Bitcoin enters a busy week, consolidating below its $ 112,000 summit while holding a business above the psychological level of $ 100,000. Despite the increase in macroeconomic tensions – the implementation of yields of the American treasury, commercial disputes between major economies and increasing geopolitical friction – Bitcoin has demonstrated a relative force, maintaining support above key demand areas. This resilience fueled the debate among analysts, some anticipating a deeper correction and others providing for an escape in prices.

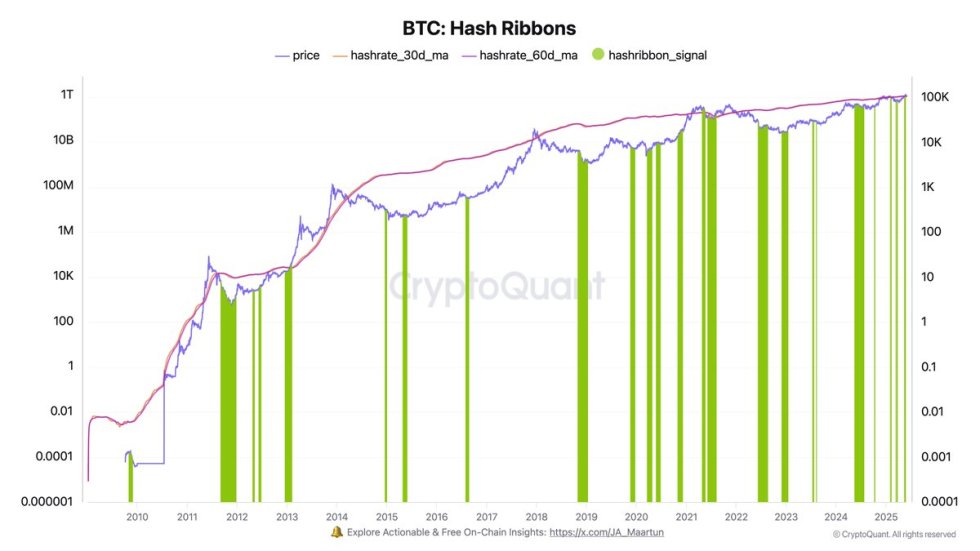

The feeling of the market remains mixed, with volatility data and data on the chain showing signs of prudence among the participants in the retail. However, a potential turning point has emerged. According to Top Analyst Darkfost, the indicator of hash ribbons – a tool that follows the stress of minors and has historically reported strong purchasing opportunities – has simply flashed a new purchase signal. This evolution is notable since the Bitcoin hashrate recently reached new heights of all time, reflecting the growing force of the network despite the consolidation of prices.

The signal of the hash ribbons suggests that the capitulation of short -term minors can be finished and that long -term investors could see a favorable entry point. With BTC wrapped now for a decisive decision, this signal could act as a catalyst, reviving the momentum while traders look closely for a push towards new heights in the days to come.

The key signal suggests that bitcoin is ready to move

Bitcoin could be about a major decision when it is consolidated below its $ 112,000 summit. The market remains tense, with bulls that have control but faced with the pressure of the increase in macroeconomic risks, including current stress on the bond market and the climbing of global trade tensions. If BTC does not resume the momentum and falls below critical demand levels, this could trigger a deeper correction. However, an escape greater than $ 112,000 would probably revive the bullish feeling through cryptographic space.

Darkfost has highlighted a key technical signal which flies under the radar – a new signal for purchase the indicator of hash. This metric assesses stress levels in the Bitcoin exploitation ecosystem by comparing the 30 -day and 60 -day mobile averages of the network hashrate. When the short -term average crosses the long -term average after a period of capitulation, it generally indicates that the sales pressure of minors is around and that the accumulation can follow.

Although these periods of stress of minors can be lower in the short term – because some minors are forced to liquidate the BTC to remain solvent – they often have high quality entry points for long -term investors. In particular, the purchase signal of recent hash ribbons aligns with the Bitcoin hashrate reaching new peaks of all time, reflecting the resilience of the network despite the stagnation of prices.

If the bulls take advantage of this configuration, the market could see a strong push towards a new phase of price discovery. But non-compliance with key support levels can open the door to the area of the area of less than $ 100,000. As always, the next sessions will be crucial to determine the Bitcoin trajectory for the coming weeks.

Daily analysis of graphics: support for sockets, Momentum awaits confirmation

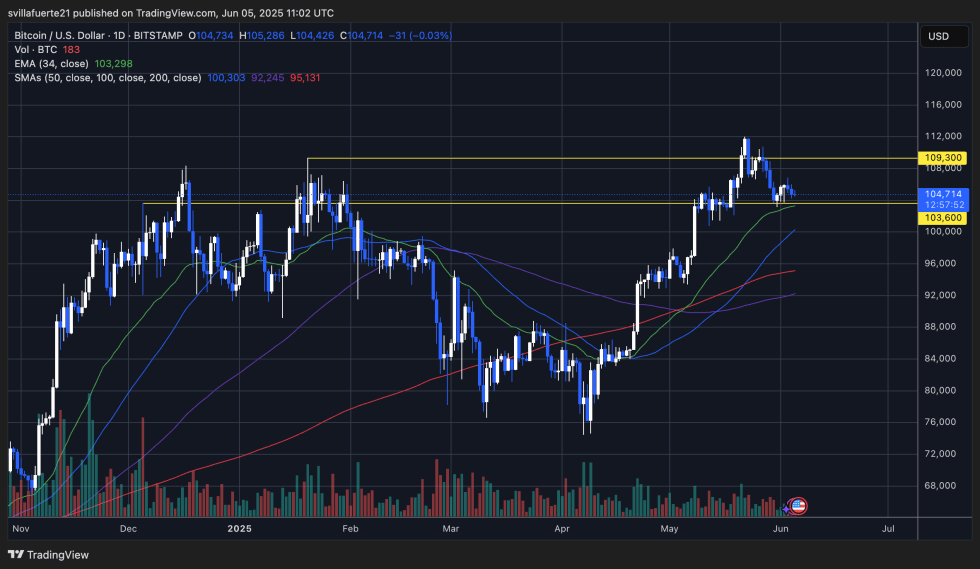

Bitcoin continues to consolidate between the support of $ 103,600 and the resistance zone of $ 109,300, as we can see on the daily graphic. After reaching a new summit of all time almost $ 112,000, the price has been traced and is now held slightly above the EMA from 34 days to $ 103,298. This mobile average, alongside the horizontal level of $ 103,600, acts as the key demand zone that bulls must defend to maintain the current bruising structure.

Despite the recent decline, BTC remains in a broader trend, supported by higher stockings from the Mars background. However, the impulse clearly fades because daily candles show lower peaks and a decrease in volume. A break over $ 109,300 will probably reintegrate the bullish momentum and opened the way for a potential thrust towards new peaks of all time.

Up to decrease, a confirmed break below $ 103,600 could trigger a clearer correction, the following key support in SMA of 100 days almost $ 92,245. Merchants should monitor a daily closure outside this beach to determine the following directional movement.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.