Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin slipped 2% over the past 24 hours to trade at $111.33 as of 3:30 a.m. on trading volume down 31% to $50.47 billion.

There could be worse to come, according to Glassnode, which warned that if the price cannot rally above its $113,000 cost basis, a fall to $88,000 could occur as long-term holders begin to reduce their positions.

🧠

Veteran Salespeople Make Moves

Bitcoin is struggling to get back above $126,000 as long-term holders maintain their profit-taking steady. Glass knot #knowledge reveal that these pros, after months of accumulation, are gradually cashing out, fueling continued downward pressure. ➡️… pic.twitter.com/h9PDRsGags

– CryptOpus (@ImCryptOpus) October 31, 2025

If the market finds enough buyers, some analysts say a rebound towards $113,000 and above could still be possible, but demand remains weak for now.

Trading volume has also slowed as investors step back, waiting for clearer signs.

On-Chain Bitcoin Signals Show Mixed Picture

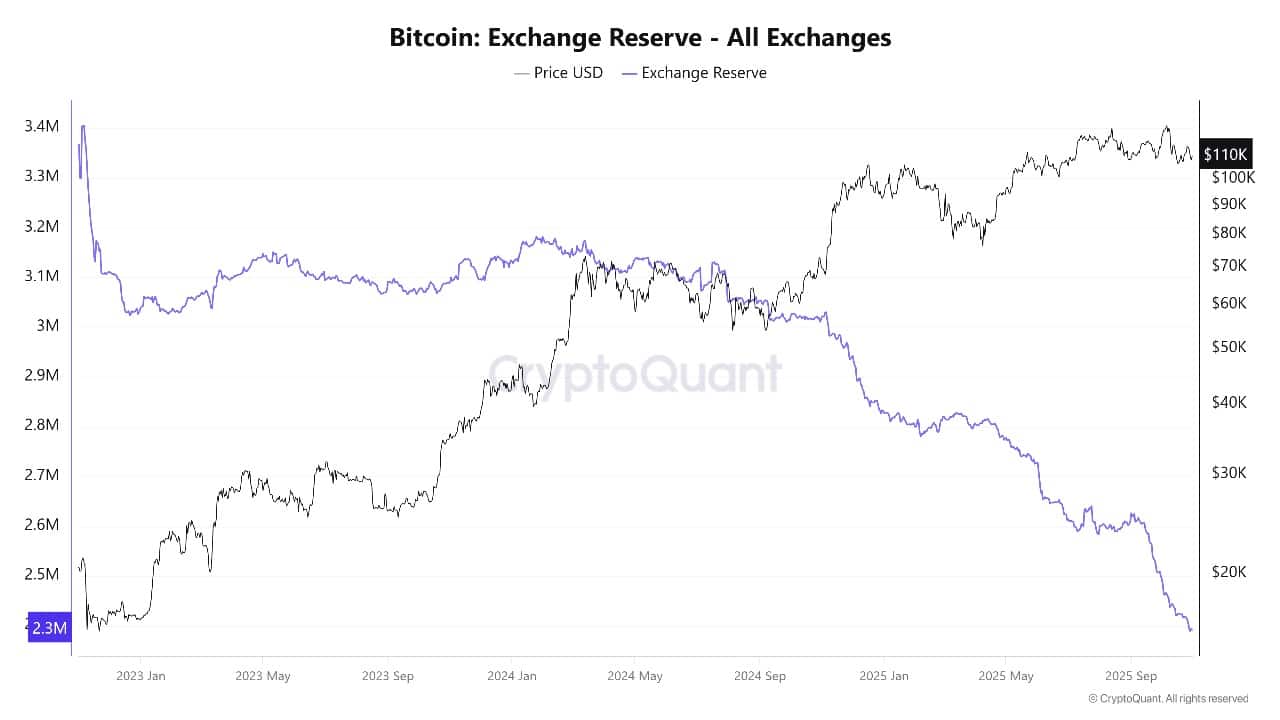

On-chain data shows caution but also some long-term confidence. Foreign exchange reserves for Bitcoin hit new lows as investors withdrew their coins instead of selling them, suggesting that a portion of holders are not eager to exit even in tough times.

Bitcoin Exchange Reserve Source: CryptoQuant

In October, more than 200,000 BTC left trading platforms, reducing the available supply and making each remaining coin a little more scarce.

Nonetheless, selling from nervous traders and low demand hurt the price of BTC on all major exchanges. Glassnode noted that failure to reclaim the $113,000 level could increase the risk of long-term holders turning into sellers as fear grows. As leverage disappears from the market after the October crash, whales and institutions remain cautious.

POWELL GOT COMPLETELY CRAZY

Markets reverse, chaos everywhere

Funding screams, whales laughRetail trapped, panic on every chart👇

Powell continues to push buttons that no one asked for.

Every statement, every clue, it’s like he’s performing a stress test on the whole thing… pic.twitter.com/egDnCEOnvR

– FarmMyTears (@FarmMyTears) October 30, 2025

Signs of further accumulation are there, particularly with ETF and custodial flows still positive, but these have not yet reversed the overall downward trend.

The feeling is stuck in neutral. Investors have not completely capitulated and some are waiting for buy signals. Fed Chairman Jerome Powell said on October 29 that a December interest rate cut was far from certain, adding even more uncertainty for risky assets like Bitcoin.

BTCUSD technical analysis: strong support tested, bearish flag threatened

Looking at today’s price chart, Bitcoin is trading in a tight range, closing just below resistance at $113,000 and hovering near support at $105,000. Recent price developments show strong resistance that repeatedly slows upward movements.

BTCUSD analysis source: Tradingview

If sellers push the price below the $105,000 level, it could quickly test the $95,800 low and then possibly collapse to $88,000, Glassnode’s warning target.

Momentum indicators indicate increased downside risk. The relative strength index (RSI) is at 44.89, showing weak buying pressure and no signs of a rally. The MACD remains negative, with the MACD line well below the signal line, confirming the downtrend. Price action also shows a “bear flag” pattern, a technical signal that often leads to further declines if support is broken.

Investors should carefully watch $105,000 as a critical zone. If buyers manage to hold this level, Bitcoin price could attempt another move towards resistance and possibly retest $115,000. If this support fails, the $88,000 area will become the next major target and sellers could quickly take control.

Price prediction: downside risks remain if support is broken

Most price models, including the latest data from Glassnode, suggest that Bitcoin is likely to see further decline, especially if it cannot return above $113,000 soon. October’s extended selloff wiped out leveraged traders and rattled markets, and without new demand, the price could slide as low as $88,000 before finding real support.

A rebound is possible if new buyers intervene. There are signs of accumulation, particularly with the decline in foreign exchange reserves and the strength of some large investors. Others warn that continued risk aversion, especially if further bad news arises, could continue to push prices lower.

For now, Bitcoin remains stuck below key resistance, under the control of sellers. Keep a close eye on the $105,000 support. If this continues, a rebound could begin; otherwise, $88,000 could be next in the charts.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news