Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

XRP has become one of the most efficient assets in recent weeks, defying broader market volatility and macroeconomic uncertainty of money. After a difficult start of the month, XRP rebounded, displaying a gain of 32% compared to the lowest of last Monday. The resilience of the token drew the attention of analysts and investors as it continues to surpass many of its peers in the Altcoin space.

Related reading

A large part of this force is attributed to the growing optimism according to which macroeconomic tensions – in particular around trade policies and global inflation – can start to relax. If this trend continues, XRP could be well positioned to direct the next step in recovery of cryptography.

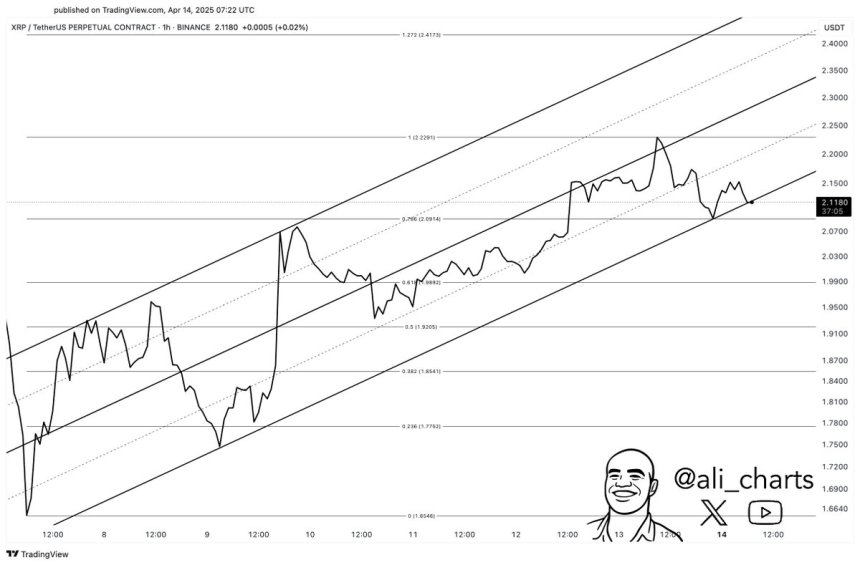

Top Crypto’s analyst, Ali Martinez, added to the Haussier story, sharing a technical analysis showing that XRP is currently negotiating in an upward triangle – a model generally associated with ascending eruptions. Martinez identifies $ 2.22 as the level of critical resistance to monitor. If the bulls can push above this line, it could open the door to a higher price levels.

With the alignment of the technical indicators of Momentum, XRP seems to approach a pivotal moment. The following movement could determine if this rally has more space to run – or if the resistance will block the break.

XRP Bulls Eye Breakout while the market is looking for management

The XRP bulls gain confidence because the market shows signs of stabilization after weeks of volatility. With global tensions that are still unresolved, the wider cryptography environment remains uncertain, but XRP has managed to maintain its land, constantly negotiating above $ 1.80. This regular performance has optimistic analysts according to which the token could prepare for a strong movement higher, especially if the macroeconomic pressure begins to facilitate the coming weeks.

Anticipation surrounding potential monetary policy changes and cooling inflation expectations could create a more favorable environment for risk assets like XRP. Some market players are betting that clarity is up to the global economy, high convictions will lead the charge – and XRP is firmly on this list.

However, not all analysts agree that the rally will be fluid. A more prudent point of view suggests that the market may need more correction to establish a solid base. This scenario would imply a drop below current levels to define a new demand zone before the start of the slight step.

Meanwhile, Martinez has identified a key model in progress: XRP is negotiated in an upward triangle – an optimistic continuation configuration. According to Martinez, the resistance level of $ 2.22 is the crucial threshold. An escape confirmed above this level could trigger a thrust at $ 2.40, potentially marking the start of a wider rise.

While traders are looking closely at prices, XRP’s ability to maintain key support and testing the top of its triangle could determine its next big movement. The next few days can be essential in the training of the short -term future of this high -level Altcoin.

Related reading

The daily action of the prices leans up after recovering the key mediums

XRP is currently negotiating at $ 2.14 after a solid decision that saw the token to recover both the mobile average (MA) from 200 days to $ 1.89 and the 200 -day exponential mobile average (EMA) at $ 1.95. This bullish development indicates a potential change in trend, as XRP bulls now have a short -term advantage. Holding above these key indicators is essential to maintain upward pressure and strengthen confidence in broader recovery.

The next major obstacle is in the daily supply area of $ 2.60. A clear break above this level could open the door to a continuation rally targeting higher resistance areas. For the moment, the bulls will have to maintain a strong purchase interest and a volume to test and possibly violate this level.

However, downward risks remain. If XRP does not hold the psychological support of $ 2.00, a deeper correction could take place. This would invalidate the recent escape and potentially return the token to the $ 1.80 or less area, depending on wider market conditions.

Related reading

For the moment, all eyes are on the question of whether XRP can consolidate gains greater than $ 2.00 and maintain enough momentum to challenge the next supply region. Merchants should monitor volume and wider market indices for confirmation.

Dall-e star image, tradingview graphic