The cryptographic markets recorded 9.9% of the gains in April, led by Bitcoin, while the price breaks increased the feeling.

Bitcoin (BTC) has strengthened its domination even though the cryptographic markets are recovering. On Tuesday, May 6, Binance Research published a report on the state of cryptographic markets in April. The report underlines that the markets have recovered, winning 9.9% during the month, largely thanks to the breaks on the prices.

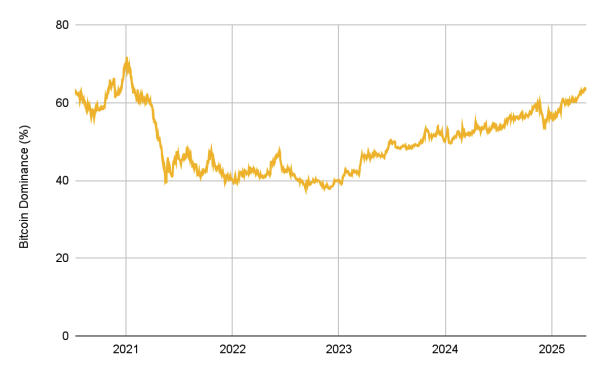

Despite the broader resumption, Bitcoin’s domination has continued to increase, a trend in progress since 2022. Currently, Bitcoin represents 63% of the total market capitalization of Crypto, the highest share since 2021. According to research on binance, the growing discussion around a Bitcoin strategic reserve and the digital story of gold has increased its attractive for investors.

The periods when the domination of Bitcoin fell often coincided with broader bull markets, more recently at the end of 2024. However, the increase in April suggests that the narrative around the BTC evolves, while the asset moves further in the dominant financial current.

An increase in money printing stimulates bitcoin

One of the trends that coincided with Bitcoin rise was a sharp increase in money supply. In particular, the M2 measurement of the money supply of the G4 countries should increase by a record of 93 billions of dollars. This expansion in American Japan, China and the money mass of Europe is positively correlated with the price of Bitcoin.

On the one hand, Bitcoin supporters see it as digital gold and coverage against inflation. In addition, the increase in money supply helps add more liquidity to the markets, including cryptographic markets.

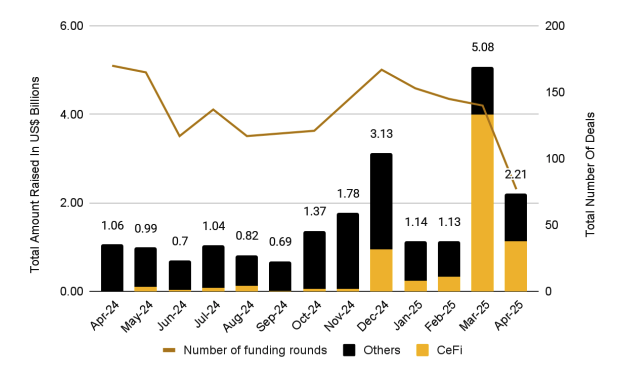

Aside from Bitcoin’s potential decoupling on cryptographic markets, Binance Reserch also underlined a new trend in centralized finance. Over the past two months, there has been a strong increase in the money collected by centralized financing companies.

According to Binance, CEFI companies are more attractive to investors thanks to a change in regulation concerning crypto in the United States, which continues to be the world center for venture capital.