- Peter Schiff criticized MicroStrategy’s stock despite it hitting a record high.

- The market value of MicroStrategy’s Bitcoin wallet has grown to over $40 billion, despite volatility.

Peter Schiff, a prominent critic of cryptography, has once again targeted Michael Saylor’s company, MicroStrategy.

In a recent article, Schiff issued a stark warning regarding MicroStrategy (MSTR) shares, which recently hit an all-time high following the company’s ambitious plan to turn it into a billion-dollar Bitcoin (BTC) bank of dollars.

This serves as another example of Schiff’s continued skepticism of companies deeply invested in cryptocurrencies, particularly BTC.

On October 22, he posted on X (formerly Twitter):

“$MSTR has to be the most overvalued stock in the MSCI World Index. When it crashes, it will be a real bloodbath! »

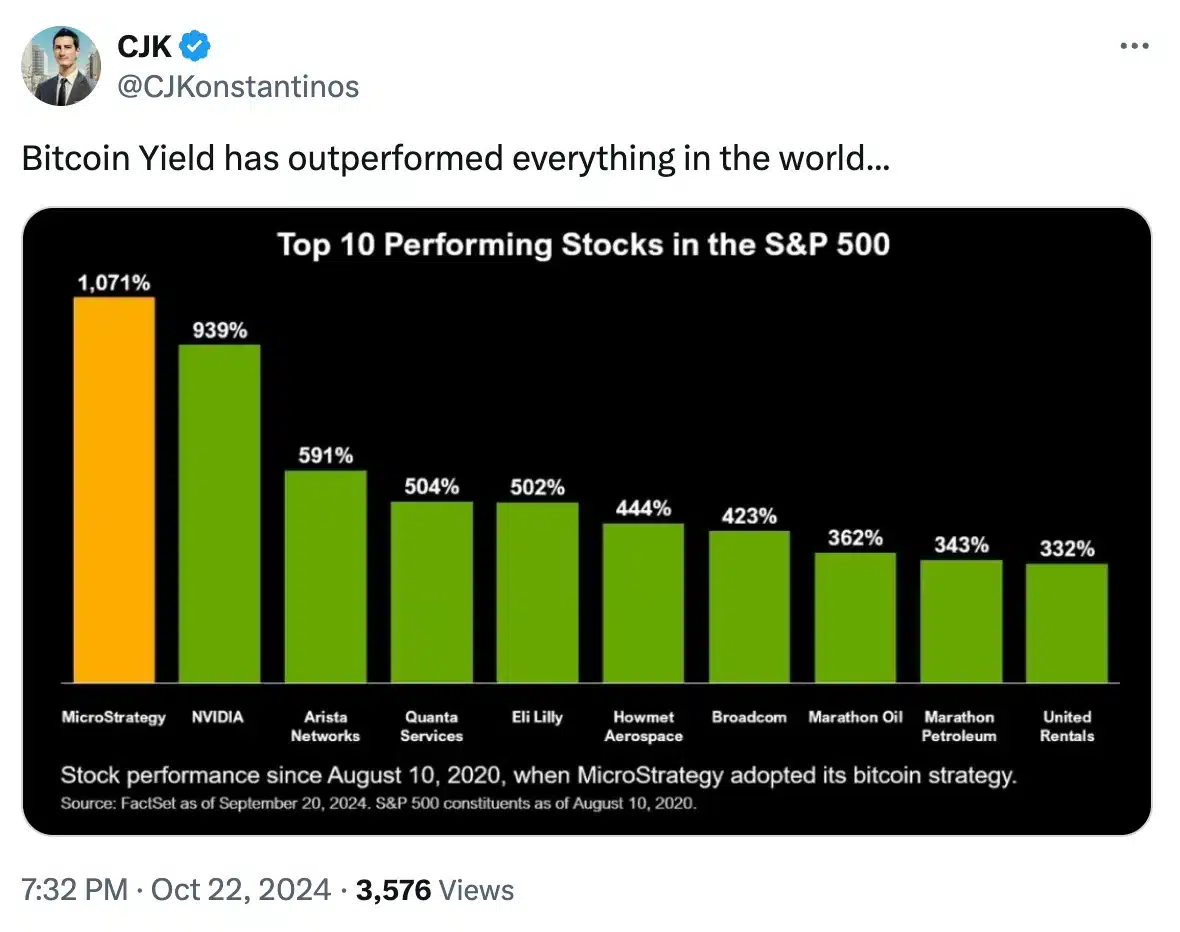

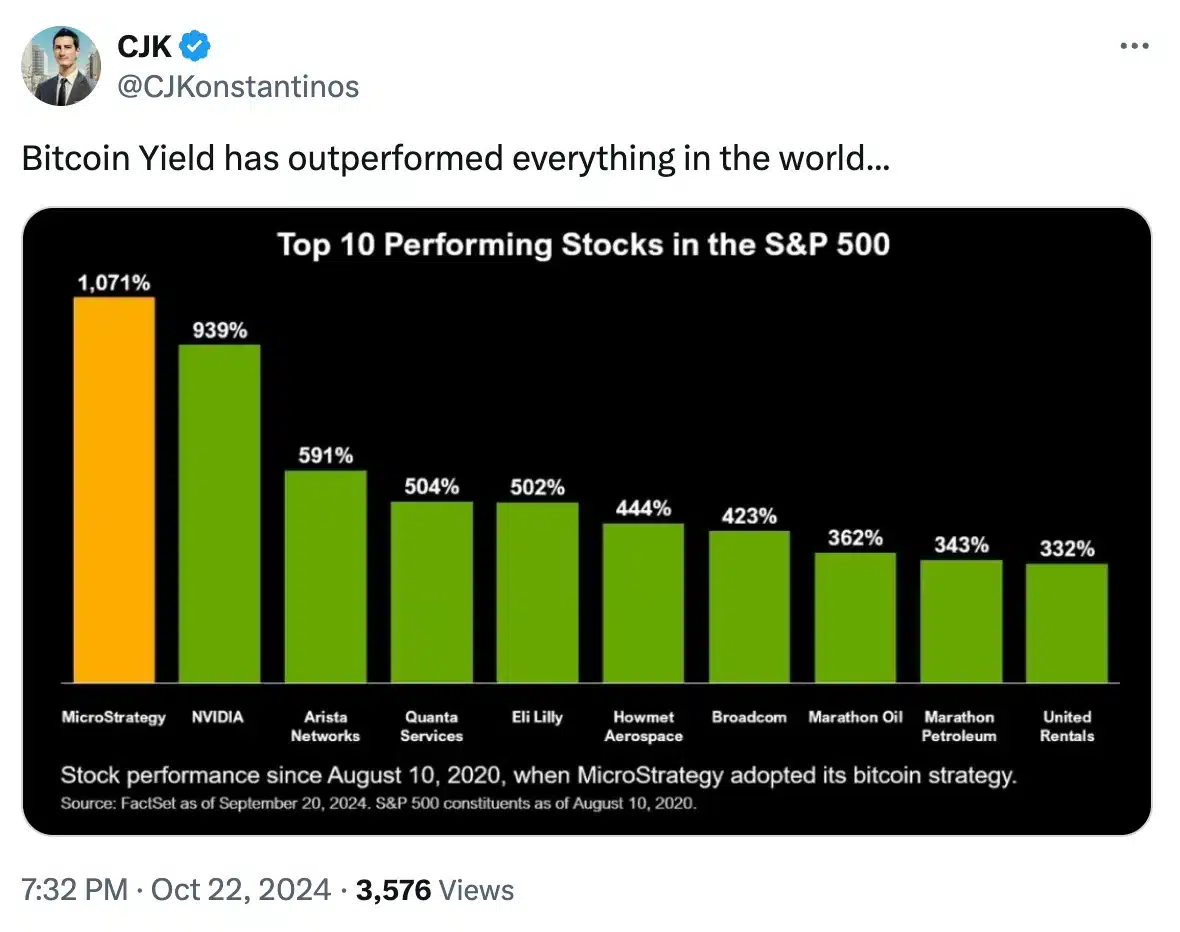

However, the warning was largely taken with a grain of salt, as CJ Konstantinos pointed out in his recent article where heI said,

Source: CJK/X

However, Schiff continued his argument, asserting his points and asserting:

“Bitcoin has no yield. You can sell it to generate capital gains, you can write calls against it to generate income, but Bitcoin itself has no return. Worse yet, if you own it in an ETF, you pay custody fees.

Why is Schiff against Bitcoin?

Schiff, a longtime gold advocate and vocal opponent of cryptocurrencies, has consistently expressed skepticism toward Bitcoin.

He has often argued that BTC is a speculative asset lacking the intrinsic value of traditional investments like gold.

This has made him a prominent figure in the ongoing debate between Bitcoin supporters and those who believe in traditional finance.

On the other hand, MicroStrategy’s strategic pivot into BTC has proven to be very lucrative.

Over the past four years, the company’s market value has grown from $1.5 billion to more than $40 billion. This growth is largely attributed to Michael Saylor’s bold decision to invest heavily in Bitcoin.

The move positioned MicroStrategy as a major player in Bitcoin, controlling 252,220 BTC.

Schiff takes a hit on Saylor

During a recent discussion about BTC seized from the Silk Road market, Peter Schiff humorously targeted Michael Saylor.

Schiff joked that Saylor should consider borrowing $4.3 billion worth of Bitcoin from the government to further bolster MicroStrategy’s already massive BTC holdings.

The sarcastic remark highlights Schiff’s consistent criticism of Saylor’s aggressive Bitcoin strategy, while subtly mocking the company’s deep commitment to growing its cryptocurrency assets.

Amid these discussions, MicroStrategy’s stock price saw a modest rise of 0.30%, to $219.70. This reflects investors’ continued confidence in the company’s BTC-focused strategy.

Source: Google Finance

On the other hand, Bitcoin saw a slight decline of 0.93% over the past 24 hours, with its price sitting at $66,947.37 at press time, according to CoinMarketCap.