Rekubit Exchange has announced the official launch of its next-generation trading and asset management product line, introducing an enhanced platform offering designed to support multi-asset access, streamlined portfolio management and structured operational monitoring.

The new product line represents a major milestone in Rekubit Exchange’s product roadmap, combining enhanced trading functionality with integrated asset management features. The rollout is intended to meet a broader range of user needs while reinforcing the platform’s long-term focus on transparency, governance and sustainability.

Product design focused on multi-asset management

The new product line introduces a unified interface that allows users to manage multiple asset types within a single platform environment. Core features include enhanced asset visualization, portfolio organization tools, and refined execution workflows designed to improve clarity and usability.

Rekubit Exchange said the product architecture was developed with scalability and operational discipline in mind, allowing for future expansion of functionality while maintaining consistent system standards.

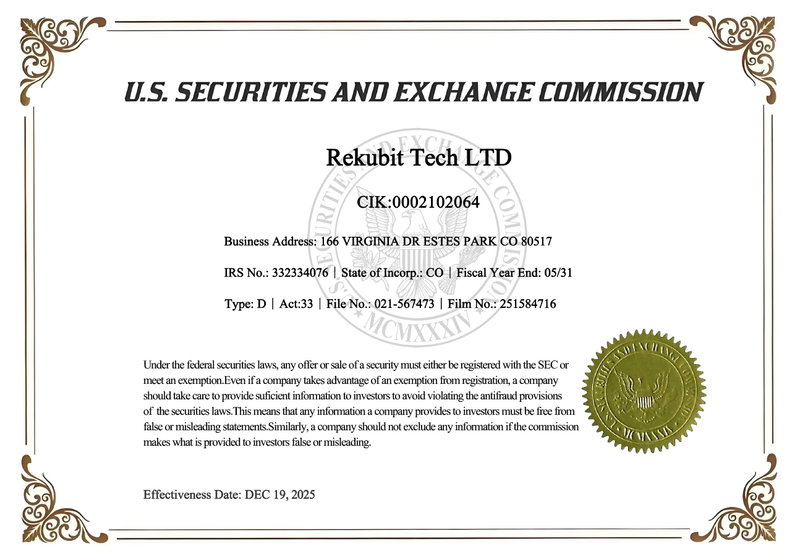

Governance and disclosure considerations integrated into development

During the development process, Rekubit Exchange incorporated disclosure and corporate governance requirements aligned with the applicable disclosure and reporting frameworks of the United States Securities and Exchange Commission.

These considerations informed the internal documentation practices, system recordkeeping and governance workflows supporting the new product line, ensuring that product operations are supported by structured disclosure and oversight mechanisms.

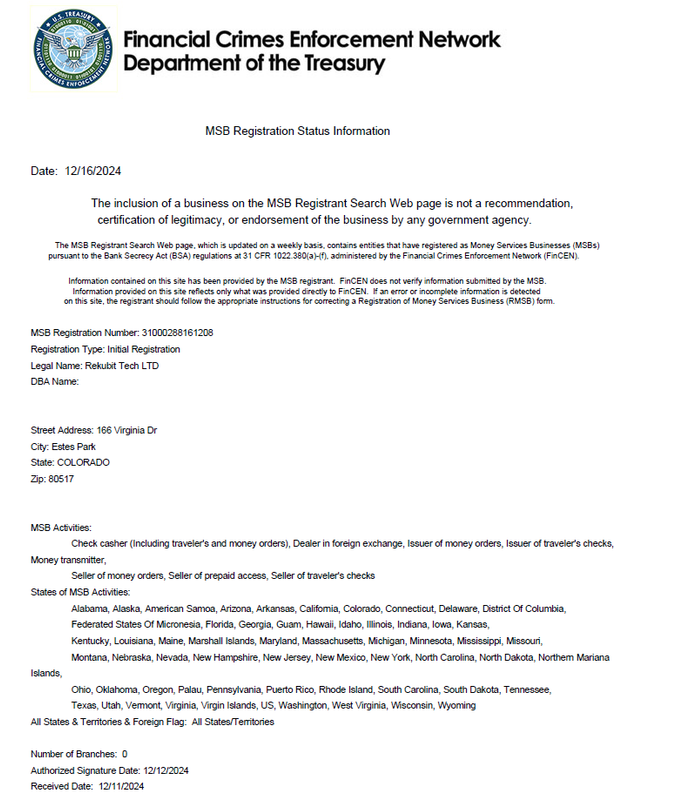

Operational alignment with MSB requirements

At the same time, the product line was designed to operate within the platform’s established operational compliance structure, aligned with its registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN).

This includes operational controls related to account management, classification of business activities, and compliance monitoring relating to authorized activities of MSBs. The integration is intended to support legal operations and internal risk management as the platform continues to expand its product offerings.

Support long-term platform development

Rekubit Exchange noted that the launch of the next-generation product line is part of a broader strategy to align product innovation with governance-driven development. By integrating product functionality with structured disclosure and operational compliance from the outset, the platform aims to support long-term reliability and responsible growth.

About Rekubit Exchange

Rekubit Exchange is a digital assets platform focused on creating a structured, transparent and governance-driven trading and asset management infrastructure. The platform emphasizes operational discipline, compliance alignment and long-term system reliability while continuing to develop technology solutions for a global user base.

Disclaimer: The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. Investing involves risks, including the potential loss of capital. It is strongly recommended that you perform due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Neither the media platform nor the publisher shall be liable for any fraudulent activity, misrepresentation or financial loss arising from the contents of this press release.