Blockchain.com, one of the oldest crypto platforms operating a blockchain wallet and explorer, has received regulatory approval in Europe as it steps up its compliance efforts.

Blockchain.com has obtained a Crypto-Asset Markets Regulatory (MiCA) license from the Malta Financial Services Authority (MFSA), the company announced on Thursday.

Through this license, Blockchain.com is able to provide custody and wallet services in 30 countries in the European Economic Area (EEA) and plans to deploy institutional services, including treasury management.

“Prior to MiCA, the company operated in a fragmented regulatory environment,” a Blockchain.com spokesperson told Cointelegraph, adding that the license helps it consolidate these services in the EEA under a single regulatory framework.

New director of the Malta Financial Association

“Malta’s regulatory clarity and strategic position make it the ideal platform to grow Blockchain.com’s European operations,” said Peter Smith, co-founder and CEO of Blockchain.com.

To lead its European strategy, Blockchain.com has appointed Fiorentina D’Amore, President of the Financial Institutions Malta Association (FIMA), as Senior Director of EU Business Operations and CEO of Blockchain.com Malta.

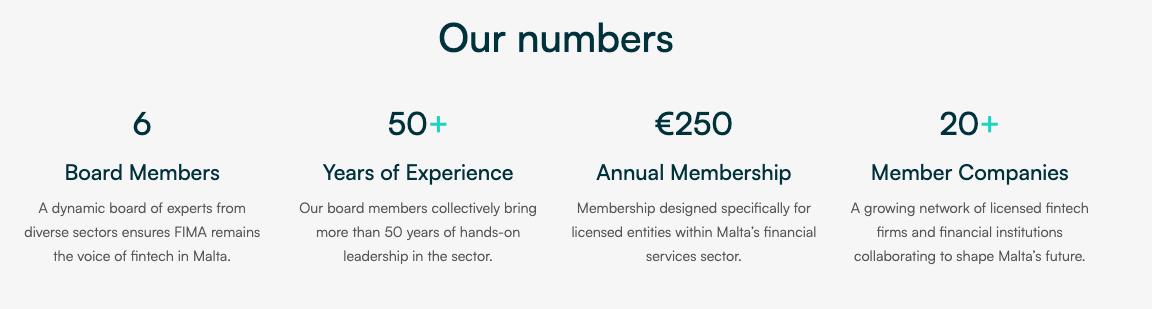

Launched in 2017, FIMA is an association representing financial institutions licensed in Malta, aiming to promote the sector in cooperation with local and European regulators. With previous experience on major platforms including Bitpanda and eToro, D’Amore will oversee Blockchain.com’s operations across the EU, focusing on strategic growth.

“Leveraging the momentum from our MiCA license, we will continue to promote the balance between innovation and compliance across the region,” D’Amore said.

Malta stands out in the MiCA approach

Malta’s approach to issuing MiCA licenses has attracted both attention and controversy within the EU.

In July, the MFSA came under scrutiny from the European Securities and Markets Authority (ESMA), the main European MiCA supervisory authority, for certain authorization shortcomings. The Maltese regulator later clarified that these issues posed no risk to its MiCA licensing process, highlighting the country’s role as an early adopter of crypto regulation.

Malta also stands out for its stance against EU centralization in the supervision of cryptocurrencies.

While member states such as France have called on ESMA to directly supervise crypto-asset service providers (CASPs), Malta has argued that it is too early to implement such a significant change, with MiCA having been in full force for less than a year.

“It is premature to assess its full impact, particularly on PSAPs, and the MFSA believes that now is not the appropriate time to introduce additional layers of supervision that could potentially hinder competitiveness and innovation within the digital assets market,” the regulator said in a September 17 statement.