Join our Telegram channel to stay up to date with the latest news

The prolonged sequence of outflows for Bitcoin and Ethereum spot ETFs (exchange-traded funds) is an indication that institutional investors have disengaged from the crypto space, according to analytics platform Glassnode.

In an X jobThe platform said the 30-day simple moving average (SMA) of net inflows for BTC and ETH products has turned and remained negative since early November.

“This persistence suggests a phase of moderate participation and partial disengagement from institutional allocators, reinforcing the broader contraction of liquidity in the crypto market,” Glassnode added.

BlackRock’s Spot Bitcoin ETF manages to record some entries mid-streak

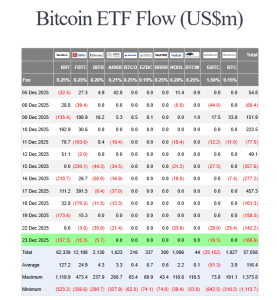

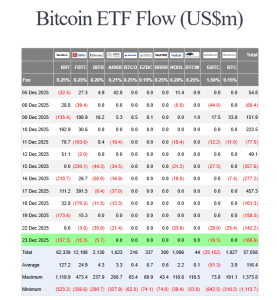

US spot Bitcoin ETFs are now on a 4-day negative flow streak, according to data from Farside Investors. This is after investors withdrew an additional $188.6 million from the products in the last trading session.

US Spot BTC ETF Feed (Source: Farside Investors)

Amid continued net outflows for Bitcoin spot ETFs in the United States, BlackRock’s (IBIT) product managed to see some inflows. While the fund experienced capital outflows of $157.3 million and $173.6 million yesterday and December 19, respectively, it saw capital flow into its reserves on December 18, when the streak began, and December 22.

Investors added $32.8 million to IBIT on December 18 and another $6 million on December 22.

The only other net inflows recorded during the latest round of capital outflows came from Fidelity’s FBTC. On December 19, investors injected $15.3 million into the fund.

Ethereum ETFs Continue Exits After Ending Multi-Day Streak

While spot BTC ETFs extend their negative flow streak to four days, ETH ETFs saw further outflows after successfully breaking a multi-day streak earlier this week.

During yesterday’s trading session, investors withdrew $95.5 million from the products, Farside Investor data watch.

Ethereum ETF Flow (Million US Dollars) – 2025-12-23

TOTAL NET FLOW: -95.5

ETHA: -25

FETH: 0

ETW: -14

TETH: 0

ETHV: 0

QETH: 0

EZET: -5.6

ETHE: -50.9

ETF: 0For full data and disclaimers visit:

– Farside Investors (@FarsideUK) December 24, 2025

The previous day, the funds had recorded daily net inflows of $84.6 million, ending a difficult period for the products.

Prior to this capital infusion, US spot ETH ETFs had experienced a streak of outflows that began on December 11 and ended on December 19. During this period, $705.6 million left the funds, with a large portion of these outflows coming from BlackRock’s ETHA product.

BlackRock Says Its Bitcoin ETF Was a Major Investing Theme in 2025

While Glassnode says the ongoing BTC and ETH spot ETF outflows are indicative of an institutional retreat from crypto, other analysts said BlackRock appears unfazed by the current market crisis.

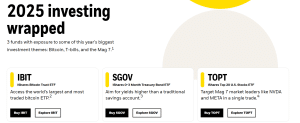

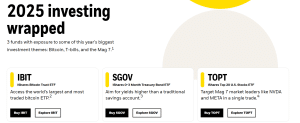

This is after the asset management giant highlighted its spot Bitcoin ETF as one of its top three investment themes in 2025, alongside Treasuries and the biggest US tech stocks.

BlackRock lists its main investment themes in 2025 (Source: iShares)

Nate Geraci, president of NovaDius Wealth Management, said on

Eric Balchunas, analyst at Bloomberg ETF echoes a similar feeling. He asked the question of how well IBIT might perform in “a good year,” noting that the fund has seen $25 billion in flows since the start of the year, even though it posted a negative return for the year.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news