Bitcoin news and Ethereum price remained stable over the past day, with traders keeping one eye on the price and the other on new political signals from Washington and London.

Bitcoin exchange near $95,648, up +0.04%, while Ethereum hovered around $3,168, a small gain of 0.16%.

Robert Kiyosaki, author of Rich Dad, Poor Dad, said his audience on X that he does not intend to sell his Bitcoin or his gold, despite the sharp drop in prices.

BITCOIN CRASHING:

The bubbles of everything burst….

Q: Am I selling?

A: NO: I’m waiting.

Q: Why don’t you sell?

A: The cause of the collapse of all markets is that the world needs liquidity.

A: I don’t need cash.

A: The real reason I’m not selling is because the…

– Robert Kiyosaki (@theRealKiyosaki) November 15, 2025

He said what he calls the “bubbles of everything” are now starting to burst. He argued that the deeper problem behind the market fall is the lack of liquidity globally.

“The cause of the collapse of all markets is that the world needs liquidity,” he wrote.

Kiyosaki also warned that what he calls “the Big Print” is coming, echoing Lawrence Lepard’s view that governments could resort to heavy money creation to manage rising debt.

He reiterated this point in a separate update and said his long-term position remains the same. “I will buy more Bitcoin once the crash is over,” he wrote, again highlighting Bitcoin’s fixed supply of 21 million coins.

TWO MORE THINGS:

1: I will buy more Bitcoin once the crash is over.

There are only 21 million Bitcoins in existence.

2: If you have a cashflow game, form a cashflow club and get Birds of Feather together…. Teaching and learning together.

– Robert Kiyosaki (@theRealKiyosaki) November 15, 2025

Bitcoin Price Prediction: Does BTC USD’s Latest Bearish Cross Signal a Deeper Correction Ahead?

Meanwhile, Bitcoin fell below its short-term trendline this week as a bearish crossover formed on the daily chart.

The fast-moving average has fallen below the 200-day line after several weeks of slowing near $110,000.

(Source:)

Traders often treat this pattern as a possible “death cross.” In previous cycles, similar crossovers aligned with local lows which then produced strong rebounds.

This time the setup seems weaker. Bitcoin fell firmly below the 200-day moving average for the first time since late 2023, and this decline pushed prices into the high $90,000 range.

The chart also shows a low forming below the spring peak, indicating that momentum has waned.

If Bitcoin is still following its usual cycle, past trends suggest that buyers tend to appear a few days after a death cross.

But if the market does not rebound in the coming week, the next move could be another decline before any attempt to return to the 200-day line.

DISCOVER: 9+ Best High-Risk, High-Reward Cryptocurrencies to Buy in November 2025

Ethereum Price Prediction: Are Derivatives Markets Signaling More Bears for ETH?

According to Coingecko dataEthereum price is down -18.5% last month and another 5.2% this week.

It has been slightly more stable than Bitcoin on the weekly chart, but there is still no real recovery signal.

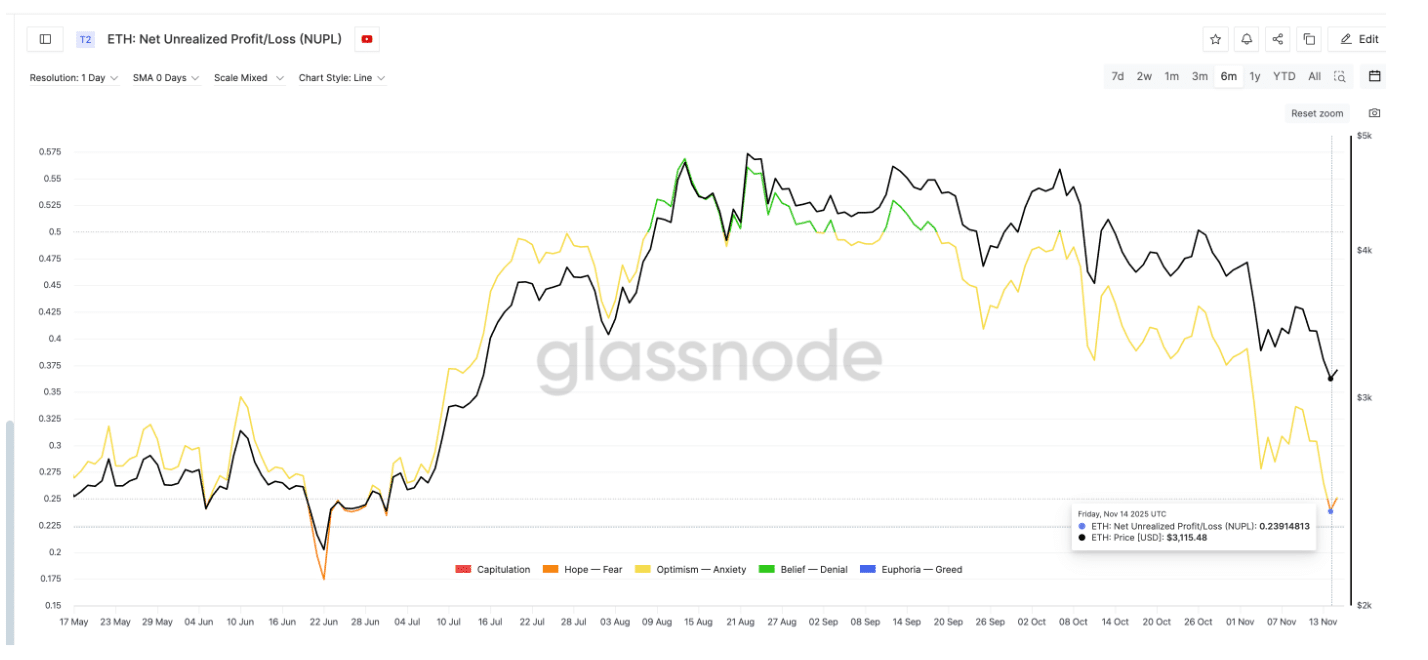

A key on-chain signal shows traders have little reason to lock in profits. Net unrealized profit and loss (NUPL) fell to 0.23, its lowest level since July 1.

NUPL measures the amount of unrealized gains or losses in the market and helps track changes in sentiment.

(Source: Glassnode)

It goes through phases such as capitulation, when most portfolios record losses, and belief or denial, when confidence begins to build.

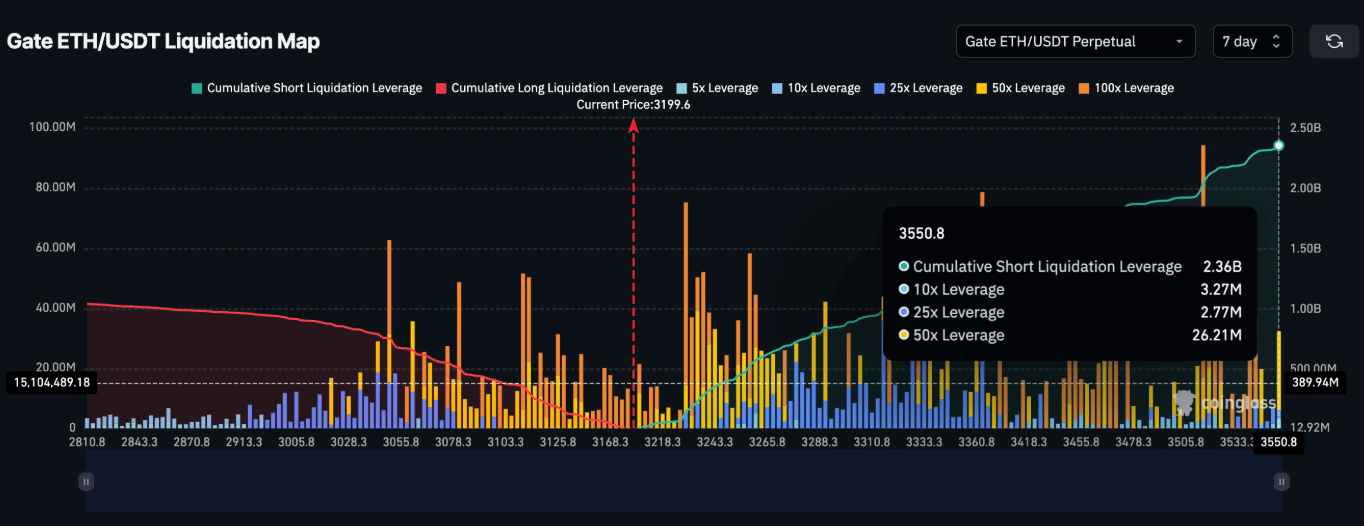

Gate’s ETH-USDT liquidation chart shows cumulative short positions at $2.36 billion, with long positions still notable at $1.05 billion.

(Source: Coinglass)

This split highlights a market caught between caution and conviction, leaving Ethereum’s near-term direction unclear.

Ethereum’s short-term trend is still down, and Crypto Tony says a liquidity sweep could precede any strong recovery.

The chart places ETH near $3,170, moving within a clear corrective structure.

The price action forms an ABC pattern, with the latest pullback opening the door for another decline towards the $3,105 to $3,110 support zone.

This area aligns with the previous trough marked by wave (a), where many stops are likely resting.

(Source:)

The chart also shows an ascending wedge that broke earlier in the move, a sign that momentum had already weakened.

ETH failed to break out above the wave (b) high near $3,250 and declined shortly after, showing that sellers are still in control.

The expected trajectory on the chart suggests a deeper decline in the liquidity pocket, followed by a possible rebound towards $3,260 if buyers intervene.

For now, Ethereum remains in a corrective phase and traders are watching for a lower range sweep before looking to go long.

DISCOVER: Next 1000X Crypto: 10+ crypto tokens that could reach 1000x in 2025

The post Bitcoin News and Ethereum hold firm as Kiyosaki warns against ‘large print’ and Global Cash Crunch appeared first on 99Bitcoins.