Data shows that positive sentiment around Bitcoin has increased on social media after BTC returned above $58,000, implying that investors may be experiencing FOMO.

Bitcoin’s positive/negative sentiment ratio has recently increased

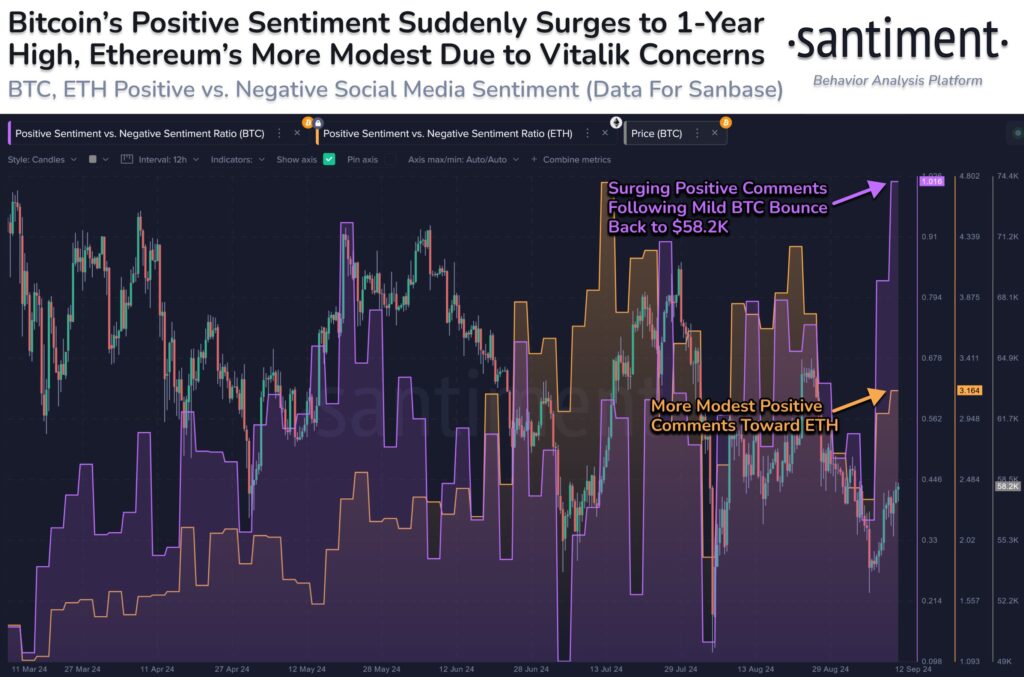

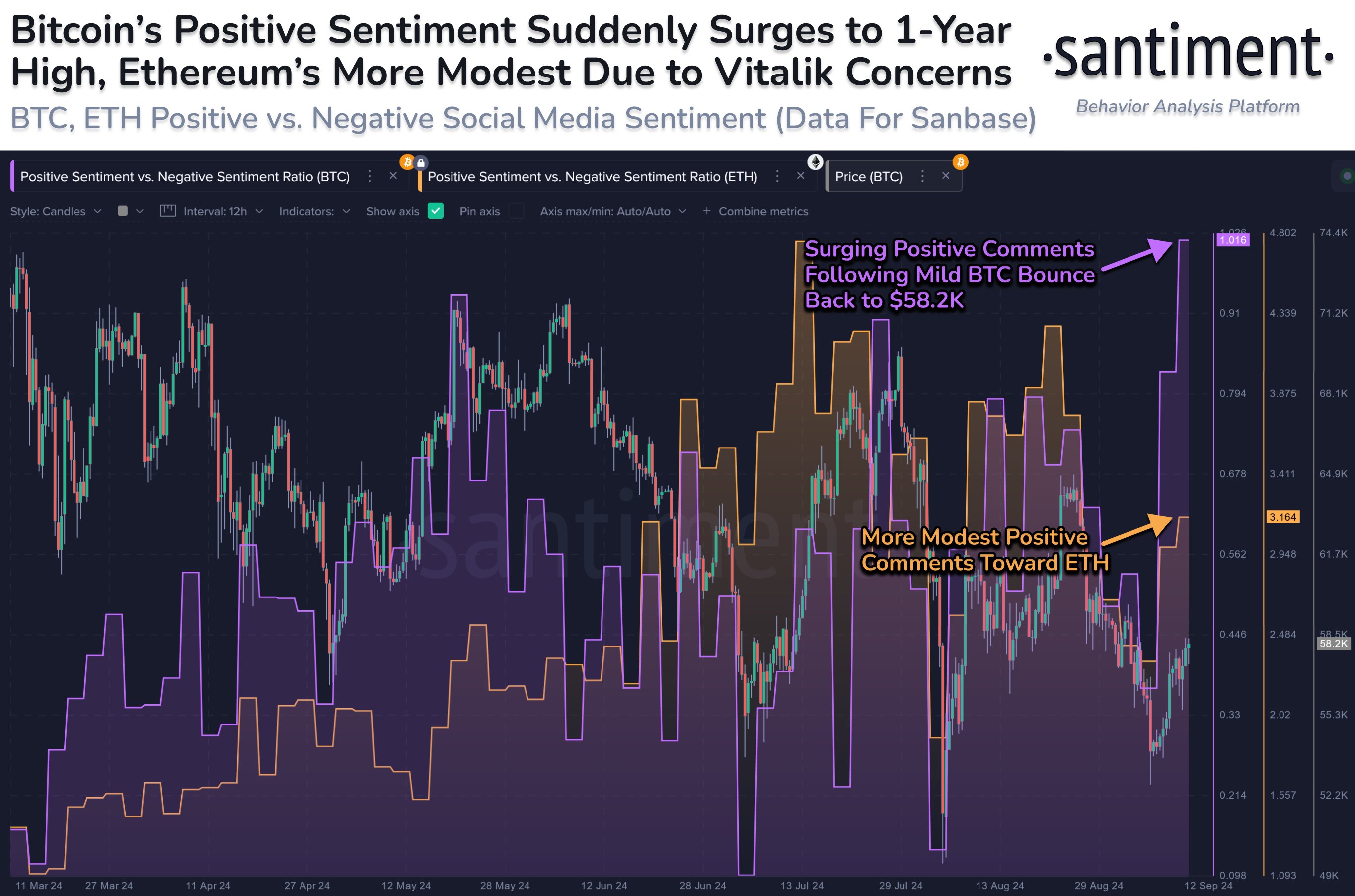

According to data from analytics firm Santiment, the public has recently shown a sudden surge of optimism towards Bitcoin. The relevant metric here is the “Positive Sentiment vs. Negative Sentiment Ratio,” which, as the name suggests, tracks the ratio of positive to negative comments on social media related to a given cryptocurrency.

The analytics company sources posts/threads/messages from platforms like Twitter, Reddit, Telegram, and 4Chan. To determine whether these posts are negative or positive, Santiment runs them through a machine learning model.

When the indicator has a value greater than 1, comments related to positive sentiment outweigh negative comments. On the other hand, being below the threshold suggests that most social media users share a negative sentiment.

Now here is a chart that shows the trend of the positive sentiment to negative sentiment ratio for the two leading currencies in the sector, Bitcoin and Ethereum, over the past few months:

As seen in the chart above, a huge increase in positive sentiment over negative sentiment was observed for Bitcoin following the cryptocurrency’s latest rally.

The peak of this increase corresponds to twice as many positive posts as negative posts on the main social media platforms. This is the first time that the indicator has reached such a high level.

While this indicates that investors are feeling bullish about the asset, the scale of optimism could be worrisome. Indeed, BTC has historically tended to go against the majority’s expectations, with the likelihood of a countermove increasing as the crowd becomes more certain of a direction.

Given that positive sentiment has exploded after only a slight price increase, FOMO could be taking over the market a little too early. This could lead to a potential top for Bitcoin. As for when BTC’s fortunes could turn bullish again, the analyst firm states:

Expect traders to “slow down” and start expressing fear again. When the crowd starts expressing doubt again, BTC will really start to test its March all-time high market caps.

Interestingly, while fear of missing out on Bitcoin is taking over social media, users are still only showing modest optimism about Ethereum. This could naturally work in favor of ETH’s price.

BTC Price

Bitcoin struggled to make a sustained move above $58,000, with the coin suffering another rejection today at $57,800.