Join our Telegram channel to stay up to date with the latest news

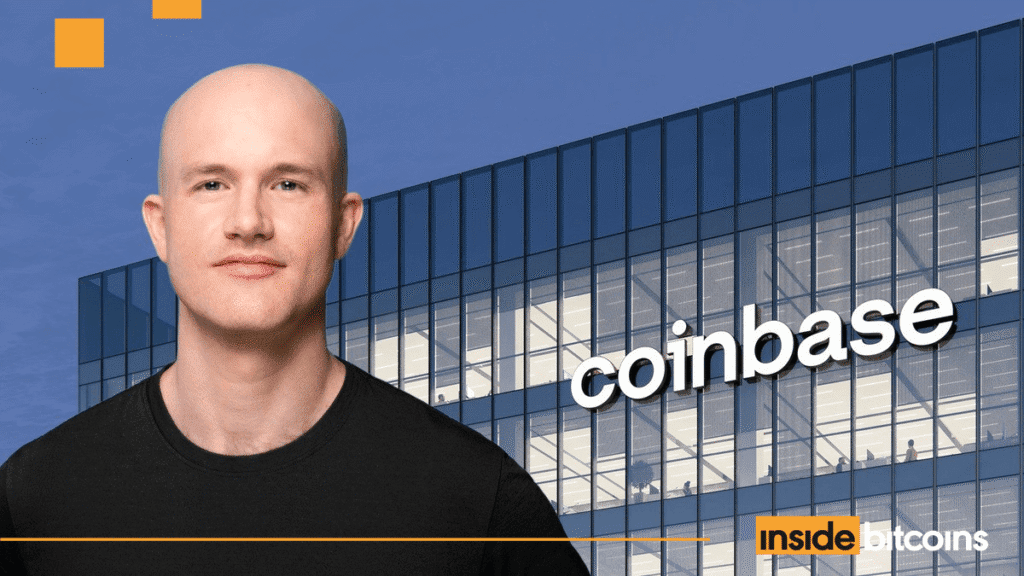

Coinbase CEO Brian Armstrong predicted that banks would start pushing for returns on stablecoins within a few years.

“My prediction is that banks will turn around and push FOR the ability to pay interest and yield on stablecoins in a few years, once they realize how big the opportunity is for them,” Armstrong wrote in a Dec. 27 statement. job.

Coinbase won’t let banks reopen GENIUS Act discussions

Amrstrong’s message was a response to a message from Max Avery, director of business development at Digital Ascension Group, who said the banking lobby wanted to reopen discussions around the GENIUS Act.

In particular, banks continue to express concerns that the current language regarding stablecoin yields poses a risk to bank deposits, Avery said.

The GENIUS Act, which is the first regulatory framework for stablecoins and was signed into law by US President Donald Trump in July, prohibits stablecoin issuers from offering returns directly to token holders. However, this does not extend this ban to third-party service providers, meaning stablecoin issuers could offer returns through these platforms.

Coinbase, for example, offers traders and investors on its platforms returns on USDC, issued by stablecoin company Circle.

Concerns about the ability to offer returns through third-party platforms have been raised repeatedly by the banking lobby this year, Avery noted.

Regardless of the banking lobby’s ongoing concerns, Armstrong said in his response that he and Coinbase “will not let anyone reopen GENIUS,” adding that this is a “red line” for them.

Following his prediction that banks will eventually push for stable returns, he said the current resistance to the GENIUS Act is “a wasted effort on their part.”

Stablecoin Market Expected to Reach $500 Billion by End of 2026

The regulatory clarity provided by the GENIUS Act has served as a catalyst for the growth of the stablecoin market this year.

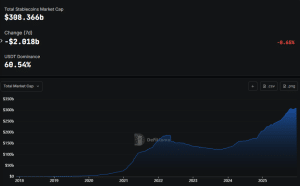

In 2025, the combined capitalization of stablecoins climbed above $300 billion for the first time and currently stands at over $308.36 billion, according to data from DefiLlama.

Stablecoin market capitalization (Source: ChallengeLlama)

Tether’s USDT token maintains a dominant market share with its capitalization of approximately $186.7 billion. USDC comes in second with a market capitalization of approximately $76.38 billion, while Ethena’s USDe is ranked as the third largest stablecoin with a capitalization of $6.29 billion.

After a strong year for stablecoins, industry experts believe that the growth of these tokens is expected to continue in 2026.

Among these experts is Joseph Chalom, co-CEO of SharpLink, who said the stablecoin market capitalization would reach $500 billion by the end of 2026.

“Global stablecoin use cases, including cross-border remittances, retail payments and institutional transactions, will continue to increase with Ethereum establishing itself as the fundamental settlement layer for the movement of value,” he said on X.

1/ The stablecoin market will reach $500 billion by the end of next year.

Global stablecoin use cases, including cross-border remittances, retail payments, and institutional transactions, will continue to increase with Ethereum establishing itself as the foundational settlement layer for…

–Joseph Chalom (@joechalom) December 26, 2025

He also said that big players will enter the stablecoin market next year, highlighting recent moves by banks from JP Morgan, PayPal, Japan, South Korea and the EU.

Chalom added that the adoption of stablecoins lays the foundation for broader crypto adoption in institutions.

Related articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news