Ethereum has taken a notable step earlier this month when the American Securities and Exchange (SEC) Commission approved negotiation options for several funds (ETF) negotiated on the stock market. This decision should increase liquidity, arouse interests of institutional investors and solidify the position of Ethereum as a major cryptocurrency.

However, the smallest market capitalization in Ethereum compared to Bitcoin means that it is also vulnerable to gamma pressures, thus increasing the risks of investors. Beincryptto consulted an expert in trade derivatives and representatives of Falconx, Bingx, Komodo Platform and Gravity Team to analyze the potential impact of this new characteristic.

ETF ETF options win the dry approval

The Ethereum community rejoiced earlier this month when the SEC approved the negotiation options for existing FNB ETFs. This approval marks significant regulatory development for digital assets.

This week has marked the official beginnings of the negotiation of options for ETHEUM SPOT ETF in the United States. Ishares Ethereum Trust of BlackRock (ETHA) was the first to list the options, with trading starting on the Nasdaq ISE.

Shortly after, a wider availability of options followed, including those of the Ethereum Trust (Ethe) in gray levels (Ethehe) and Ethereum Mini Trust (ETH) in gray levels, as well as Ethereum Bitwise (ETHW), which all started to negotiate on CBOE BZX exchange.

This decision allows a wider range of investors, beyond Crypto traders, to benefit from coverage and speculation on the price of Ethereum thanks to options on familiar investment vehicles such as ETF without direct property.

The time of this news is particularly positive, because Ethereum has lost land on the market in recent times.

Exchange of options to strengthen the position of the Ethereum market

A significant drop in market confidence surrounded Ethereum this week, with Beincrypto reporting that its price had dropped to its lowest point since March 2023. This drop coincided with a larger slowdown in the market, aggravated by Donald Trump’s release day.

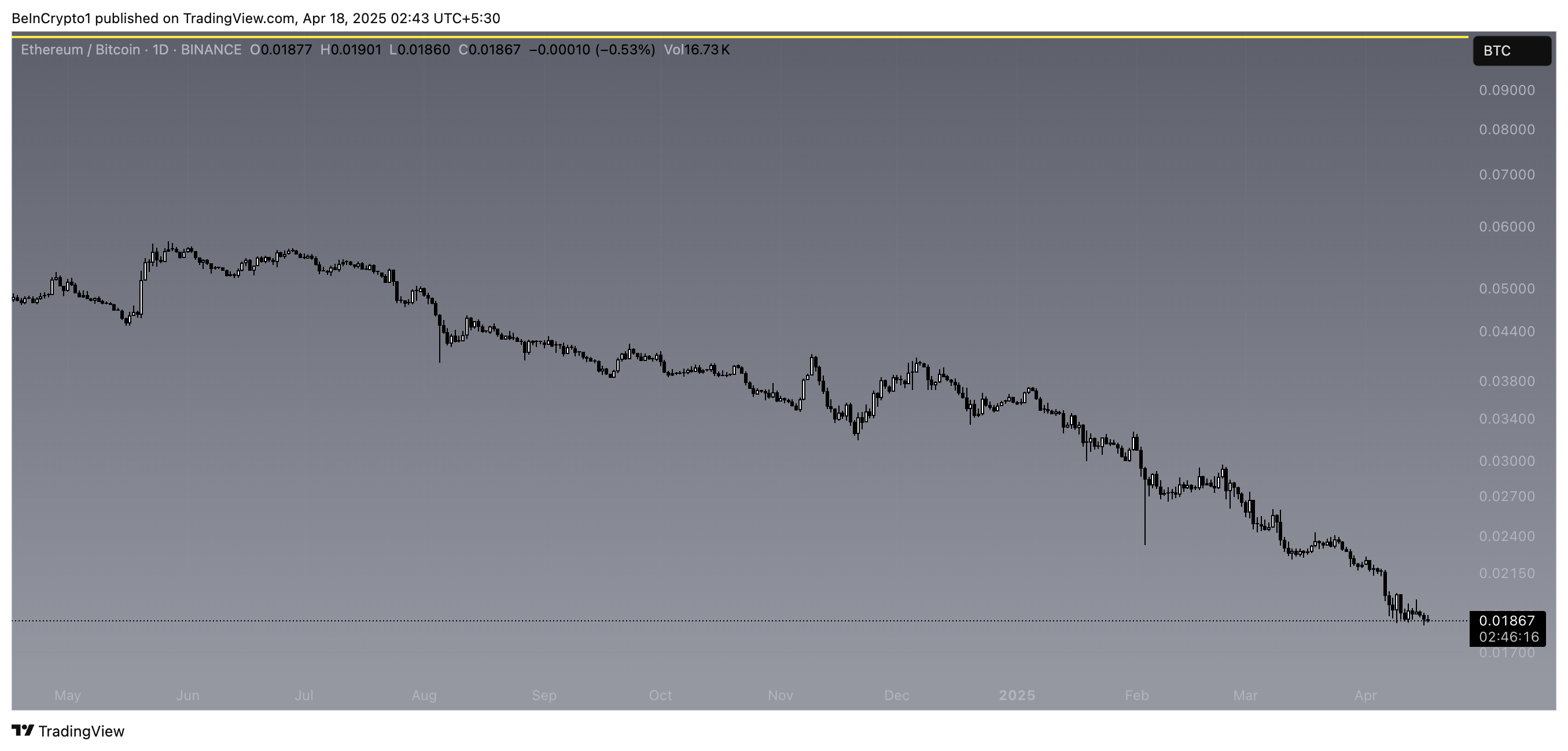

Food more about this lower feeling, the ETH / BTC ratio has reached a five -year hollow, highlighting the growing domination of Bitcoin over Ethereum.

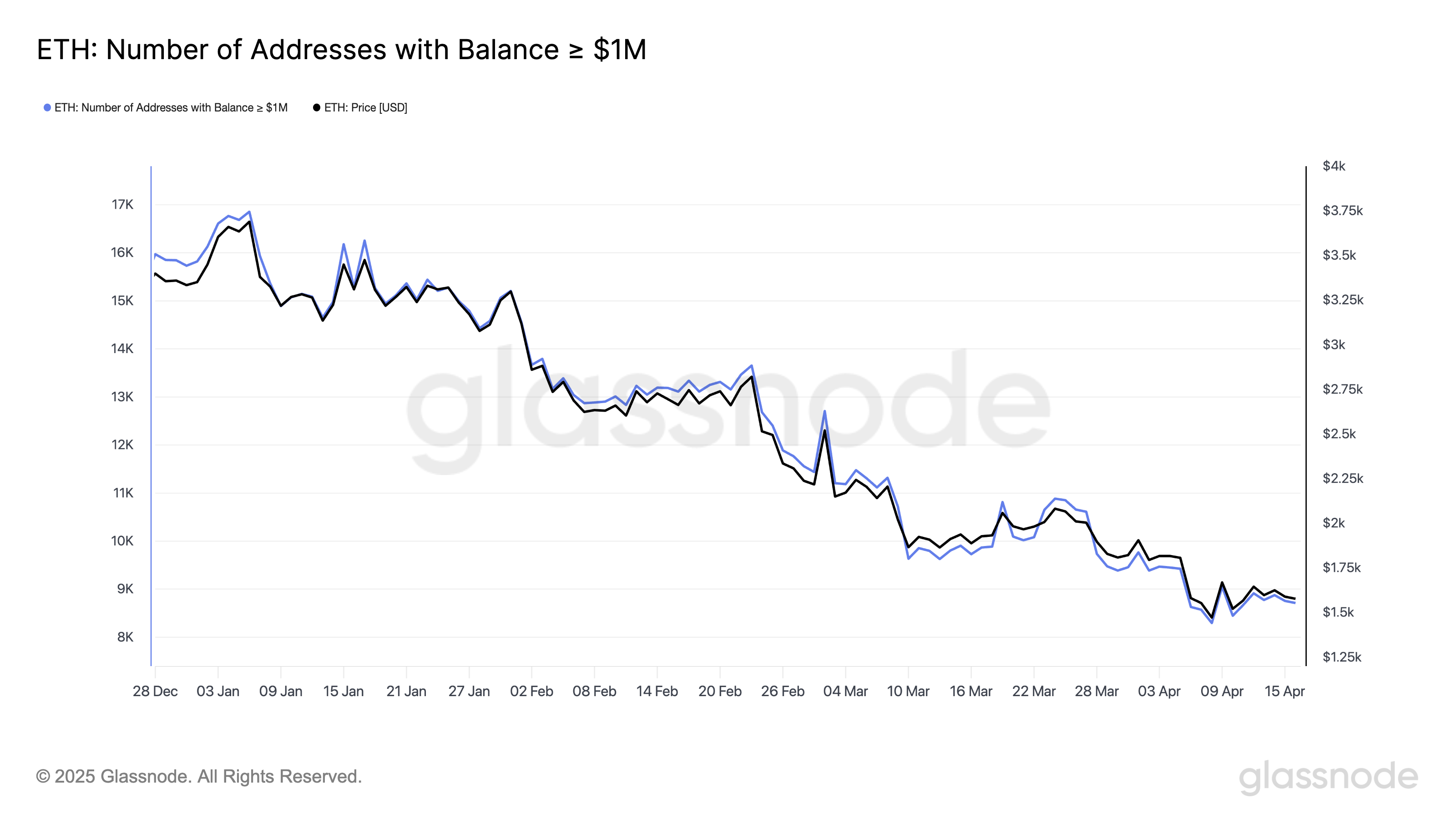

Meanwhile, the great holders of Ethereum sell more and more substantial amounts, exerting downward pressure on their prices. The value of Ethereum has dropped sharply by 51.3% since the beginning of 2025, and the confidence of investors has decreased, as evidenced by a decrease in addresses holding at least $ 1 million in ETH.

The trading of options now accessible to more traders, the experts provide that the position of the Ethereum market will improve.

“ETH has fled domination, less than 17%.

This new accessibility to trading options will create additional opportunities for investors and the wider Ethereum ecosystem.

Higher access and liquidity

The ETHEREUM SEC approval by the ETHEREUM in July 2024 was important because it allowed traditional investors to penetrate the cryptography market without directly holding the assets. From now on, with the trading of options also available, these advantages should be even more important.

“It will offer additional opportunities for the diversification of the portfolio and will create more tracks for products based on ETH. With options beyond the limited offers of Bitcoin ETF, investors can reconsider the way they allocate their funds. This change could lead to more sophisticated trading strategies and greater participation in products based on Ethereum ”, Vivien Lin, director of bingx product, said Beincrypto.

The ETF ETF market will naturally become more liquid with increased participation thanks to the trading of options.

High trading volumes and coverage requests

The new approval of the SEC negotiation options for investors ETF ETF suggests that the market will probably initially experience a high negotiation volume. As a result, merchants must be prepared.

An increase in purchase options will require institutional market manufacturers to cover themselves by buying more Ethereum to meet demand.

“This is the canonically accepted dynamic of the options of options providing better liquidity to the spot markets,” said Gordon Grant, the derivative trader.

Ethereum will also guarantee a unique advantage, especially in institutional trade, improving its perceived quality and stimulating optimism among the main market players.

“ETH has just received a serious institutional rear wind. With options now at stake, Ether is closer to the BTC in terms of negotiable instruments. This increases the legitimacy and usefulness of the ETH in coverage strategies, reducing the gap on the story of the domination of Bitcoin,” said Benkitis to Beincrypto.

However, rapid increases in the trading of options could also have unexpected consequences on the price of Ethereum, in particular in the short term.

Will investors have gamma pressure?

While market manufacturers rush to acquire more underlying assets in the event of higher volume of options, the price of Ethereum will naturally increase. This situation could lead to a pronounced gamma pressure.

When market manufacturers cover their positions in this scenario, the resulting purchase pressure would create a positive feedback loop. Retail investors will feel more inclined to join, in the hope of taking advantage of the rise in the price of Ethereum.

The implications of this scenario are particularly pronounced for Ethereum, since its market capitalization is notably smaller than that of Bitcoin.

The aggressive purchase of traders of ETHA options of traders could force market manufacturers to hide by acquiring the underlying ETHA actions, potentially leading to a more pronounced effect on the price of the ETHA and, by extension, Ethereum.

“We believe that options of options will generally dominate in the long term, but in short gusts, we could see the retail Momentum merchants become massive buyers of etha calls and create gamma compression effects, similar to what we have seen on coins actions like GME dit Beincryptto.

Meanwhile, Grant predicts arbitration -oriented flows will further exacerbate price oscillations.

Arbitration opportunities that should emerge

Investors experienced in the trading of options can continue arbitration to make profits and reduce exposure to risks.

Arbitration involves exploiting price differences for the same assets or almost identical in different markets or forms. This is done by buying on the cheaper market and selling in the most expensive.

According to Grant, traders will seek and exploit these price differences more and more as the ETH options market on different platforms will develop.

“I would expect more arbitration behaviors between the CME drinking and punctual Ethics options and although the flows unilled on the three markets can be temporarily destabilizing, greater liquidity through a diversified range of places should ultimately reduce the extrema of positioning of dislocations and the frequency of such dislocations. Ibit options, ”he explained.

Although arbitration activity should refine prices and liquidity on the Ethereum options market, the asset continues to operate under the shadow of Bitcoin’s established market leadership.

Will the approval of benchmarks help Ethereum fill the gap on Bitcoin?

Although Ethereum has produced a major benchmark this week, it faces competition from a large rival: Bitcoin.

At the end of the fall of 2024, the trading of options started on Ishares Bitcoin Trust of BlackRock (Ibit), becoming the first ETF US Spot Bitcoin to offer options. Although even a year has not been sold since the original launch, negotiation options on Bitcoin FNB have experienced solid trading volumes on the part of retail and institutional investors.

According to Kadan Stadelmann, Director of Technology of Komodo platform technology, the trading of options for ETHEREUM will be relatively disappointing. Bitcoin will always be the cryptocurrency of choice for investors.

“Compared to the FNB Spot of Bitcoin, the FNB of Ethereum has not seen such a request.

Consequently, its perspectives do not include the position of the Ethereum market exceeding that of Bitcoin in the immediate term.

“The formerly promised elissement of Bitcoin market capitalization by Ethereum remains unlikely. Conservative investors and more on the frames probably prefer Bitcoin because of its security perceived compared to other cryptographic assets, including Ethereum. Ethereum, in order to reach the prominence of Bitcoin, must depend on the growing utility in the usefulness of defi and stablecoin, “he concluded.

Although this may be the case, the trading of options does not harm the prospects of Ethereum; This only strengthens them.

Can the era of Ethereum optional trading capitalize on opportunities?

Ethereum is now the second cryptocurrency with the approval of the dry for the negotiation options on its ETF. This unique movement will further legitimize digital assets for institutions, increasing their presence on traditional markets and stimulating global visibility.

Despite significant recent blows to the position of the Ethereum market, this news is a positive development. Although it is not enough to exceed its main competitor, it represents a step in the right direction.

While investors get used to this new opportunity, their level of participation will reveal how beneficial it will be for Ethereum.

Non-liability clause

Following the directives of the Trust project, this operating article presents opinions and prospects of experts or individuals in the industry. Beincrypto is dedicated to transparent relationships, but the opinions expressed in this article do not necessarily reflect those of Beincrypto or its staff. Readers must check the information independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.