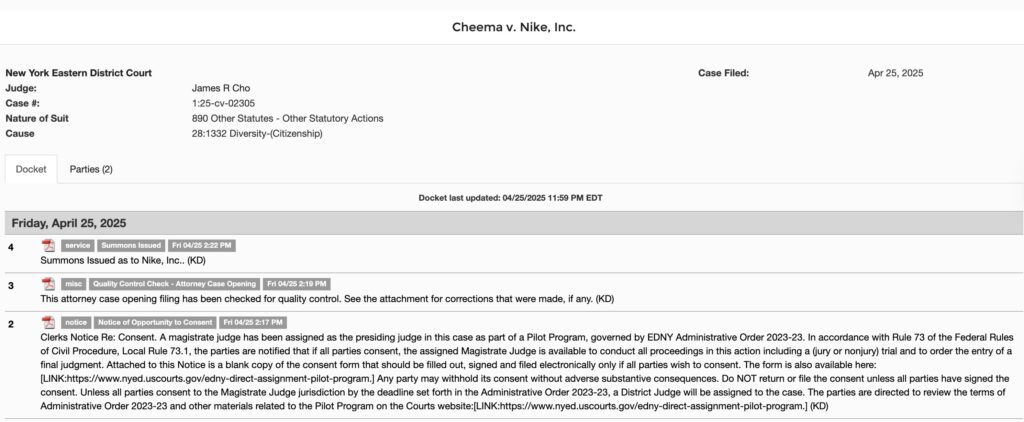

The swoosh has just been trained in a legal waste and NFT holders want blood. Nike faces a collective recourse in Brooklyn on the collapse of RTFKT, its large -scale NFT adventure.

Investors say that Nike sounded the platform, then killed it – leaving them trapped with heavy losses. The allegations range from false advertising to the sale of unregistered titles.

This case gives the entire market NFT under a microscope.

NFT Holders vs. Nike

Remember NFTS? It quickly memory.

I think that the original intention of NFTS was to create acts of digital property by showing that you can “do it like a room” or make it a transferable asset. Now NFT has been the most sinister meme since it is “Rick Rolled”.

NFTs are like pic.twitter.com/mhvgrmb7ce

– Charker (@Therealchaseeb) April 27, 2025

At the heart of the trial is the statement that Nike has surveyed NFT on the theme of RTFKT sneakers to attract investors, to close operations in January 2025, leaving buyers with devalued or even “worth” tokens. The complainants argue that Nike has violated consumer protection laws by not revealing that NFT could be considered as not registered securities under federal law.

The trial indicates: “Because the Nike NFTS has made their value from the success of Nike and its marketing efforts, investors bought this digital active in the hope that its value would increase in the future.”

The carpet’s shooting accusation arouses controversy

When Nike disconnected the RTFKT, it did not just closed a platform – it has erased the main features which once precious it. Heck, Trump did not even do this to his NFT holders … not yet at least.

The challenges, quests and rewards linked to NFTs have disappeared overnight.

The benefits were brutal. Nike’s Nike Cryptokick NFT, which are in the past negotiate at 3.5 ETH (around $ 8,000) in 2022, now scratch the soil at 0.009 ETH, $ 16.

The complainants say that Nike has led a manual carpet traction – spanning media threshing, then abandoning investors when the market has cooled.

OPENSEA, the cheaper NFT, has already put pressure on the dry to keep the NFT away from securities law. However, prosecution like this show that the problem is anything but solved, and uncertainty stifles both creators and buyers.

Meanwhile, the wider NFT market collapses. Global sales dropped 63% in annual shift in the first quarter of 2025, going from $ 4.1 billion to $ 1.5 billion. The RTFKT Gamble of Nike, launched with fanfare in 2021, ended with the closure three years later – another victim in a heap of narrowing garbage market that the NFT has become.

What is the next step in the Nike NFT trial?

With 5 million dollars of damages on the table and allegations of shady business practices in New York, California and Oregon, the challenges are high – not only for Nike, but for the next theoretical wave of NFT.

The case could carve out a new legal field, forcing companies to rethink the way in which they managed NFT projects and what real obligations they owe the people who buy.

Explore: the XRP price jumps 11% after the progression of dry crypto unit tease xrp etf

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

Nike faces a collective recourse in Brooklyn on the collapse of RTFKT, its large -scale NFT adventure.

-

Damages of $ 5 million requested by the complainants underline the extent of the losses which, according to them, were motivated by the actions of Nike.

Is the position unhappy with NFT holders about to delete Nike? appeared first on 99Bitcoins.