- The rendering has been in a downward trend for almost three months.

- The short term buying opportunity could be risky due to lack of demand.

Render (RENDER) was rebranded from RNDR in July and moved to the Solana (SOL) network after a community vote in 2023. On-chain metrics showed worrying news for long-term investors.

Traders can prepare for a short-term price rebound. Given the lack of demand for the token and the fear sentiment in the market, short selling could generate more profits than buying now.

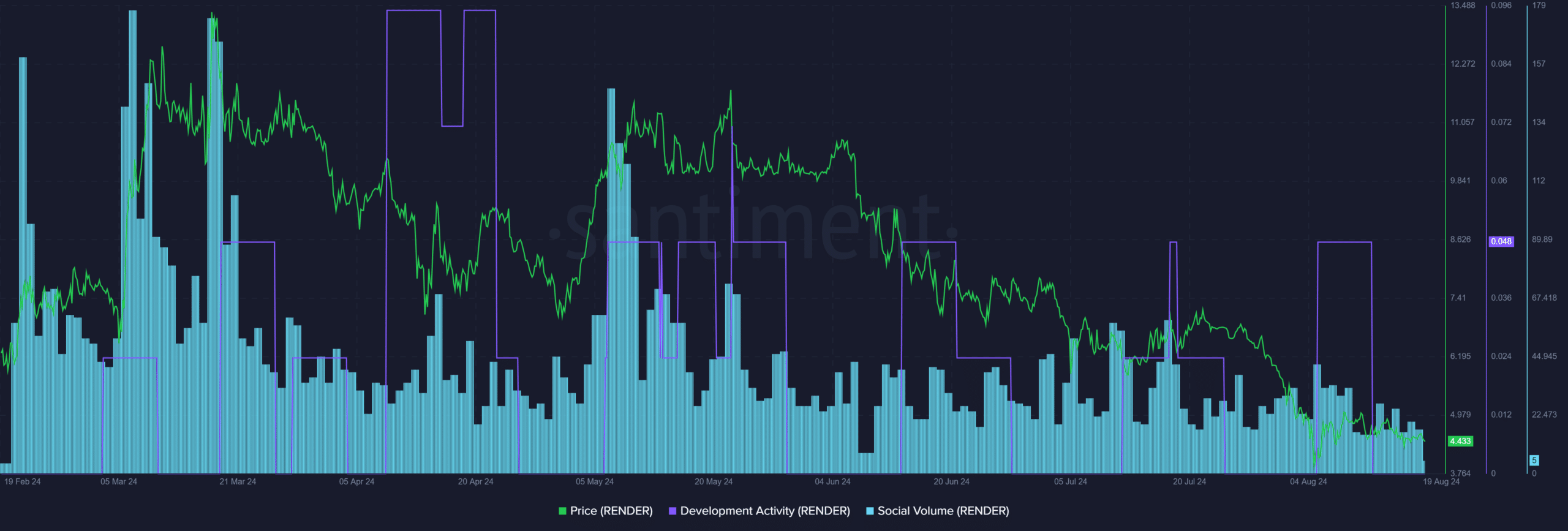

Poor development activity and online engagement

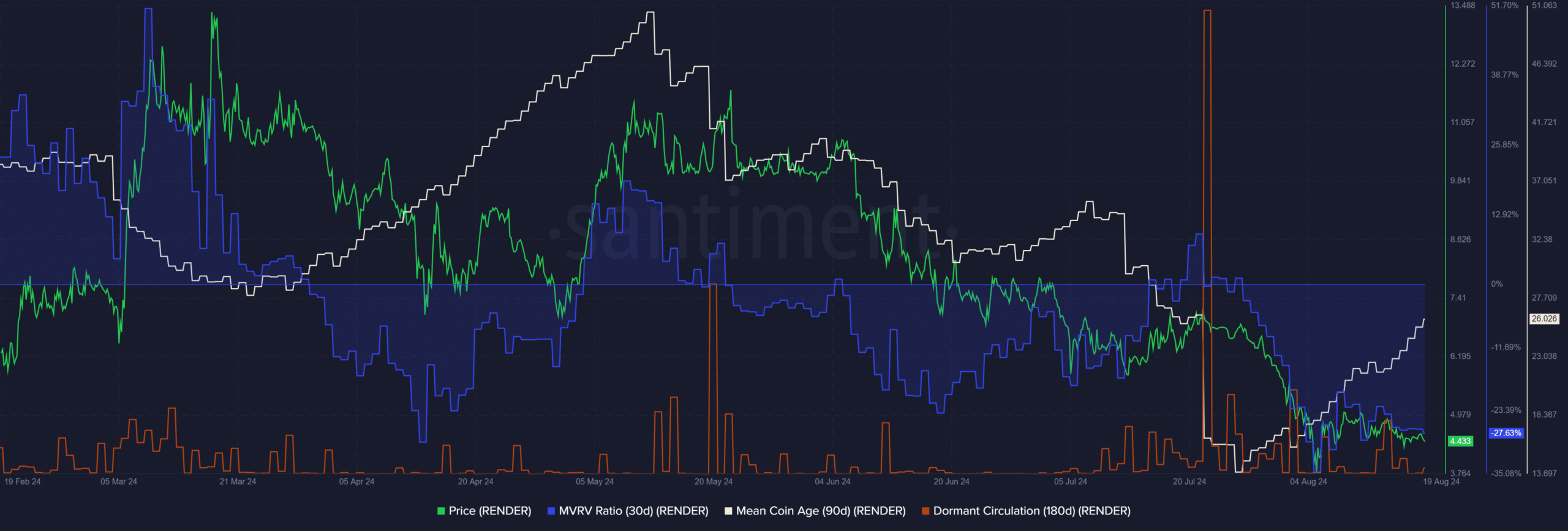

Source: Santiment

Development activity behind RENDER has been very erratic and limited to decimal places at press time. For comparison, Cardano (ADA) is among the industry leaders in this metric with readings around 80.

Social media engagement was also very weak and continued to decline in August. Overall, long-term investor confidence could be shaken by these Santiment metrics.

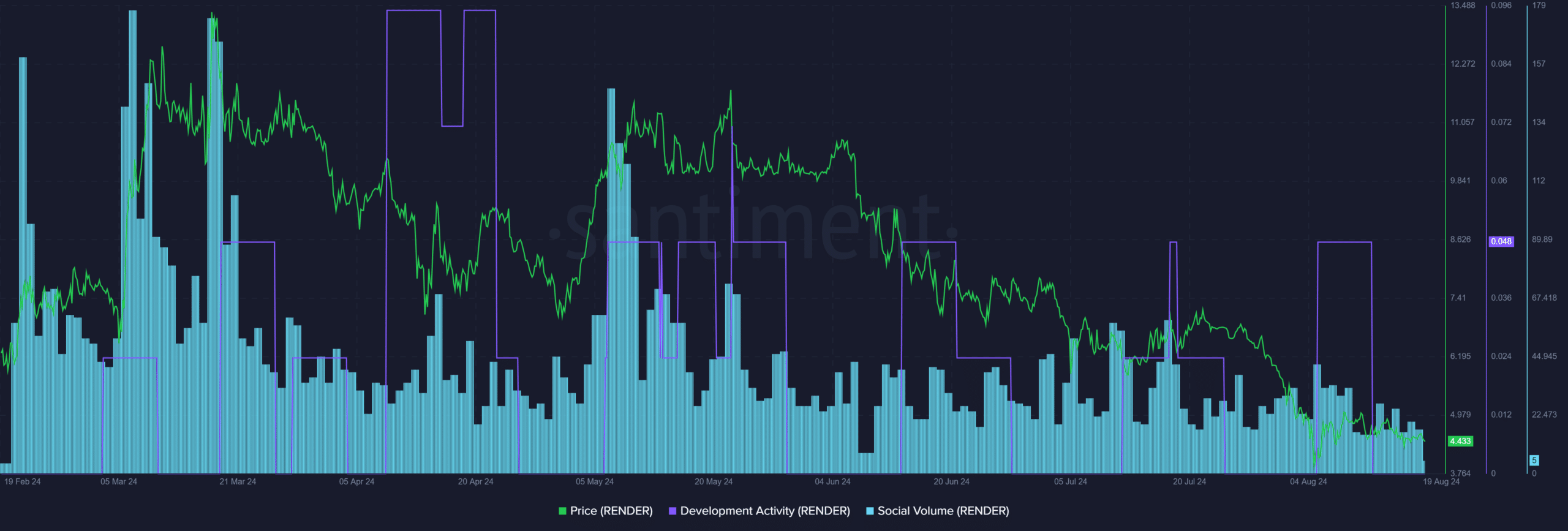

Source: Santiment

On the other hand, a trading opportunity could present itself. The average coin age (MCA) has been trending upwards even as RENDER dropped precipitously in early August. This showed the confidence of holders.

The MVRV ratio was deeply negative, indicating that short-term holders suffered a significant loss. Combined with the accumulation trend, a short-term buying opportunity was present.

This idea was supported by dormant traffic, which has not increased significantly in recent days.

Does RENDER Price Action Support the Bulls?

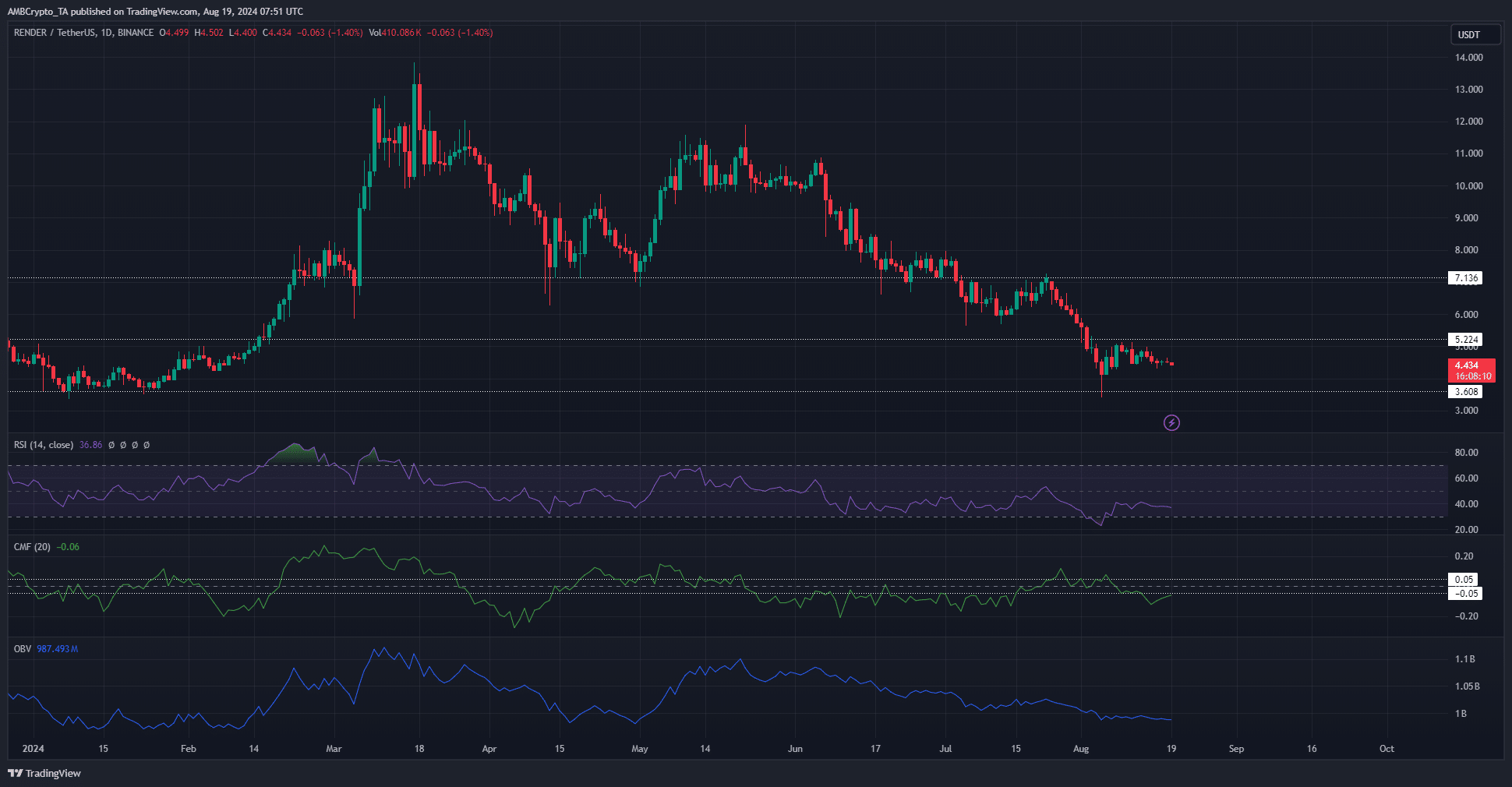

Source: RENDER/USDT on TradingView

Since June, RENDER has lost several key support levels. The $3.6 support level was defended this month, but the downtrend has not been defeated. A move beyond $5.22 would be needed.

Volume indicators showed strong selling pressure and a large flow of capital out of the market. The RSI reflects a strong bearish momentum on the daily chart.

Realistic or not, here is RENDER’s market cap in terms of BTC

Therefore, even though the MVRV and MCA metrics have given a buy signal, traders should remain cautious.

A price rebound towards the $5-$5.22 resistance could be used to go short instead, or stay away altogether.