AAVE, the second largest player in decentralized finance, has performed well this year, reaching its highest point since 2022.

AAVE (AAVE) hit a high of $160, up nearly 120% from its lowest point this year, bringing its valuation to over $2.5 billion.

AAVE’s DeFi TVL Surges

The token has performed well, helped by the substantial increase in assets on its network. Data shows that its total value locked in the ecosystem has jumped to more than $12.1 billion.

This growth makes it the second largest DeFi player after Lido, which has over $25 billion in staked assets. It is followed by EigenLayer, Ether.fi, and JustLend.

AAVE’s growth has also driven substantial fees on the network. According to TokenTerminal, The ecosystem’s total fees this year are over $287 million, making it the third most profitable player in DeFi after Lido and Uniswap.

Increased whale activity has contributed to the rise in AAVE price in recent months. For example, several whales have made substantial purchases and currently represent most holders, followed by investors and retail investors.

Nansen data shows that while the number of savvy investors has fallen slightly recently, it remains significantly above the June low of 71. The total balance held by these investors remained stable at 439,000.

The top smart wealth owns over 25,000 AAVE tokens worth $4 million along with other coins like Ethereum (ETH), Pepe (PEPE), Ondo Finance, and Beam.

AAVE also jumped as the Federal Reserve begins cutting interest rates. At its meeting on Wednesday, the central bank decided to cut interest rates by 0.50% and hinted at further action. The interest rate cut could lead to more capital inflows to lending platforms like AAVE and JustLend.

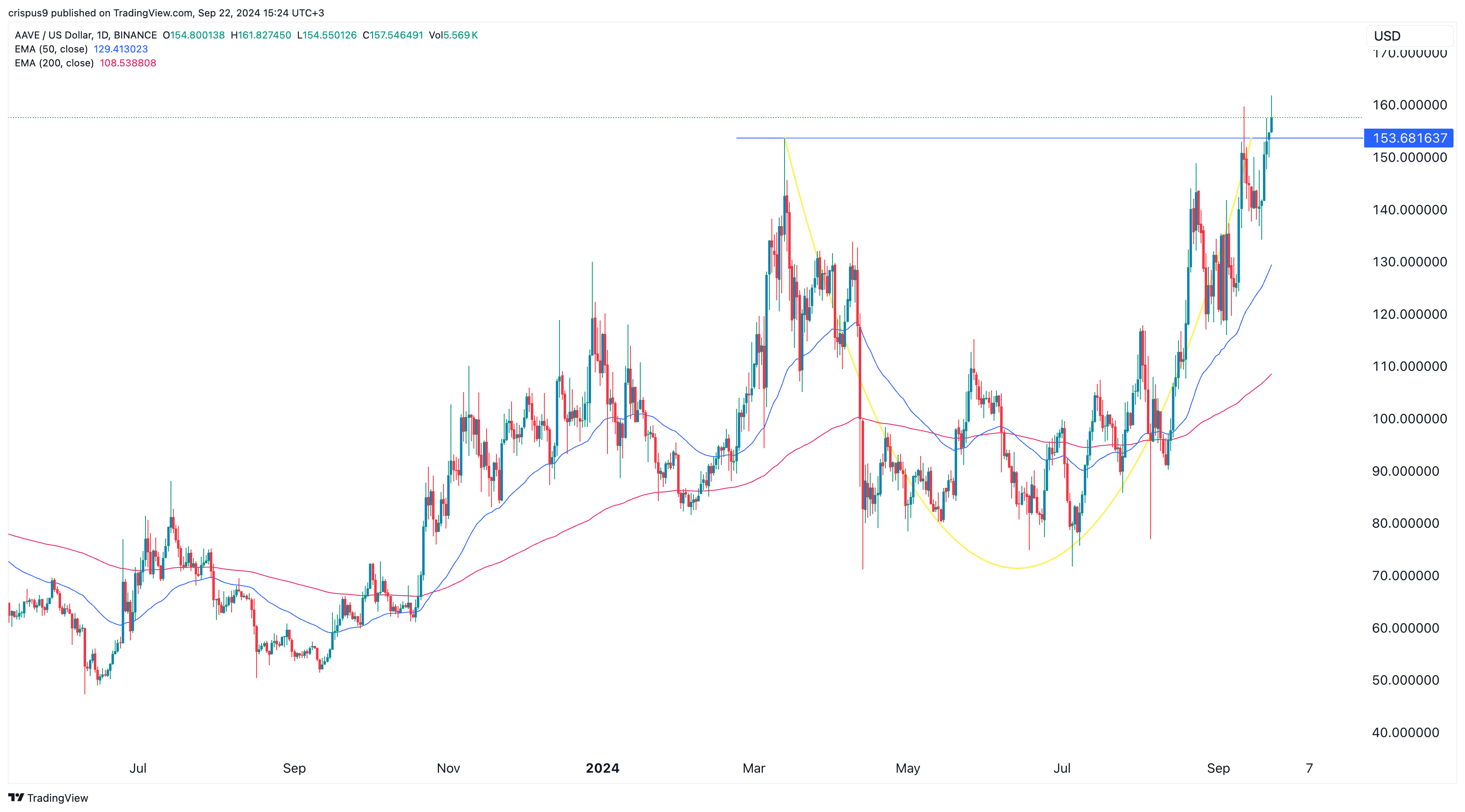

AAVE forms a golden cross in July

AAVE’s surge also came after the coin formed a golden cross pattern in July, as the 50-day and 200-day exponential moving averages crossed.

Bitcoin continued to form a series of higher highs and higher lows. Furthermore, the coin turned the key resistance at $150 into a support level. It also broke above the important point at $153.68, its highest point in March this year.

More importantly, AAVE has formed a cup and handle pattern, a popular continuation sign.

Therefore, as the analyst below noted, there is a chance that the token will continue to rise as the DeFi comeback continues. If that happens, the next point to watch will be at $170.