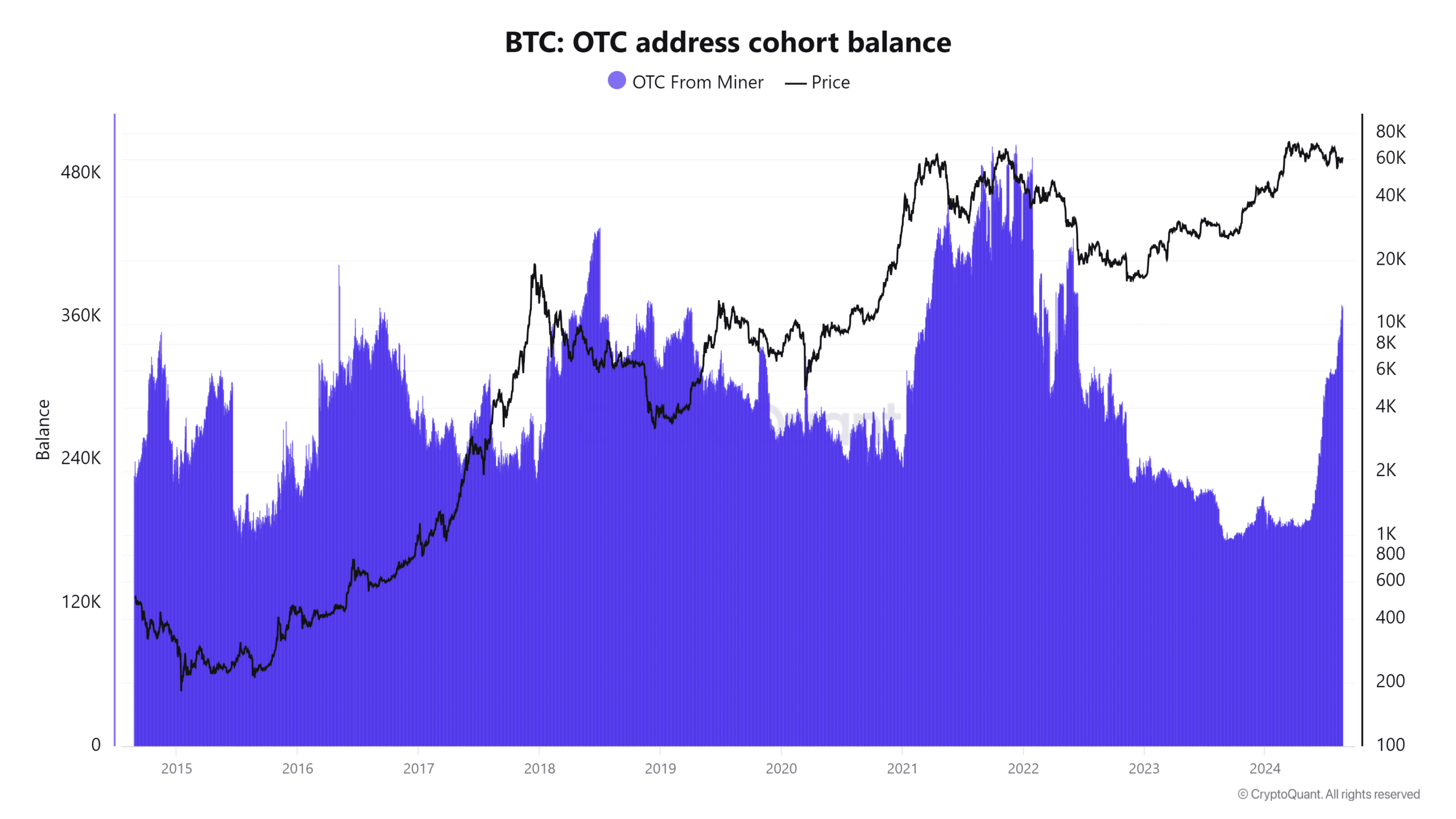

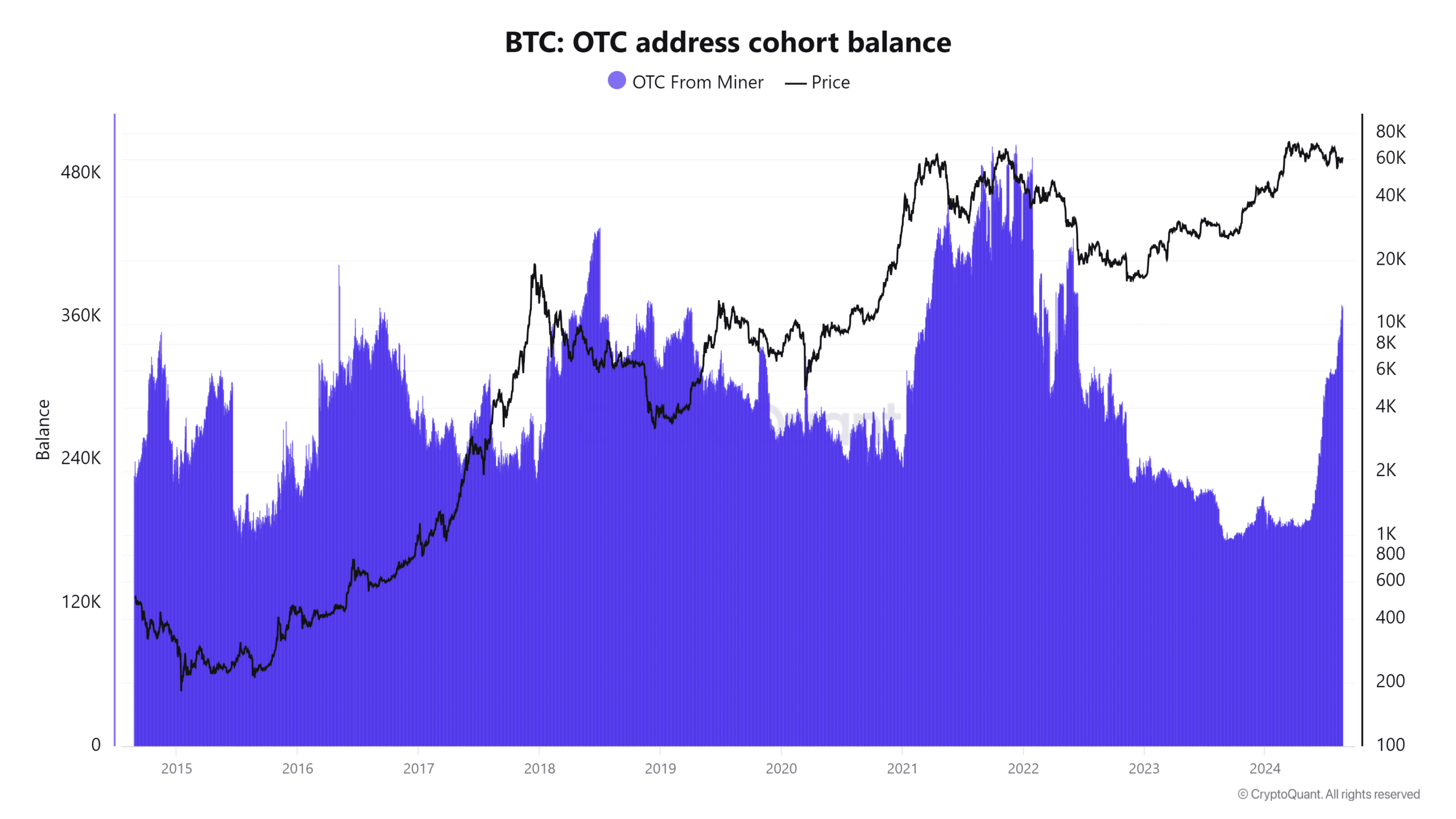

- Miners added 153,000 BTC to their OTC stash over the past three months.

- The BTC price trend remained slightly bearish.

A recent analysis reveals that Bitcoin Miner’s OTC reserve has reached its highest level in years.

Historically, spikes in this metric have not always been favorable to Bitcoin’s price, and this trend appears to be continuing as BTC has faced significant challenges in recent weeks.

Bitcoin Miners OTC Spikes

Recent data from CryptoQuant reveals that Bitcoin Miner’s OTC supply has reached its highest level since 2022.

Data shows that over the past three months, the reserve has increased by more than 70%. It went from 215,000 BTC in June to 368,000 BTC in August, which is a significant increase of 153,000 BTC.

Source: CryptoQuant

Miners typically use over-the-counter (OTC) sales to avoid triggering negative price reactions during large-scale transactions.

However, historical analysis indicates that even with this strategy, the price of Bitcoin has struggled to avoid the impact of these substantial increases in the OTC supply.

How the price reacted

In May 2018, after the balance of Bitcoin Miner’s OTC desk exceeded 400,000 BTC, the price of Bitcoin was around $8,475. By December 2018, the price had dropped by 63%, falling to $3,183.

A similar pattern occurred in November 2021, when Bitcoin was trading at around $64,000 and OTC desk balances for miners hit an all-time high near 500,000 BTC.

Two months later, in January 2022, the price of Bitcoin had dropped by 45%, falling to $35,058. These historical examples highlight the significant impact that OTC balance spikes can have on the price of Bitcoin.

This increase in OTC supply could signal potential selling pressure from miners, contributing to the challenges of maintaining price stability.

An unfavorable market, which leads to massive sales

The current price volatility in the Bitcoin market has further intensified the recent increase in miners’ OTC supply.

Additionally, the recent halving event, which resulted in a decrease in miner rewards, has prompted miners to sell more of their holdings to secure their profits.

This problem is compounded by the recent increase in mining difficulty.

When this increased difficulty is compared to the reduced fees, it becomes clear that BTC mining has become less profitable, causing miners to liquidate more of their reserves.

At the time of writing, Bitcoin is trading at around $61,000, which is up more than 1%. Let’s assume that the price can maintain this upward momentum.

Is Your Wallet Green? Check Out the BTC Profit Calculator

In this case, Bitcoin Miner profitability could stabilize, providing a more favorable environment for miners amidst current challenges.

Continued positive price trends could help offset recent pressures from increasing mining difficulty and reducing fees.