The main driver of cryptocurrency sentiment and price action this week was not endogenous to the cryptoasset market, but rather a brutal “black swan” geopolitical event that shook both traditional and crypto markets.

President Trump’s January 18 announcement of a 10% tariff on key European allies, contingent on the US acquisition of Greenland, triggered a violent de-risking event across all speculative categories. Bitcoin, which had been consolidating near the psychological threshold of $96,000, experienced a “liquidity hunt,” liquidating nearly $900 million in leveraged long positions as the market turned to traditional safe havens. However, BitGo’s successful IPO on the NYSE suggests that while short-term price action remains sensitive to macroeconomic shocks, the structural institutionalization of the asset class is reaching terminal velocity that is difficult to reverse.

Key takeaways

-

Geopolitical sensitivity: BTC’s temporary decoupling from “digital gold” status during the pricing announcement highlights its current role as a high-beta liquidity proxy rather than pure geopolitical hedge. Gold’s rise to $4,800 highlights a “preference for the physical” in times of NATO-centered instability.

-

Legitimacy of infrastructures: The IPO of BitGo (ticker: BTGO), priced above the range for an implied valuation of $2.08 billion, marks the end of the “crypto discount” for regulated service providers. Backing from Goldman Sachs and Citi provides the necessary seal of approval for the next wave of capital.

-

Regulatory Stasis: The delay of the CLARITY Act in the Senate Banking Committee constitutes a tactical setback for the optimism of the first quarter. The shift toward housing affordability suggests the “Crypto Summer” of legislative certainty could be pushed back to late spring.

Macroeconomic and market structure

The liquidity regime

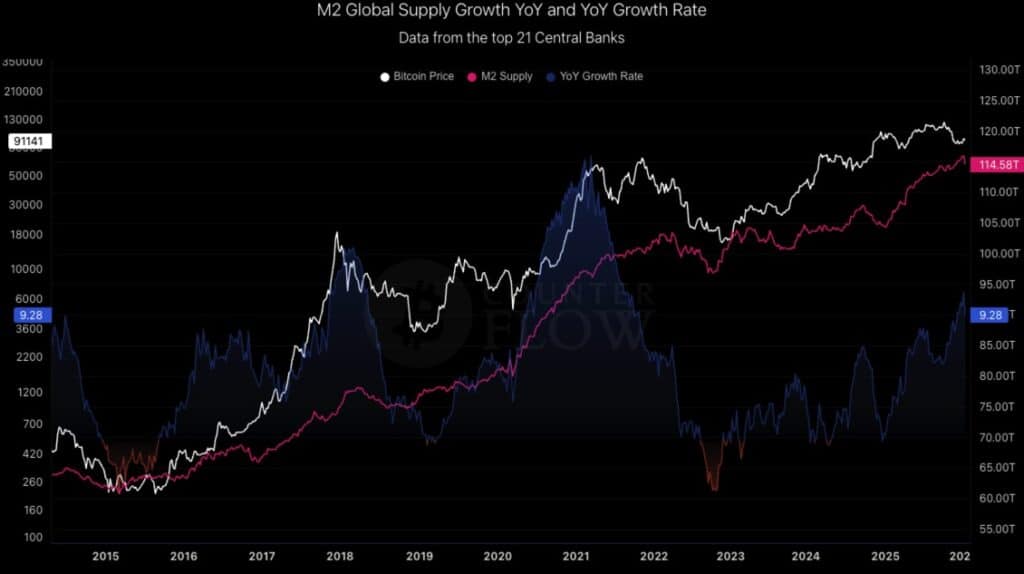

We are currently navigating a complex volatility regime. Growth in global money supply M2 has stabilized at around +1.0% over three rolling months, but the “carry cost” for institutional players remains high. The Fed’s current stance, complicated by a criminal investigation into Chairman Powell, has introduced a political risk premium into U.S. Treasury yields. We view the current environment as a “liquidity standoff”: expansionary fiscal rhetoric battles risk aversion triggered by the escalating trade war.

How assets performed this week

(crypto-widget coin=”bitcoin” link=” text=”Buy with the best wallet”), (crypto-widget coin=”ethereum” link=” text=”Buy with the best wallet”), and most altcoins saw outflows this week, amid market uncertainty. Bitcoin lost 5.23% of its price, Ethereum did a little worse at -12.22% and the total crypto market cap fell just below 7%.

| January 18 | January 22 | Percentage change | |

| Bitcoin | $93,635 | $88,737 | -5.23 |

| Ethereum | $3,347 | $2,938 | -12:22 p.m. |

| Total market capitalization | $3,360,736,914,106 | $3,130,345,656,216 | -6.86 |

Correlation observations

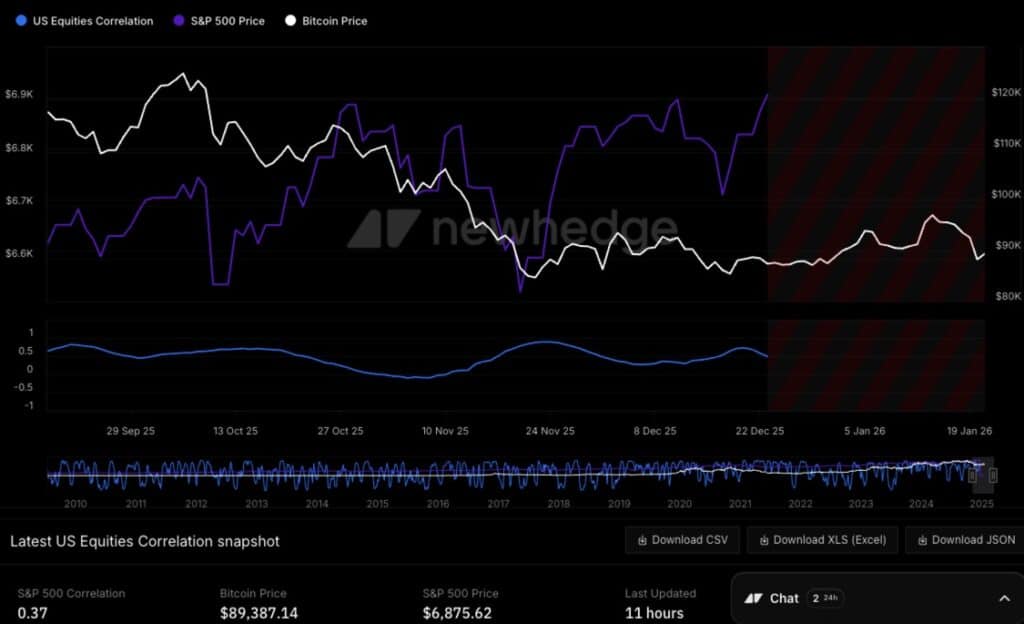

The 30-day correlation between Bitcoin and the S&P 500 reached 0.37, due to the synchronized selling of “risky” assets following the tariff announcement. Conversely, the correlation with gold reversed to -0.15 this week as the yellow metal absorbed the safe-haven flows that Bitcoin failed to capture during the initial two-hour slide from $3,600.

Techniques: the majors

Bitcoin: testing the ETF cost basis

The $91,000-$92,000 area is not just a technical level; it represents the basis of the estimated overall cost for the 2025 institutional cohort (the “ETF Category”). As the spot price fell to $91,900, we observed aggressive “dip buying” from authorized participants, although this was not enough to prevent a deeper break below the $90,000 level. Core trading remains profitable, although the shrinking of “Kimchi Premium” in South Korea, amid an investigation into the demise of government Bitcoin, suggests a cooling of retail fervor in the APAC region.

Bitcoin has fallen below a weak trendline and could move down to 84,000, where the next major support level lies.

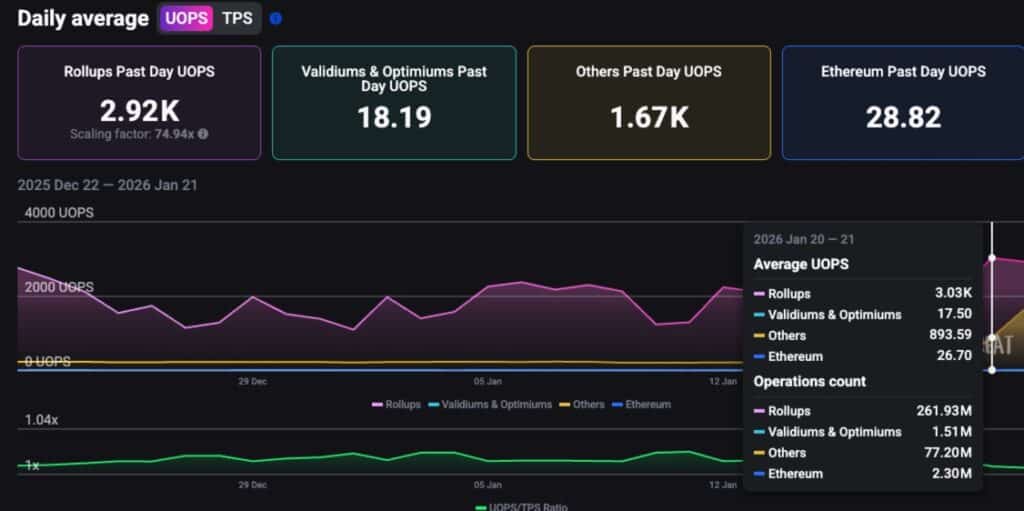

Ethereum: the L2 value capture dilemma

Ethereum continues to face a fundamental identity crisis regarding value accumulation. As network activity reaches an all-time high, capturing L2 value remains problematic for mainnet players. Around 88% of transaction revenue this week was retained by Arbitrum, Base and Starknet, leaving Ethereum mainnet fees at their lowest level in 12 months. Until the “exhaustion rate” of L1 blobs is adjusted via EIP-7762 (expected for late 2026), ETH will likely continue to underperform BTC on a risk-adjusted basis.

Industry Spotlight: AI and the Agentic Economy

We closely monitor Agentic Inflows (capital controlled by autonomous AI agents). This week, we tracked over $140 million in on-chain volume generated by “heuristic arbiters,” which are AI entities operating without human intervention on the Solana and Base networks.

Maturation of DePIN: Projects focused on decentralized computing (e.g. Akash, Render) saw a 12% increase in utilization rates this week as centralized GPU vendors face possible tariff-related supply chain disruptions.

The “River” bet: Justin Sun’s $8 million injection into the River DeFi project is a play on “Chain Abstraction.” By integrating sTRX yields with stablecoin infrastructure, Sun attempts to capture liquidity from “unbanked” AI agents which requires high-speed, low-cost settlement layers.

All of this is leading to growing bullish sentiment around the intersection of AI and the crypto economy and the potential for a long-term play, although it should be cautioned that if this AI hype is anything like the dotcom boom, more than 90% of early projects will fail and eventually go to zero.

My opinion: It’s too early to try to pick DePIN AI winners in the long term, although there is certainly interesting business potential in the short term.

On-Chain Intelligence

Stablecoin speed: USDT speed on the TRON network increased by 18% this week. The Elliptic report regarding Iran’s acquisition of $500 million USDT suggests that stablecoins are increasingly being used for “sanctions-neutral trading.” While this creates regulatory hurdles, it demonstrates the “asymmetric utility” of the asset class.

Exchange flow: We noted a significant outflow of BTC from centralized exchanges into cold storage during the $91,900 decline, suggesting that “smart money” viewed the Greenland sell-off as a volatility event rather than a structural trend reversal. We analyzed this behavior as a “flight to safety” amid growing geopolitical unrest, with Bitcoin holders rushing to withdraw their coins from exchanges, as soon as Trump ruled out the use of force and easing EU tariffs, BTC flows increased to exchanges.

The return on exchanges likely means that investors are anticipating Bitcoin to return to around the $97,000 level, where we expect to see significant selling pressure.

Regulatory and political monitoring

The Clarity Act delay is making headlines here. The Senate’s shift in focus toward housing affordability suggests a cooling of the “Trump pump” for crypto legislation. AI, tariffs, geopolitical unrest, and the Trump administration’s focus on affordability for U.S. citizens are taking some of the focus away from crypto legislation. However, despite the delay of the Clarity Act, we do not foresee a return to the “Gensler era” attack on crypto, as Atkins sits at the head of the SEC and has already shown himself to be crypto-forward, although it is unclear how the jurisdictional relationship will play out between the SEC and CFTC until the introduction of the Clarity Act.

Meanwhile, the GENIUS Act remains the only firm safeguard for stablecoin issuers, which explains why BitGo’s IPO was met with such enthusiasm; they are one of the few entities with the “compliance gap” necessary to survive the current impasse.

Upcoming events to watch out for

CME Altcoin Launch (February 9)

The addition of Cardano (ADA), Chainlink (LINK), and Stellar (XLM) to the CME derivatives suite on February 9 is the next major structural tailwind. We expect “top tier” liquidity to shift specifically to LINK, given its role as the primary oracle for the Real-World Asset (RWA) sector. We wouldn’t be surprised if this was a “news sell” type event, with price appreciation occurring in the days leading up to the event, followed by a sell-off.

DISCLAIMER: This report is provided for informational purposes only and does not constitute financial, investment or legal advice. Digital assets are subject to extreme volatility and risk of total loss. Consult a qualified professional before making any investment decision.

The article Weekly Crypto Market Update January 18-22 appeared first on 99Bitcoins.