A big change could happen to the game book of your financial advisor. Bitcoin ETF entrances take a row seriously while large name institutions are preparing for open access to millions of investors. According to Matt Hougan, director of investments in Bitwise, the four largest American Wirehouses, Merrill Lynch, Morgan Stanley, Wells Fargo and UBS, prepare to open Bitcoin ETF floods.

If this happens, it could put a lot of crypto in the hands of traditional investors.

$ 12 billion CIO on the bias expects the four big threads #Bitcoin ETF this year.

– Merrill Lynch

– Morgan Stanley

– Wells Fargo

– UBSThe institutions are there.

– next layer capital (@nextlayercap) April 30, 2025

These companies manage 10 billions of dollars combined with assets, so when they move, the entire market feels. Currently, their customers do not have direct access to Bitcoin ETF on their platforms. But Hougan says it changes. Behind the scenes, reasonable diligence journals occur, systems are updated and conversations warm up.

The wait? At the end of 2025, the advisers of these companies could recommend Bitcoin ETF alongside the shares, obligations and common funds.

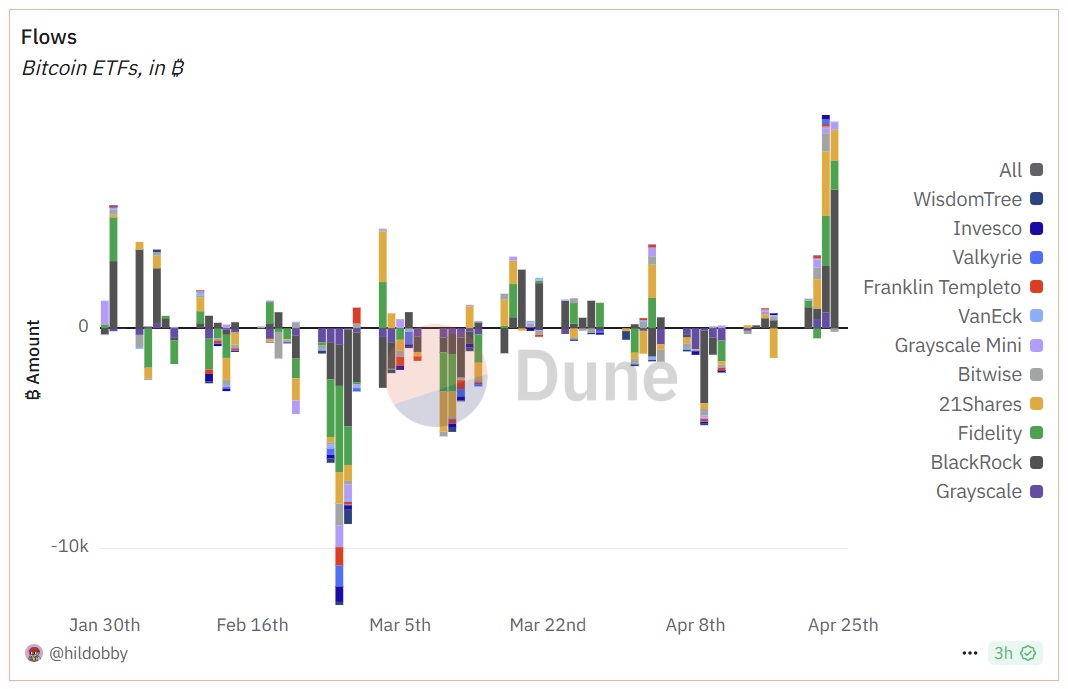

Bitcoin ETF surrounds so far in 2025

Until now, Bitcoin Flows have shown major investor changes. The gray level has seen major outings, while Blackrock and Fidelity won most of the entries. At the end of April, marked a high return with more than $ 500 million.

Recording inputs projected in Bitcoin ETF

So far, 2025 has been slower for Bitcoin ETF entrances compared to last year. In 2024, the launch frenzy brought up $ 35 billion. This year, we have been sitting at around $ 3.7 billion so far. But if the wired open the doors, Hougan says that these figures could explode again, perhaps even establish new records before the end of the year.

This is a case of “Slow now, Big later”. Hougan believes that once FNB Bitcoin are offered on the same platforms that manage the retirement and brokerage accounts of most Americans, the entries will pass from a net to a flood. Financial advisers tend to move carefully, but once they have entered, they often stay in the long term.

Change From retail trade to institutional investment

A big trend that is already played? The transfer of retail trade to institutional investors. While individual cryptography investors have helped start the FNB party, institutions quickly take over.

DISCOVER: The best new cryptocurrencies to invest in 2025

Robert Mitchnick, responsible for digital assets of Blackrock, has noted that wealth managers and institutional customers are now responsible for a larger share of Bitcoin ETF assets than individual investors. It is a strong vote of confidence of some of the most cautious players in finance.

What can we expect to see on the cryptography market?

If the four large wired people are really starting to offer FNB bitcoin, we will probably see more liquidity, fewer price swings and potentially a more robust floor under the market. It also opens the door to other cryptographic active ingredients to follow a similar path in traditional wallets.

It is not only a victory for Bitcoin fans. It is a sign that the crypto finds its place in the broader financial system, not as a marginal bet, but as something serious, investors should now consider.

Conclusion

We are not there yet, but the wheels turn. If Hougan’s prediction is realized and the main hugs are on board by the end of 2025, the cryptography market could enter a whole new phase. To date, it would mark one of the most important steps to fully provide digital assets in the dominant financial current. Investors, noteyour The advisor could speak of Bitcoin earlier than you think.

DISCOVER: 20+ Next Crypto to explode in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

The four largest American wrehouses, Merrill Lynch, Morgan Stanley, Wells Fargo and UBS, are preparing to offer Bitcoin ETF to their customers.

-

These companies manage a combination of 10 billions of dollars in assets, and the opening of access to Bitcoin ETF could considerably stimulate the adoption of consumer cryptography.

-

The IOC to Bit Matt Hougan predicts that Bitcoin ETF entries could reach new records by the end of 2025 once Wirehouse platforms are posted.

-

Institutional actors are increasingly dominating ETF’s allowances, marking a distance from the retail -focused investment in the crypto.

-

If they are approved, Bitcoin ETF on wire-wire platforms could cause greater market liquidity, reduced volatility and wider portfolio integration.

The Big Four Wirehouse position should unlock the FNB Bitcoin for millions of investors appeared first on 99Bitcoins.

$ 12 billion CIO on the bias expects the four big threads

$ 12 billion CIO on the bias expects the four big threads