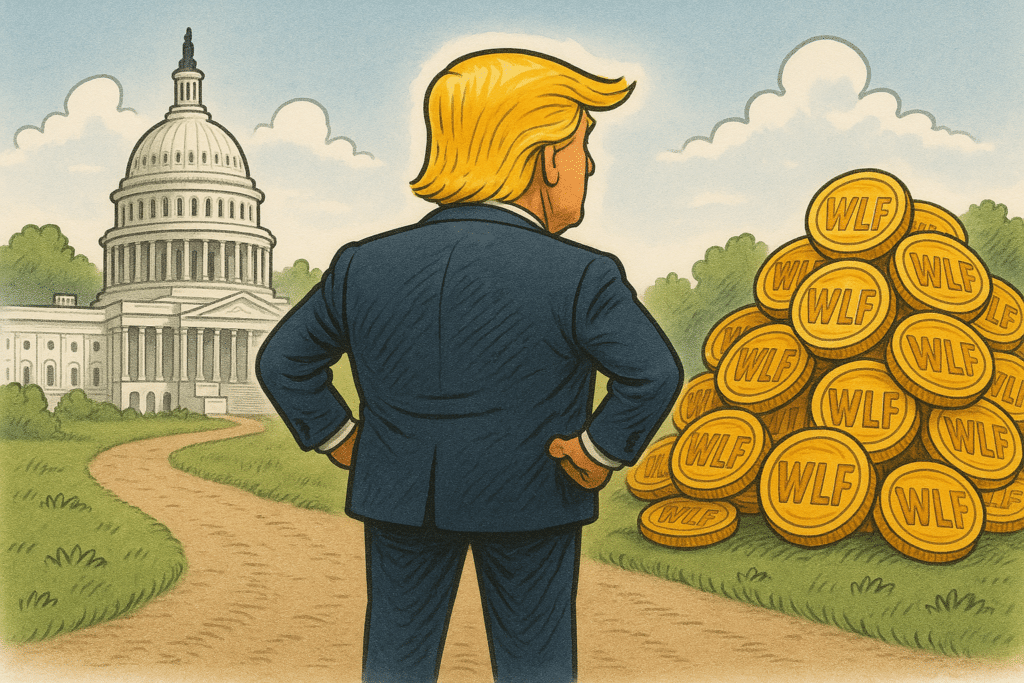

Trump’s DeFi platform could force him to choose between regulatory credibility and personal profit, with consequences for the entire industry.

Trump’s WLFI Platform and Crypto Legislation Are About to Collide

(ChatGPT)

Posted December 17, 2025 at 5:05 PM EST.

Since September 2024, President Trump’s sons Donald Jr., Eric and Barron have built their DeFi project, World Liberty Financial, alongside longtime Trump ally Steve Witkoff’s sons, Zach and Alex Witkoff, and struck deals with major crypto companies such as Kraken, Aster Exchange and Bithumb.

The market capitalization of its WLFI token East to $3.52 billion, and its USD1 stablecoin was used as a settlement asset for a $2 billion investment by Abu Dhabi’s MGX in Binance, one of the largest stablecoin-funded crypto transactions to date. USD1 has its own market capitalization of 2.7 billion dollars, or class 6th among global stablecoins by market capitalization.

However, as our report shows, the WLFI project is structured in such a way that it is very unlikely to fit the definition of “decentralized” finance in a long-awaited market structure bill, which could create problems between the White House, Congress and the industry as a whole.

Read more: USD1 Airdrop rewards early adopters with 8.4 million tokens

Legislation is moving through Congress, but the two biggest sticking points involve ethics and DeFi. The White House has already reported that the president will not sign legislation that would include constraints on how he, his family, and his entourage operate in the crypto industry.

Will Trump sign a law that could handcuff his iconic “DeFi” platform? And given that WLFI is centralized, will he and his family comply with the new law or could he try to argue that his plan is different from that of Coinbase and Kraken? What would it mean for the new legislation if the president and his family sought a special exclusion for themselves?

Our research takes time, calls and credibility.

If this report helps you make sense of this space, consider subscribing to read the rest and help make more possible

Take advantage of the limited time offer!

Only $1.75 for the first month (95% off)

Renews at $35/month

Upgrade

Already a member? Log in here.

Why a subscription can save you thousands:

- In-depth investigations who report scams, bad actors and hidden risks before they reach the deadline, protecting you from losing money that you will never get back.

- Breakdowns that show where the real opportunities lietransforming messy information and onchain noise into clear, usable information you can act on.

- Direct explanations of market eventswritten so everyone can understand what’s going on and what it means for your money.

- Early warnings on projects showing red flagsso you can get out before things explode and everyone panics.

- Profitable reportingbecause avoiding a bad trade or catching a smart move often covers the entire subscription several times over.