Join our Telegram channel to stay up to date with the latest news

Bitcoin price fell 3% in the past 24 hours to trade at $93,324, as crypto investment products continue to see strong interest from investors with record inflows.

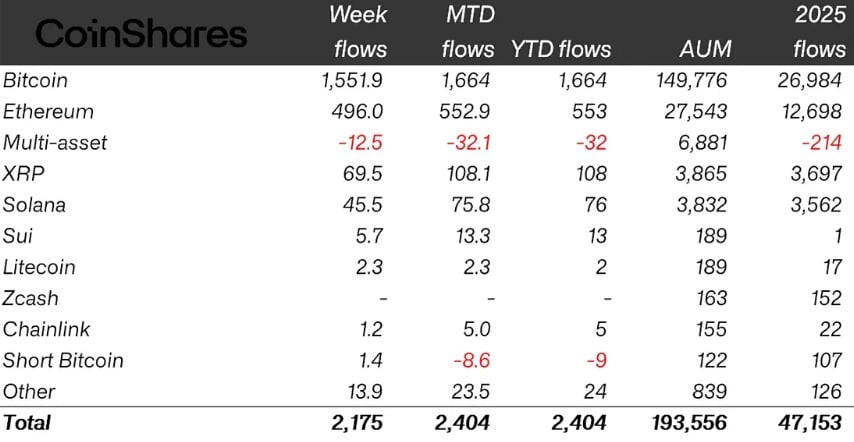

Last week, crypto funds saw inflows of $2.17 billion, the highest in 2026 so far and the biggest weekly gain since October, according to European asset manager CoinShares. Most of the money entered the market at the start of the week, but on Friday there were outflows of $378 million due to geopolitical tensions in Greenland and renewed concerns over tariffs.

James Butterfill, head of research at CoinShares, also noted that sentiment was affected by expectations that Kevin Hassett, a leading contender to chair the US Fed, would likely remain in his current position. Bitcoin dominated last week’s inflows, bringing in $1.55 billion, accounting for more than 70% of the total.

Ether followed with $496 million, while XRP and Solana attracted $70 million and $46 million, respectively. Smaller altcoins such as Sui and Hedera saw minor inflows of $5.7 million and $2.6 million. Despite U.S. Senate CLARITY Act proposals that could limit stablecoin returns, Ether and Solana funds have held up well.

Among fund types, multi-asset and short Bitcoin products were the only categories to see outflows, totaling $32 million and $8.6 million. On the issuer side, BlackRock’s iShares ETFs led the market with $1.3 billion in inflows, followed by Grayscale Investments with $257 million and Fidelity Investments with $229 million.

Geographically, the United States accounted for the majority of inflows at $2 billion, while Sweden and Brazil saw small outflows of $4.3 million and $1 million, respectively. With these gains, total assets under management in crypto funds surpassed $193 billion for the first time since early November, demonstrating renewed investor confidence.

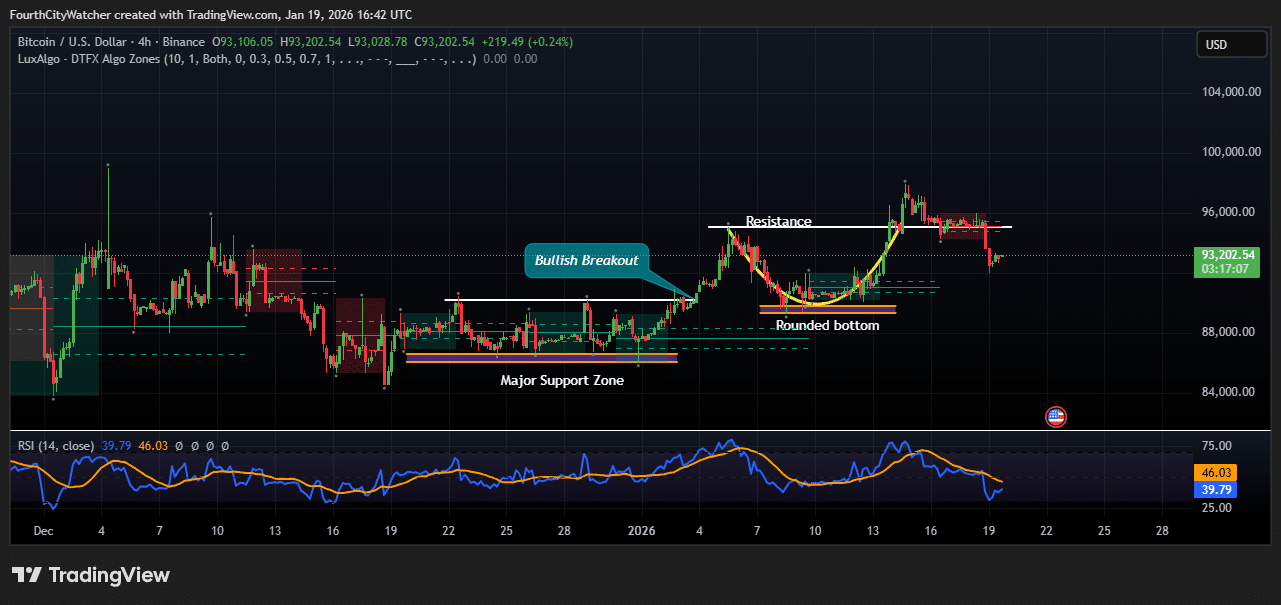

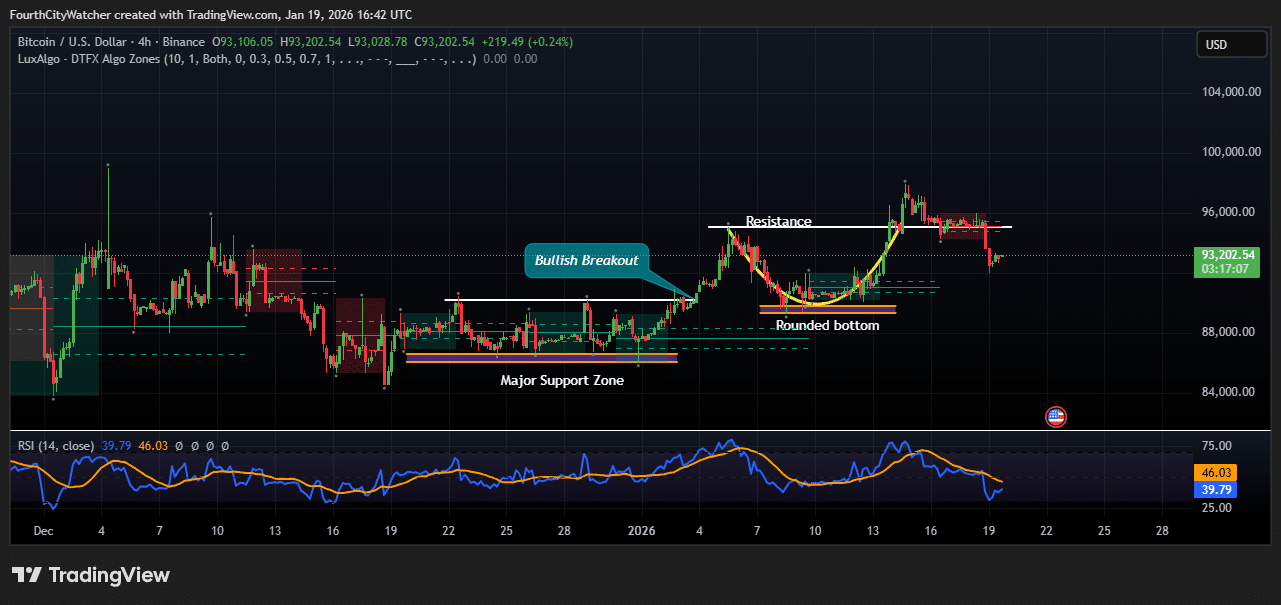

The 4-hour Bitcoin price chart shows a series of bullish developments, although recent price action indicates some consolidation in the short term. The price recently rebounded from a major support zone around $87,500 to $88,500, which previously served as a strong accumulation zone. This level has managed to absorb selling pressure several times in the past, providing a solid foundation for higher moves.

Following this support, Bitcoin formed a rounded lower pattern between January 6 and 12, signaling a shift from bearish to bullish sentiment. The rounded bottom reflects a gradual loss of sales momentum, allowing buyers to regain control.

A bullish breakout occurred after the rounding bottom, pushing the price above previous resistance levels around $91,000. This breakout was accompanied by strong bullish momentum, with the price briefly testing the $96,000 region. The breakout confirms that buyers were ready to intervene decisively after the consolidation, signaling a potential continuation of the uptrend in the short term.

Currently, the price has pulled back slightly after reaching the $96,000 resistance zone. The minor retracement appears healthy, as it allows buyers to enter at lower levels without threatening the overall bullish structure. The relative strength index (RSI), currently around 39.8, shows that Bitcoin is not yet oversold, indicating room for further upside once buyers return. Level 46 on the RSI also indicates previous momentum resistance, now acting as a potential pivot point.

The chart shows a well-defined support and resistance structure, with the price respecting the range of $88,000 to $91,000 before attempting higher levels. The rounded bottom and bullish breakout highlight a transition from accumulation to new bullish momentum. Traders could expect a retest between $91,000 and $92,000 as a key support level, while the $96,000 area remains a near-term resistance barrier.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news