Main to remember

What does the data before avalanche show?

They reported caution because the leveraged positions accumulated quickly.

How did long-term investors react to this information?

The price action graph has shown that the upward trend was intact, and a price drop to $ 26 to $ 27 would be a purchase opportunity.

September 15 experienced a good amount of price volatility for cryptographic markets. The action of avalanche prices (AVAX) was influenced by the market leader price movement.

Bitcoin (BTC) has lost 1.65% in recent hours after reaching the $ 116.7,000 mark, which seemed to point to a bull’s ripper after the resistance of $ 116.5,000.

Instead, it turned out to be a liquidity. In the hours before the press time, BTC fell at $ 114.6,000, diving below a hollow of $ 114.7,000 on September 13.

Now that the liquidity in both directions has been withdrawn, Bitcoin could prepare to establish this week’s trend.

The FOMC meeting on September 17 will probably see the announcement of a rate drop.

This event, although long -term bullish, could introduce additional short -term volatility of which Bitcoin and Altcoin traders should be wary.

There were other reasons why avalanche traders should be very careful in the coming days.

Do you have to expect a drop in avalanche prices?

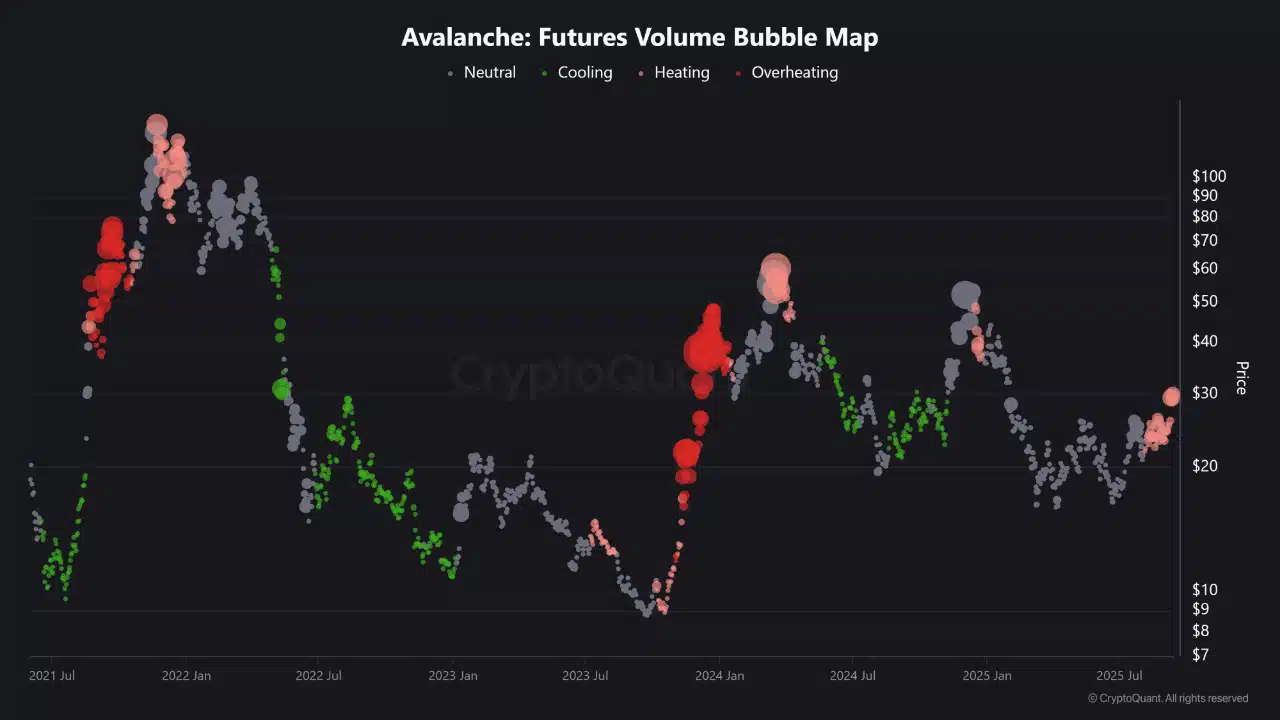

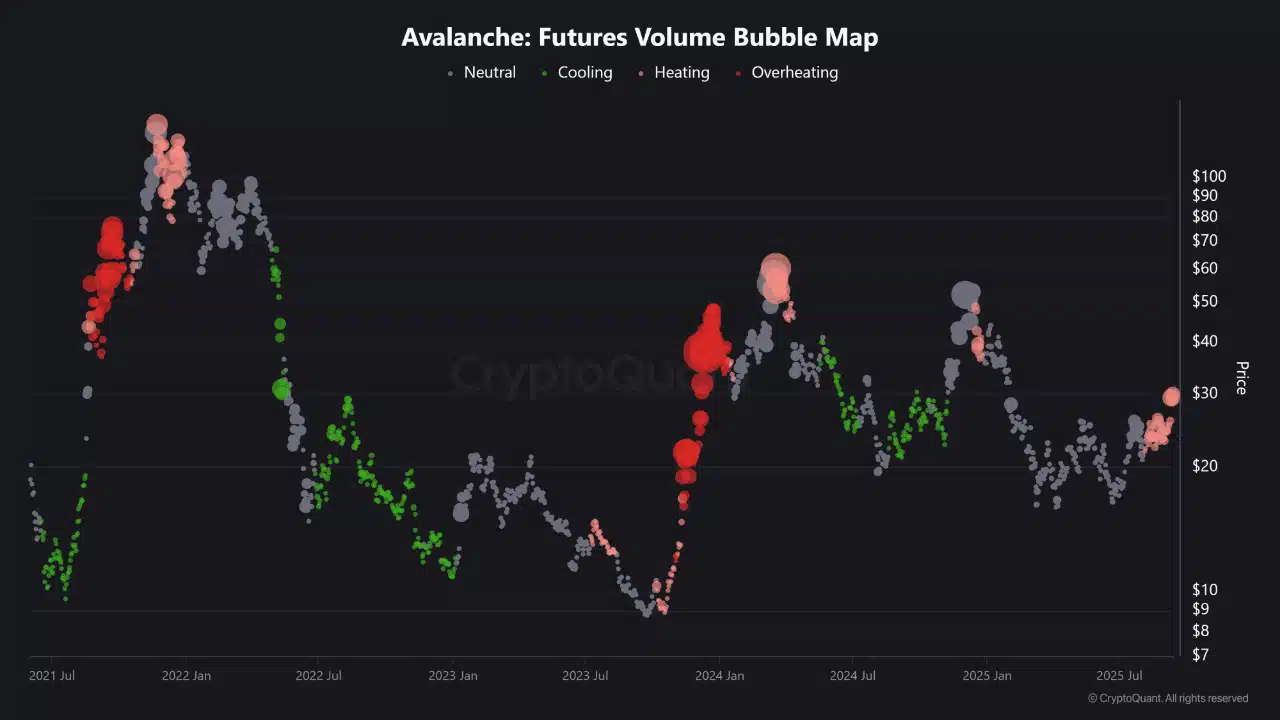

Source: cryptocurrency

Crypto analyst Burak Kesmeci stressed that Avax showed clear signs of heating. The map of bubbles in a long -term volume has shown red bubbles, which indicate that leverage positions accumulate rapidly.

Historically, when avalanche’s term contracts enter this overheated area, it was followed by price corrections.

This could be the case once again, especially if bitcoin and the rest of the market testify to short -term price reductions and increased volatility.

This does not mean that an immediate price accident would occur, but rather that traders should be wary of a drop in prices.

Source: cryptocurrency

The Term Payer CVD has also shown a phase of sale dominance of takers over the past six weeks. This could be a warning sign of a price correction strengthening, but pricing has an upward structure.

Could it be that the avalanche rally is fragile?

Source: Avx / USDT on tradingView

The market structure on a day’s graph was optimistic. The CMF was greater than +0.05 to show high purchase pressure, and the MFI agreed with this observation.

Overcoming the resistance of $ 26.5 came with a difference of fair value (white box) which alluded to an upward force.

A price drop in the support area of $ 25.4 to $ 26.5 should be considered as a purchase opportunity. Overall, Avalanche has long -term upward prospects, with a chance to lower prices to $ 26.5 to $ 27.5.