Join our Telegram channel to stay up to date with the latest news

Tom Lee’s BitMine Immersion Technologies has purchased more Ethereum (ETH), pushing its holdings beyond 3% of the altcoin supply.

According to on-chain analytics platform Lookonchain, the world’s largest ETH treasury company acquired $199 million worth of Ethereum in the last 48 hours.

On Friday, the company purchased 41,946 ETH worth $130.7 million. Then, 24 hours later, he acquired an additional 22,676 ETH for $68.67 million.

Tom Lee(@fundstrat) #Bitmin I just bought 22,676 more $ETH($68.67 million) 4 hours ago. pic.twitter.com/vey8AwqmnF

– Lookonchain (@lookonchain) December 6, 2025

BitMine holds over 3% of ETH supply

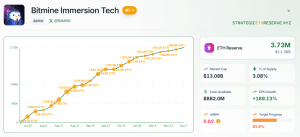

Following these purchases, BitMine now holds 3.73 million ETH tokens worth $11.38 billion, according to data from StrategyETHReserve.

BitMine ETH holdings (Source: Strategic reserveETH)

This brings its reserve to 3.08% of the total ETH supply. This allowed the company to progress more than 61% toward its goal of owning 5% of the crypto supply under its “5% Alchemy” plan.

BitMine may continue its ETH purchases in the coming weeks as it holds approximately $882 million in liquidity reserves that can be used for future purchases.

This could allow the company to establish its dominance in the ETH Treasury market, whose activity has slowed over the past three months. During this period, ETH acquisitions fell by 81%, from 1.97 million ETH in August to 370,000 ETH purchased in November.

During this downturn, BitMine had also purchased the majority of ETH. Over the past month, the company purchased 679,000 ETH worth $2.13 billion.

Smart Money Traders Bet Against ETH in the Short Term

As BitMine adds to its ETH reserves, the top performing traders in the crypto space in terms of returns, who are followed as “smart money” traders on Nansen platform, bet on the short-term depreciation of the altcoin.

Smart money traders added $2.8 million in short positions over the past 24 hours, with a cumulative short position of $21 million.

Meanwhile, US spot Ethereum ETFs (exchange traded funds) are currently on a two-day outing streak. Data from Distant investors shows that investment products saw outflows of more than $110 million by the end of the business week.

Investors withdrew $41.5 million from ETH spot ETFs on Dec. 4, followed by another $75.2 million in the last trading session.

This is a continuation of the negative trend seen last week, when funds saw outflows four out of five days. The only day with net daily inflows was Wednesday, when investors pumped $140.2 million into the funds that day.

ETH price tries to break out of consolidation channel

BitMine’s recent purchases come as the price of ETH remained stable over the past week following a 9% decline last month. Over the past 24 hours, the crypto managed to climb by a fraction of a percentage, data of CoinMarketCap broadcasts.

Daily chart for WETH/USD (Source: GeckoTerminal)

However, ETH’s stable trading may soon come to an end, as the altcoin attempts to break out of the consolidation channel between $2,707 and $3,055 it has been trading in over the past fortnight.

ETH previously managed to breach the $3,055 resistance but has since moved back below the level. If bulls attempt to push ETH above this point again in the next 48 hours, the crypto could end up reaching $3,606 in the near term.

Conversely, a takeover by the bears could cause the recent oscillation to continue. In an extreme case, sellers could even push ETH below the $2,707 support all the way to $2,331.

Technical indicators such as short-term exponential moving averages (EMA), moving average convergence divergence (MACD), and relative strength index (RSI) show that momentum has stalled. As such, bears or bulls can take over and push Ethereum price in the desired direction.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news