- AAVE has a bearish structure and neutral momentum.

- Short-term holders likely contributed to the price decline with profit-taking activity, and accumulation has yet to resume.

Aave (AAVE) was well positioned in the DeFi sector and could efficiently handle decentralized liquidations. This allowed it to generate $6 million in revenue overnight.

The protocol also saw some important milestones in July, such as the proposed introduction of a “fee change.”

On the price side, AAVE appears to have held firm despite the losses suffered by the broader market earlier this month. This idea was abandoned during the sell-off on Monday, August 5th.

What are the prospects for the token from now on?

AAVE retains its downside potential

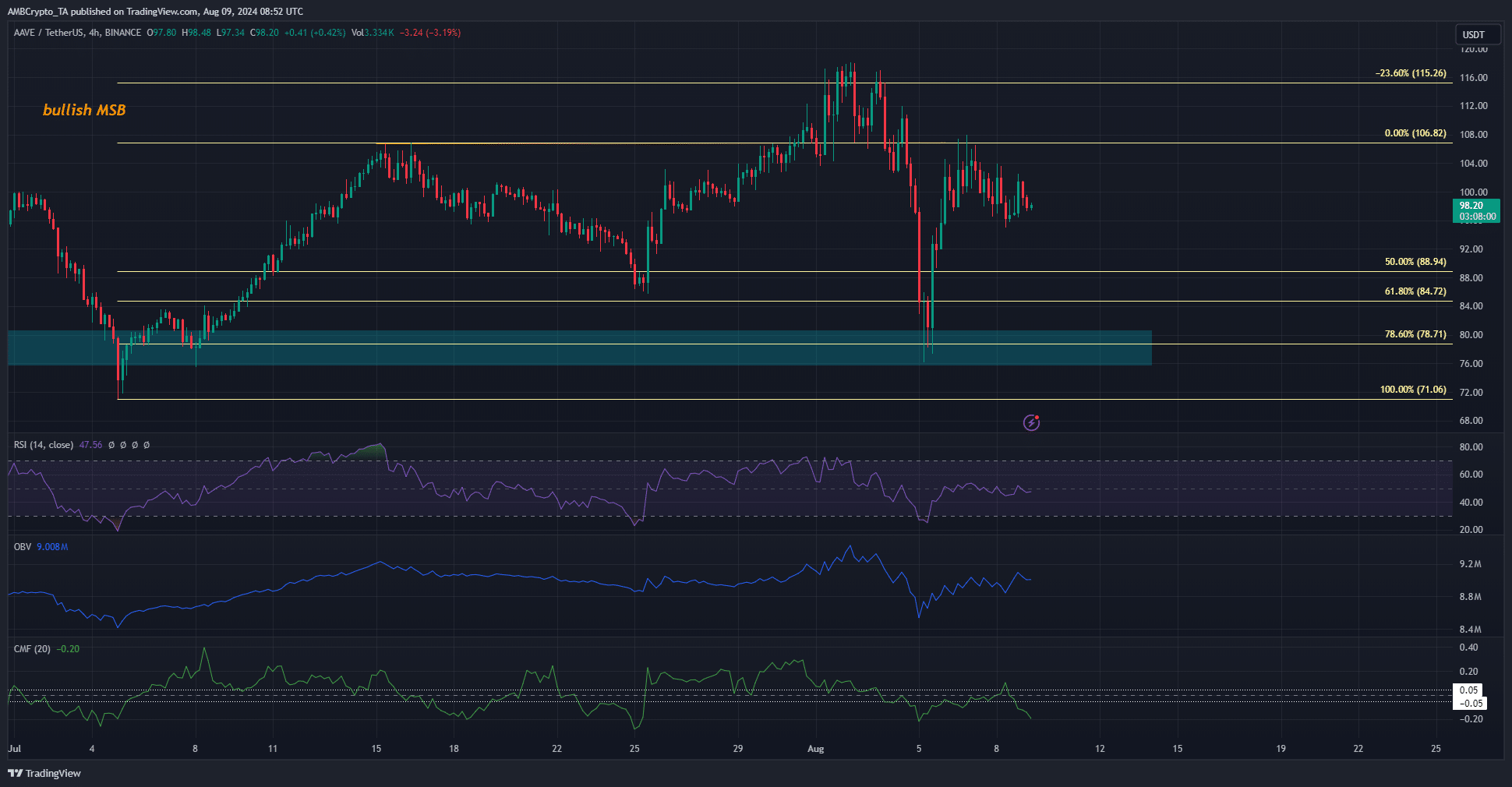

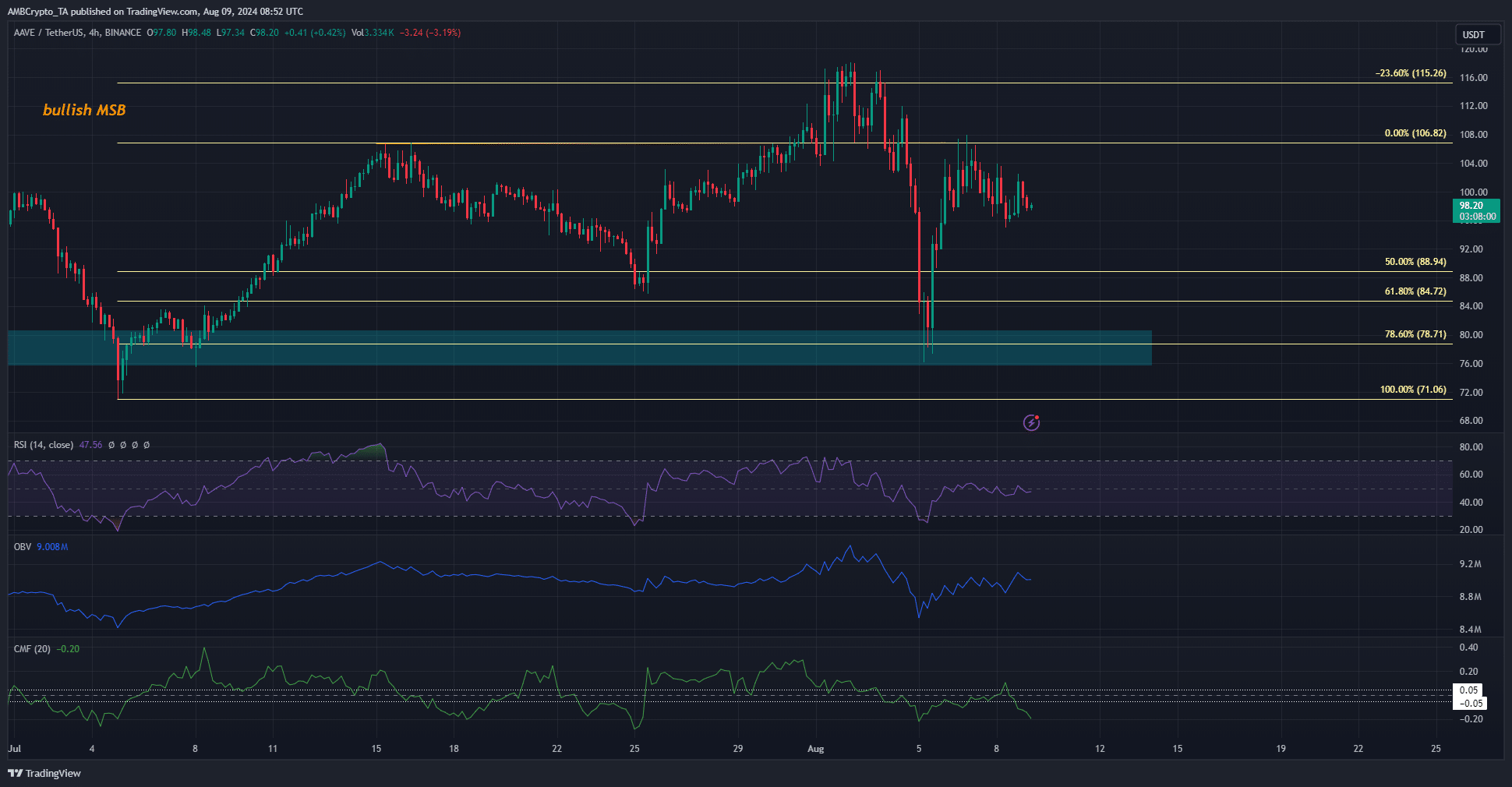

Source: AAVE/USDT on TradingView

AAVE market structure remained bearish on the daily chart. It fell to the 78.6% Fibonacci retracement level at $78.71 and bounced back to the $106 level.

However, it failed to reach a new high and the rejection set a lower high instead.

The daily RSI has been hovering around the neutral 50 mark for the past few days, showing that momentum has not yet favored the bulls.

The OBV has been trending upward since August 5, but the CMF has fallen to -0.2, signaling a significant flow of capital out of the market.

AAVE measures signal volatility and distribution

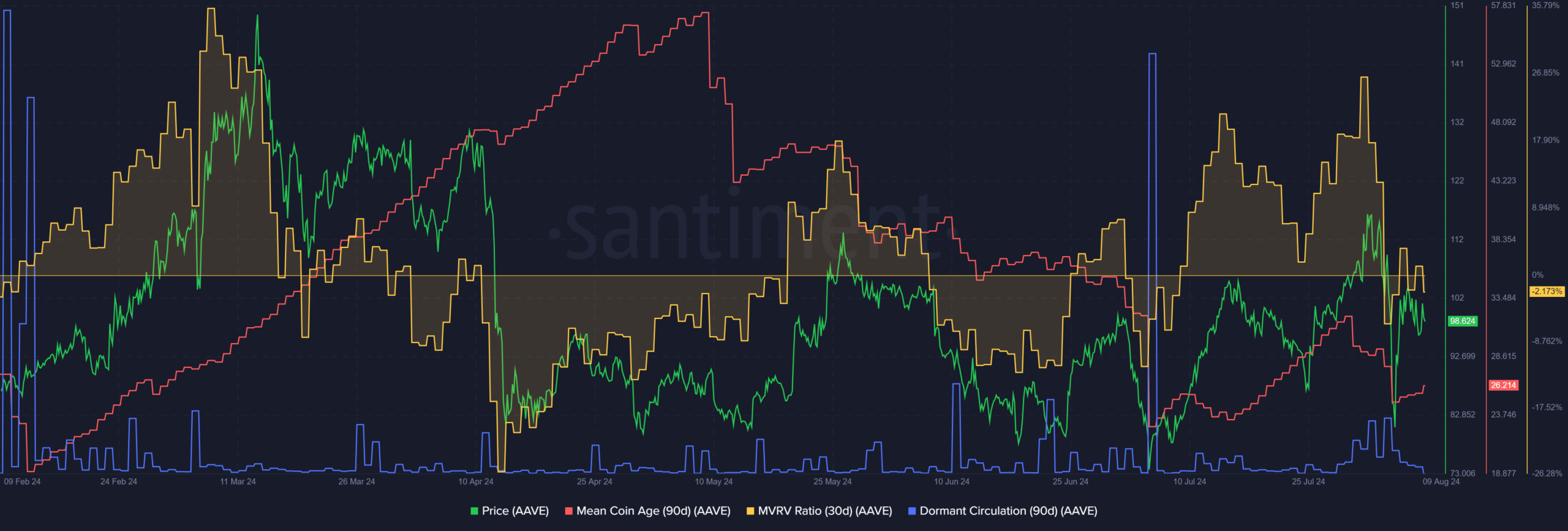

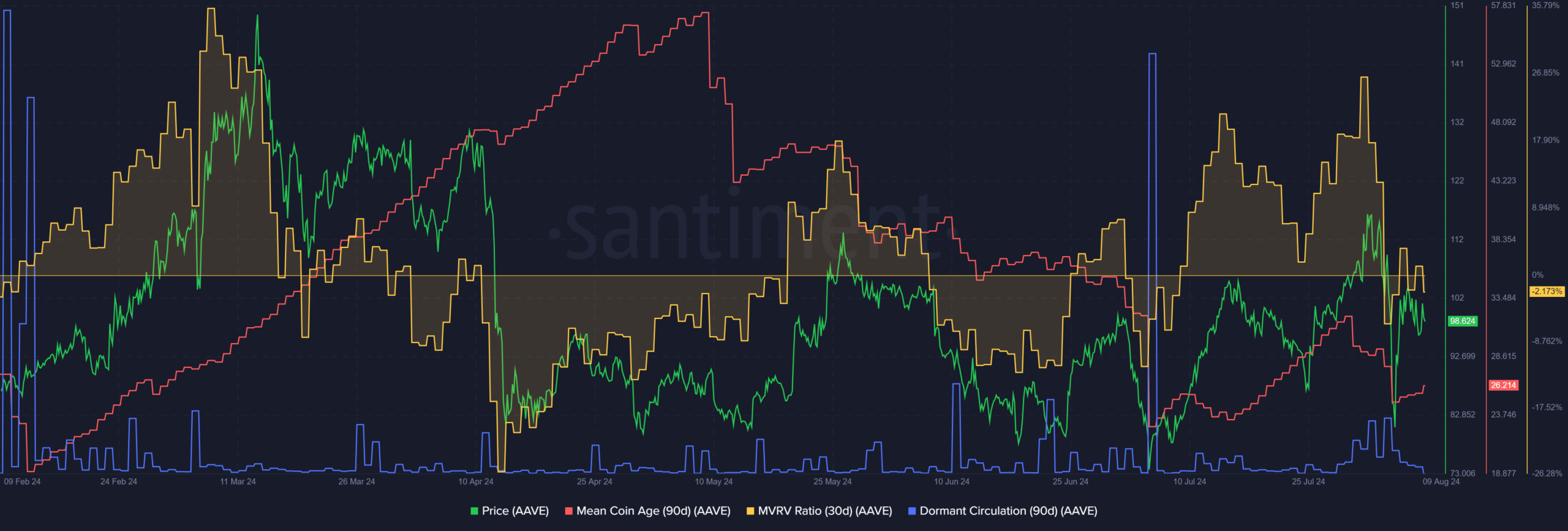

Source: Santiment

The MVRV ratio has dropped from nearly 30% to -2%, indicating that short-term holders were taking a profit before the price crashed below $100. During the price drop, dormant circulation has seen a surge.

Overall, this indicates that holders have cashed out and likely taken profits. This idea was also supported by the decline in the Average Coin Age (MCA), which showed an AAVE distribution.

MCA should trend upwards to signal that buyers are accumulating the token.

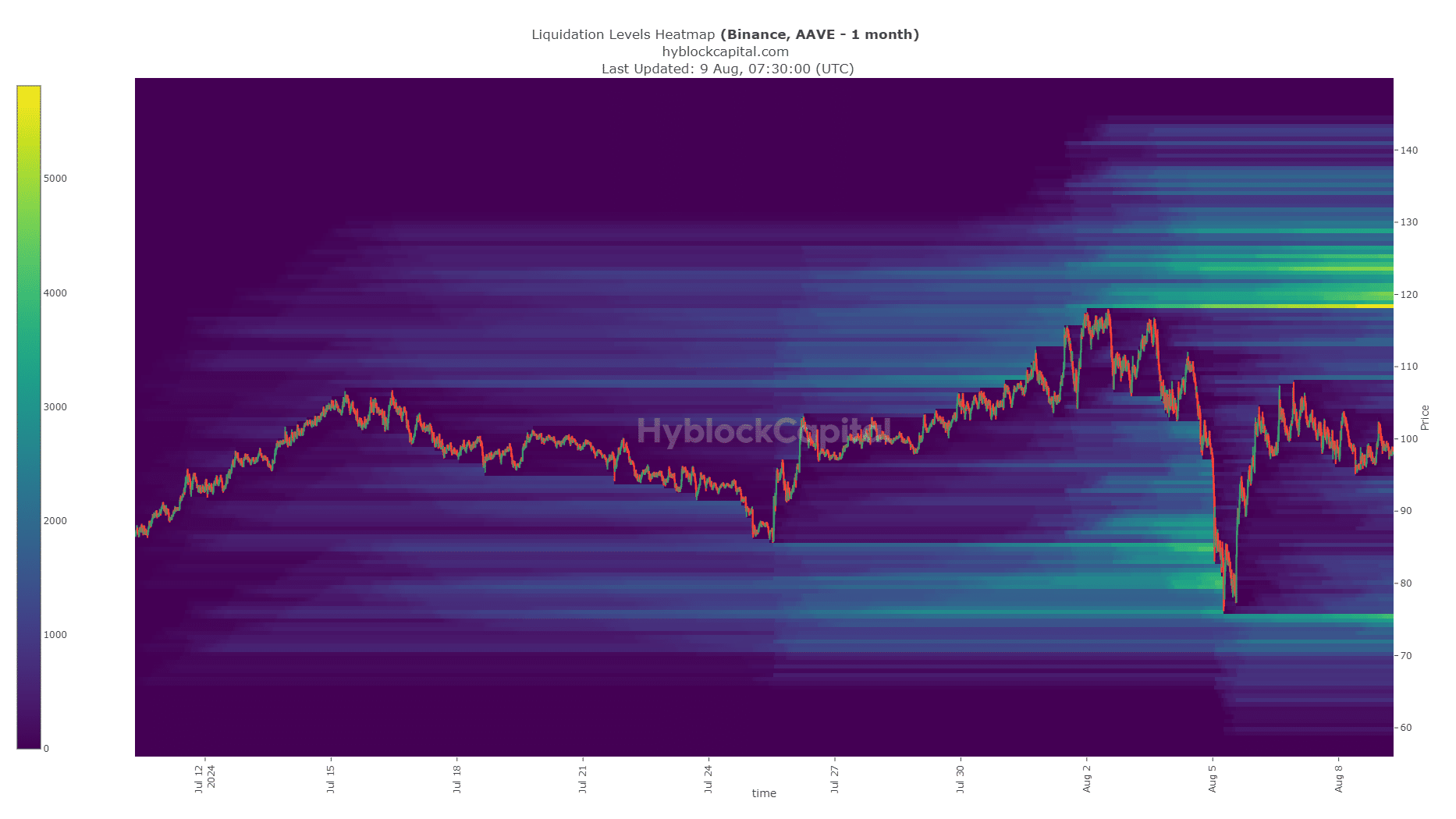

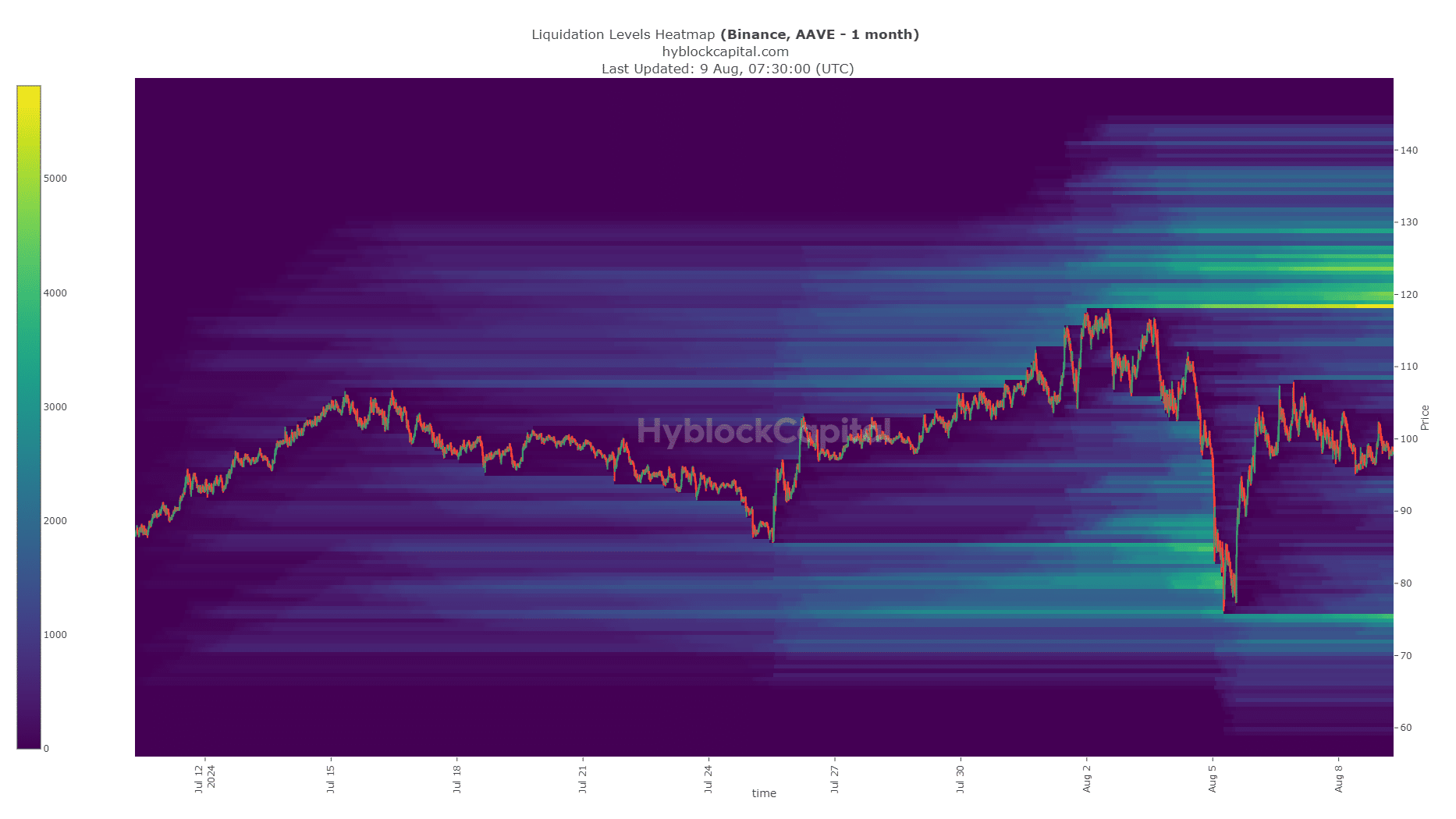

Source: Hyblock

The liquidation heatmap highlighted a short-term target at $108.5 and a much stronger liquidity pool at $118-120. This could serve as a short-term target for the AAVE token before a pullback.

Realistic or not, here is the market capitalization of AAVE in terms of BTC

Overall, the show of relative strength against Bitcoin (BTC) was quickly wiped out, which did not boost investor confidence.

However, the protocol’s performance during this period of network stress has been positive and could be reflected in AAVE prices once market sentiment begins to change.