- AVAX price retested a key level at around $31 on charts

- Metrics indicate potential bullish momentum if key support holds

Avalanche (AVAX) is in the spotlight again today after recent data and technical analysis hinted at a potential uptrend. AVAX has shown resilience lately by bouncing off its key support level at $31. At the time of writing, the altcoin had climbed to $32.37, up 3.78% in 24 hours.

Here, it is worth noting that this price action came after a few days of sideways trading and consolidation. The consolidation phase suggests that the previous selling pressure has been absorbed by the market and it may be time for a breakout north.

In fact, the aforementioned rise indicates that market participants are gaining confidence in the possibility of higher price targets.

Source: TradingView

Measures support bullish scenario

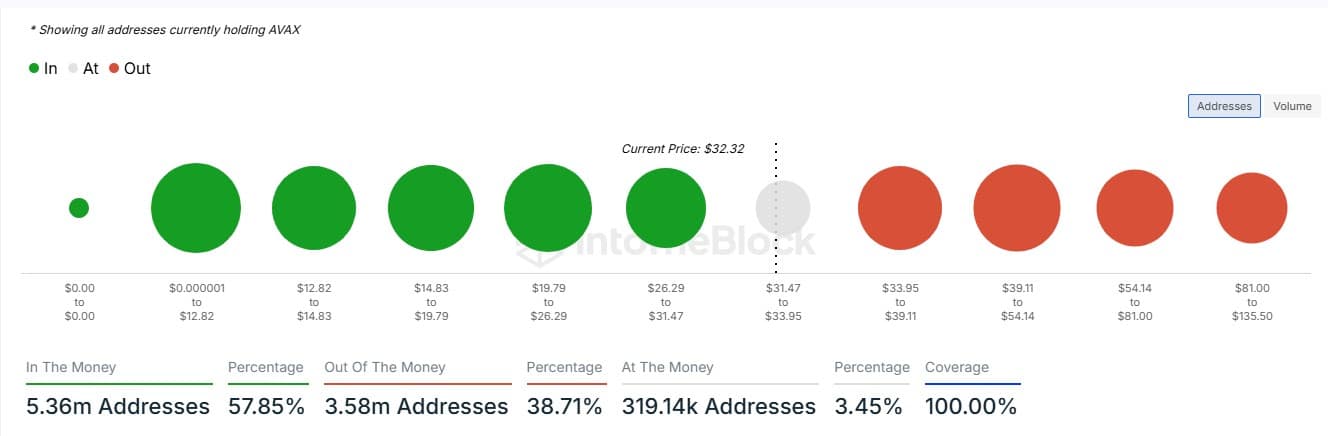

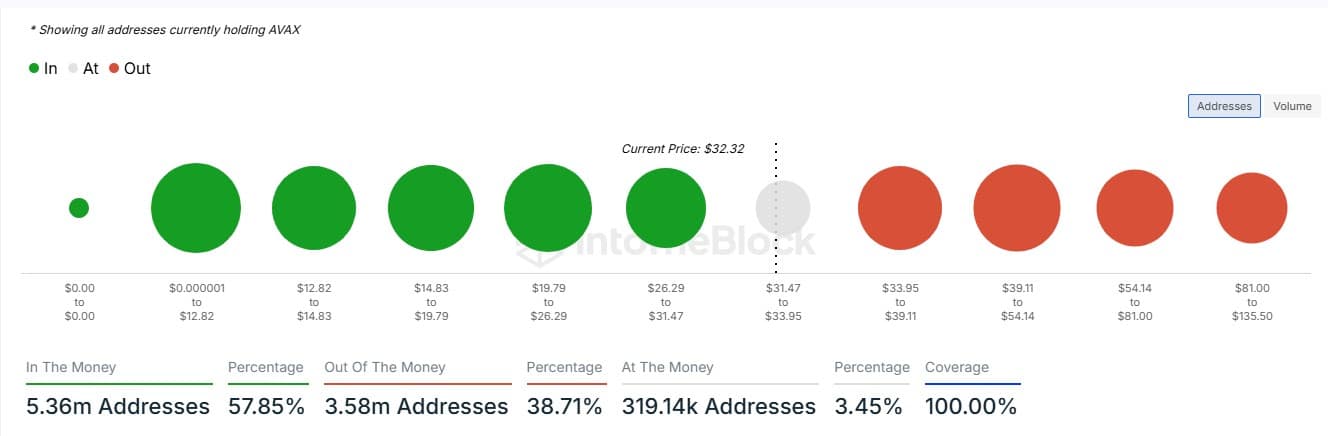

AMBCrypto’s analysis of AVAX’s on-chain metrics revealed more positive insights into the altcoin’s recent movements. According to IntoTheBlock, approximately 58% of AVAX holders made profits at the price at press time. This significant proportion indicates strong investor sentiment at the current price level.

This level of profitability implied that the asset had a solid foundation and could well have room for further upside.

Source: In the block

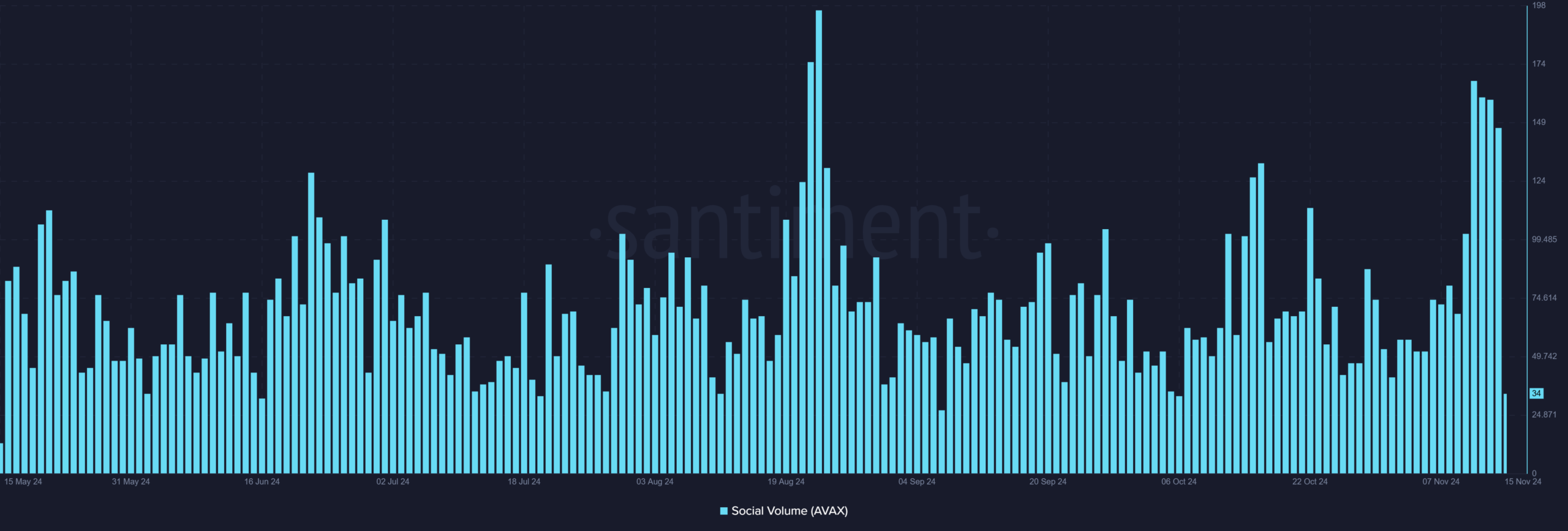

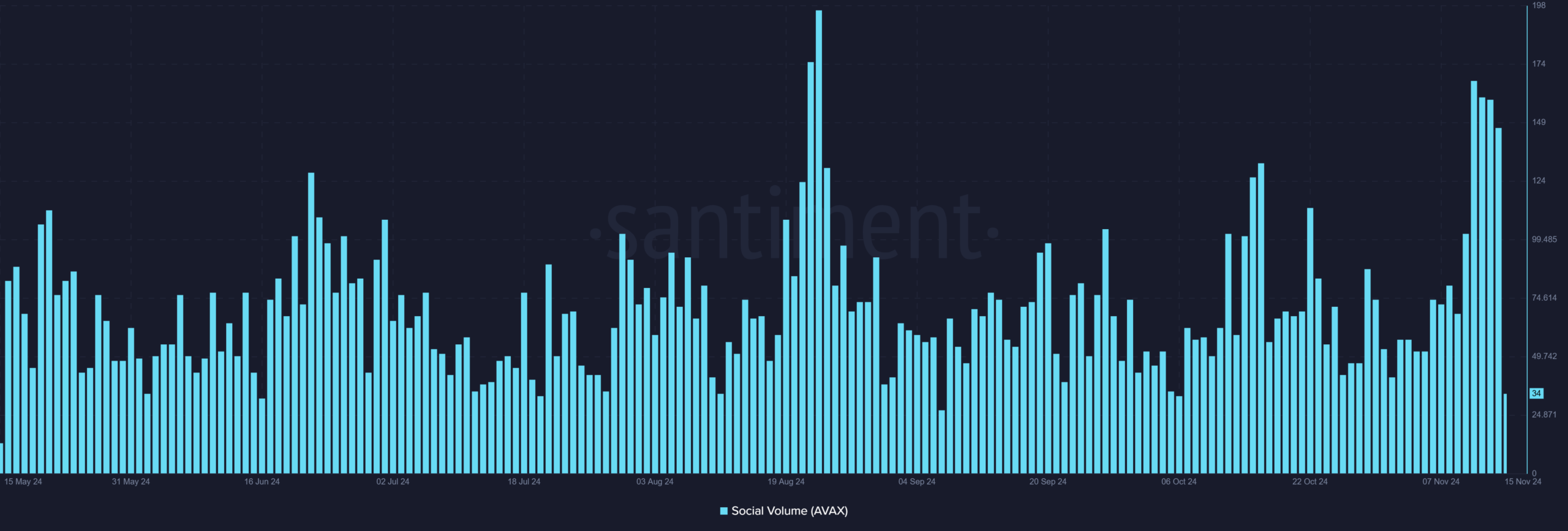

Additionally, AVAX saw high social volumes, as indicated by Santiment social data. The corresponding figures revealed a gradual increase in the altcoin’s social volume since the start of the month.

Such an increase in the number of social mentions added to the positive sentiments around the AVAX market.

Source: Santiment

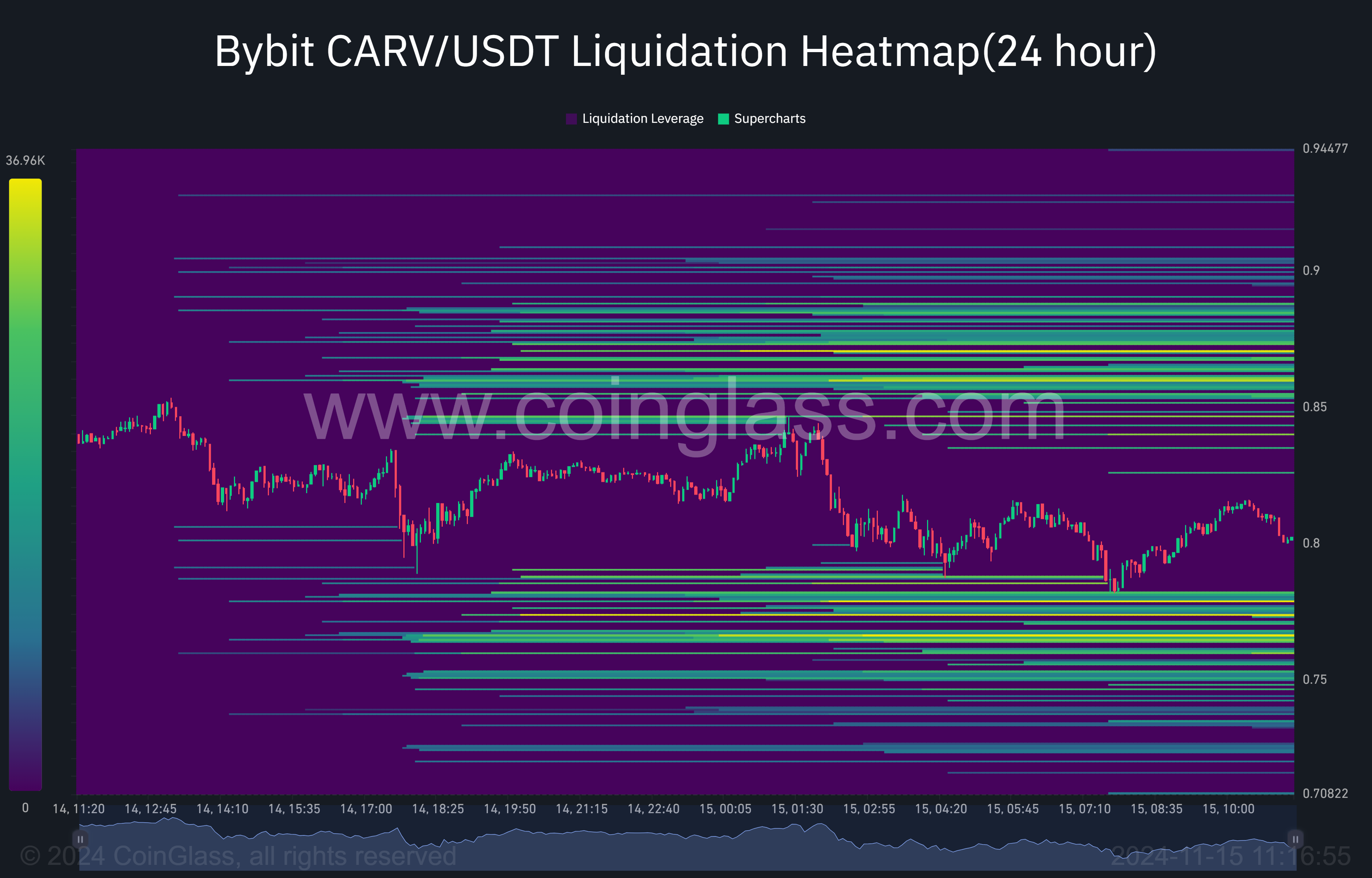

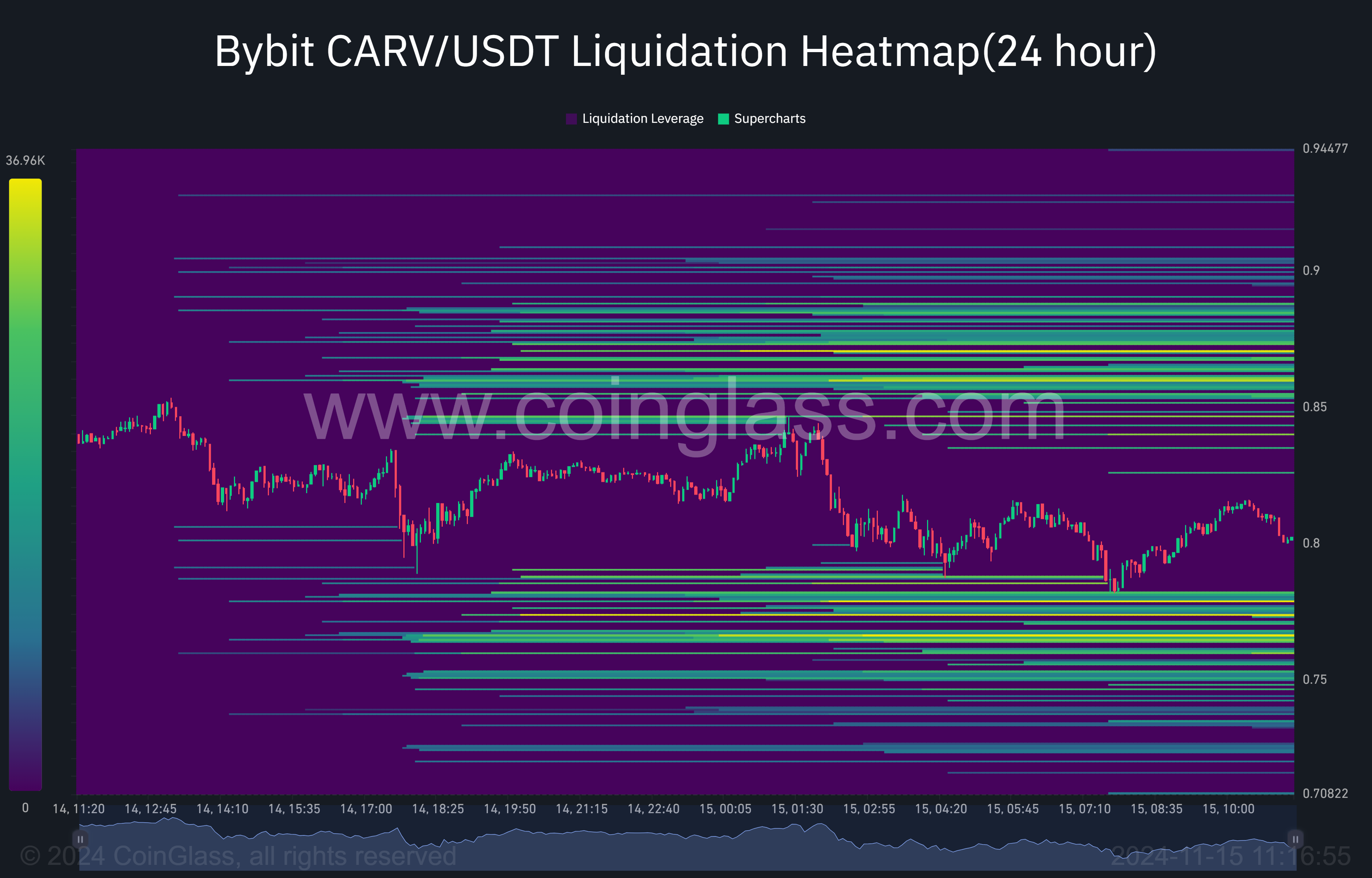

According to Coinglass liquidation data, AVAX appeared to have a bullish bias, with liquidation pool groups above its retested support level.

These areas serve as critical thresholds and could trigger buy-side liquidations and fuel an uptrend.

Source: Coinglass

What future for AVAX?

In conclusion, market conditions and AVAX metrics at the time of publication indicate a potentially bullish outlook.

As long as the $31 support holds and social sentiment remains positive, Avalanche could continue its bullish momentum on the charts.