announced plans to acquire German data center operator Northern Data, which also counts Tether among its major investors and backers. Earlier this year, Tether acquired a minority stake in Bit2Me, a leading Spanish digital asset platform, and in February the stablecoin issuer made a strategic investment in the Zengo wallet to drive global adoption of self-custody and stablecoin-based payments.

And the company’s approach appears to be paying off. Last month, Tether became one of the world’s top 20 holders of U.S. debt after reporting more than $10 billion in year-to-date profits and disclosing $135 billion in exposure to U.S. Treasuries, ranking ahead of sovereign holders like South Korea.