The global non-fungible token market is experiencing a new bear market season, which began in November. In response to this slowdown, trading has slowed and many people appear to have turned their attention to other markets. This does not mean that traders are done taking risks. Nonetheless, attention has returned to memecoins, particularly those built on Solana (SOL).

The collapse of the NFT market explained

Data compiled by tiexo.com, a multi-chain non-fungible token explorer, indicates that overall NFT activity has been declining gradually, with some spikes and a stable business model across various NFT markets. NFT market share has become increasingly concentrated, with OpenSea and Blur accounting for the majority of total trading volume, while smaller NFT platforms are losing relevance.

Over the past 30 days, OpenSea, the largest trading platform by commercial sales volume, generated $73 million in commercial sales volume, accounting for 53% of the total commercial sales volume across the top five NFT marketplaces. Blur, a specialized Ethereum-based NFT marketplace and aggregator designed for professional traders, offering advanced analytics, fast NFT scanning and zero marketplace fees, ranks second with $30 million in trade sales volume.

Magic Eden, a leading multi-chain NFT marketplace and Web3 platform that allows users to buy, sell, create and trade digital assets on Solana, Bitcoin, Ethereum and Polygon, ranks third in December, with $18 million. CryptoPunks, an NFT marketplace dedicated to CryptoPunks NFT collections, and Tensor, the leading NFT marketplace on Solana, ranked fourth and fifth, with $10 million and $2.23 million.

On the other hand, the main NFT collections saw their floor prices plunge in December. Mutant Ape Yacht Club, an NFT collection from digital asset company Yuga Labs, is the most impacted NFT collection during the NFT winter. Over the past 30 days, the Mutant NFT collection has seen its floor price drop by 30% to 0.59 ETH. Lil Pudgy is the second most impacted NFT, with its NFT floor price plunging +34% to 0.46 ETH.

source: nftpricefloor.com

During the current NFT winter, Moonbirds, an NFT collection previously from digital asset company Proof Collective but now managed by Orange Cap Games, also saw its floor price drop. Over the past 30 days, the Moonbirds NFT floor price has decreased by 21% to 1.45 ETH. Other NFT collections that saw their floor price drop include CryptoPunks, Bored Ape Yacht Club, and Pudgy Penguins.

Other top NFT collections, like Azuki, Chimpers, Bitcoin Puppets, Good Vibes Club, Milady Maker, Doodles, and NodeMonkes, saw their floor value plunge by +20% in December 2025. Compared to other months, many NFTs are definitely losing momentum and are no longer in the spotlight. It’s true that the NFT market is not dead. But where have NFT traders focused their attention?

NFT Traders Switched to Memecoins

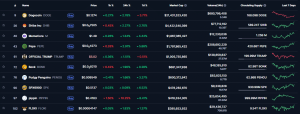

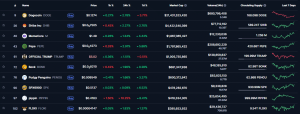

Data from CoinMarketCap shows consistent volume for the largest coins. Big names like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) are proof of this. Despite the crypto collapse, their numbers are staggering. New entrants are also experiencing strong daily business activity. Most of the most actively traded tokens over the past week either originated on Solana or traded heavily on it.

The data further reveals that other Solana-based memecoins exhibit high volume despite smaller market caps. They are frequently traded rather than held long-term. Additionally, low transaction fees and fast settlement allow traders to enter and exit positions quickly. This keeps activity high. Perhaps this is what led to the rapid attention of NFTs. Traders look for markets that allow them to move quickly and make short profits as quickly as possible.

Related NFT News:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month