- Ethereum leads in social dominance and developer activity, maintaining a stronger developer presence.

- Ethereum and Solana show similar whale interest, while Solana has lower liquidation volumes.

With bullish sentiment from crowd and smart money indicators, Solana (SOL) shows significant upward momentum, sparking interest in whether it can compete Ethereum (ETH) as the leading platform for decentralized applications (dApps).

At press time, Ethereum is trading at $2,680.82, an increase of 2.17% over the past 24 hours.

Meanwhile, Solana was priced at $178.27, reflecting a 1.43% decline over the same period. Examining key indicators (social dominance, development activity, whale activity, and liquidation data) highlights the distinct position and strengths of each network.

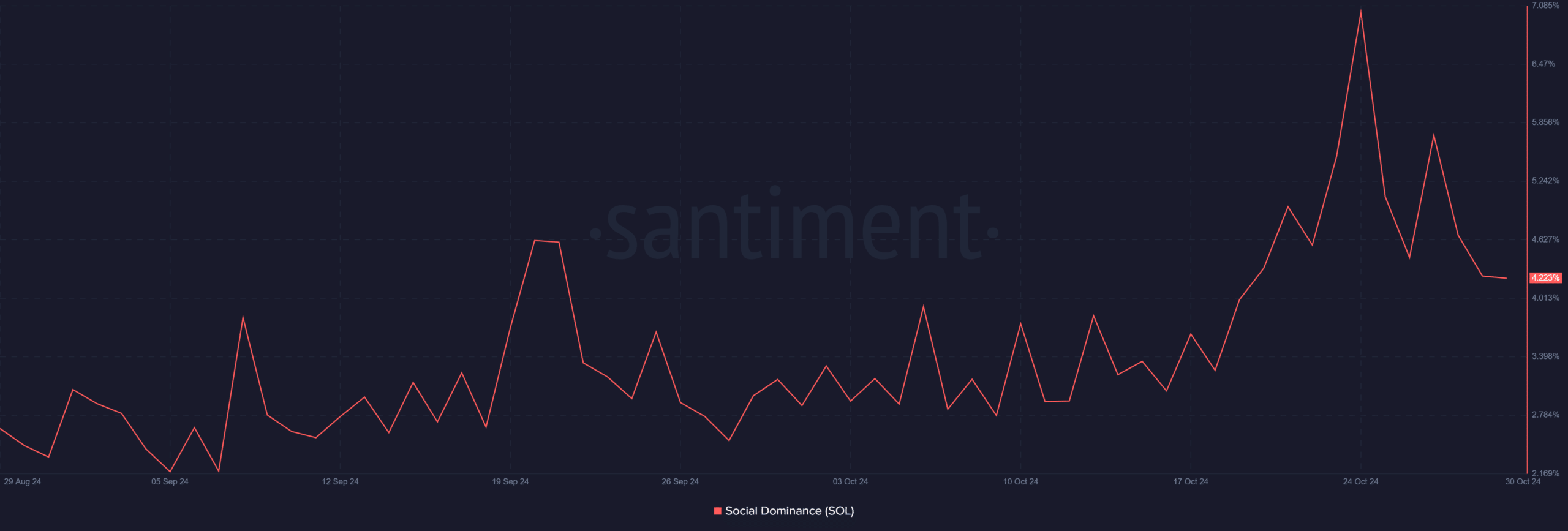

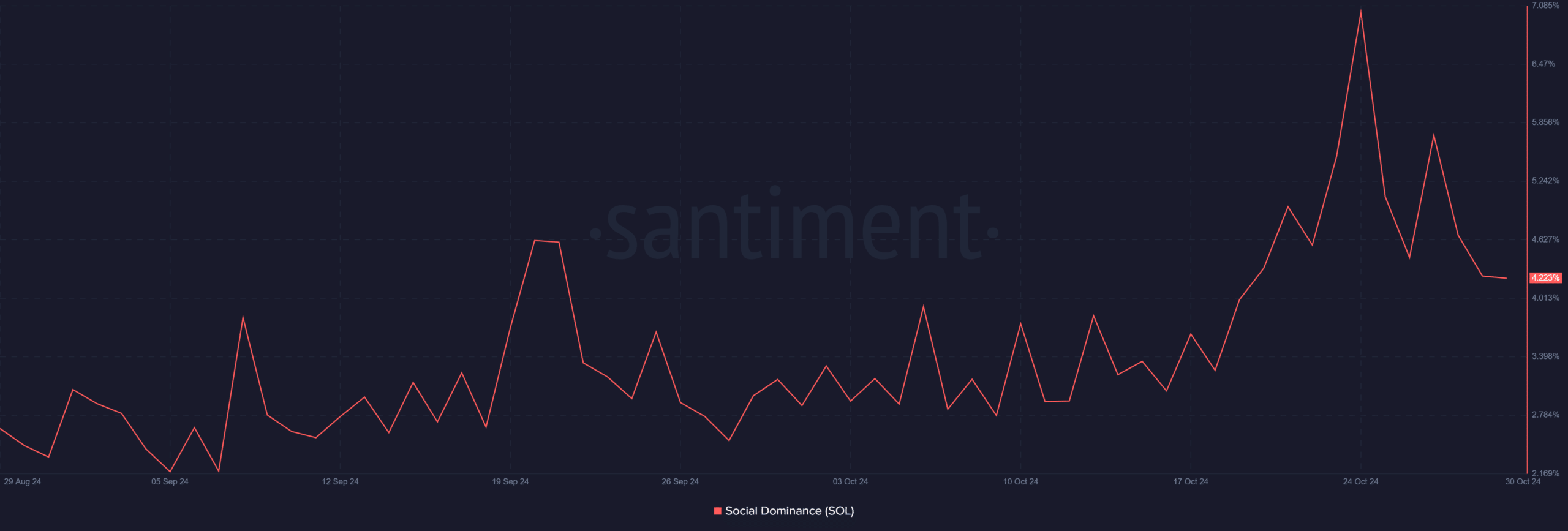

Social Dominance: Is Ethereum Still Leading the Conversation?

Ethereum enjoys higher social dominance than Solana. Over the past month, Ethereum’s social presence has consistently peaked above 6%, while Solana’s high point has been around 4.22%.

This metric measures the share of discussions and mentions on social platforms, reflecting community interest levels.

Therefore, Ethereum dominates online conversations more than Solana. However, Solana’s growing user base indicates an upward momentum in its social presence, demonstrating growing attention around the network.

Source: Santiment

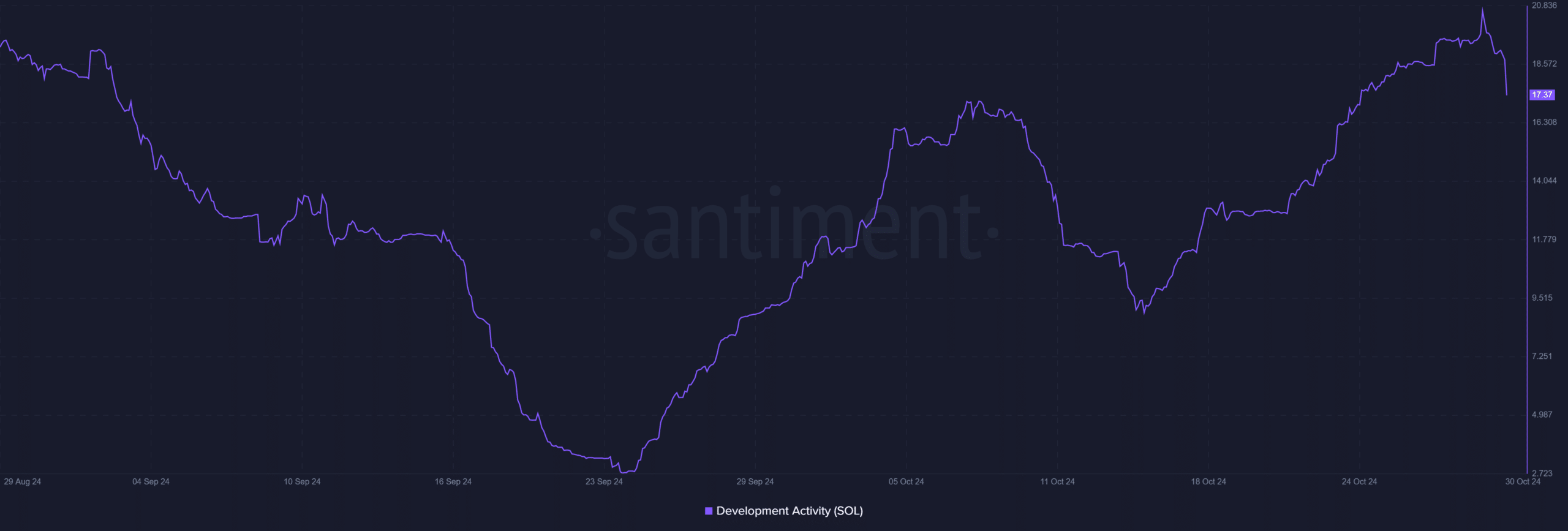

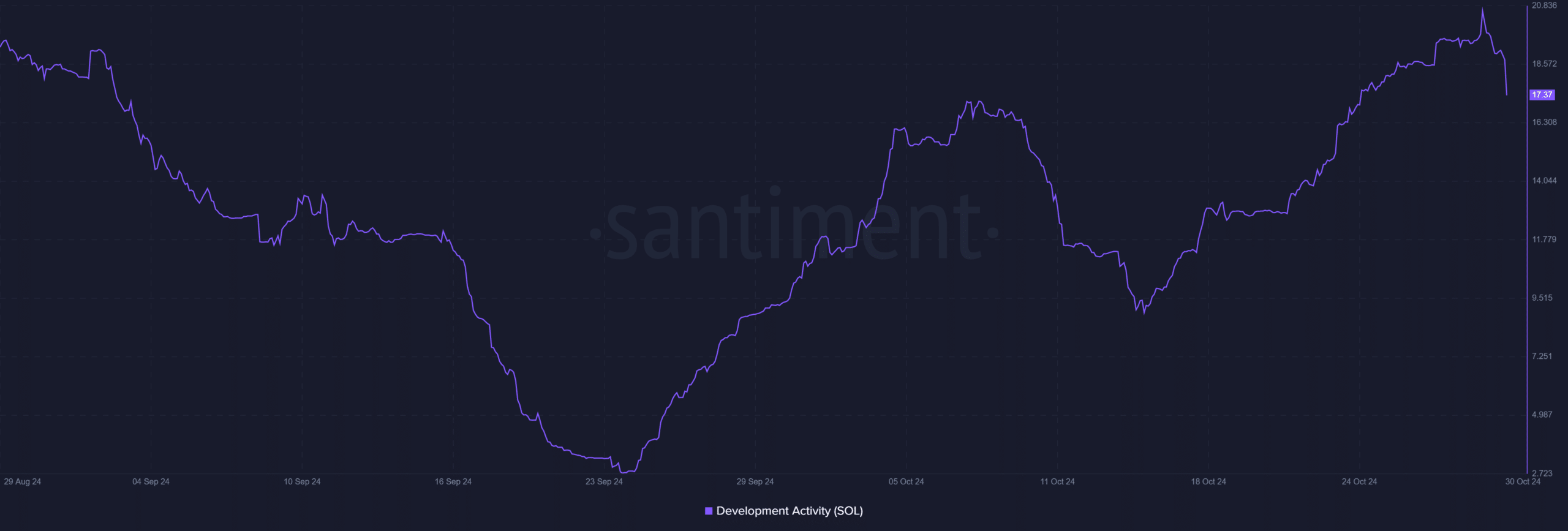

Development Activity: Is SOL Innovation Growing Faster?

Ethereum is currently leading in development activity, with a score of 25.5 compared to Solana’s 17.37. Development activity reflects code updates, project contributions, and ongoing maintenance, showing the health and growth of each ecosystem.

Therefore, Ethereum benefits from a very active developer community focused on innovation and improvements.

Additionally, Solana’s development activity shows a positive trend, indicating increasing developer engagement. However, it still lags behind Ethereum in absolute terms, underscoring the long-standing dominance of Ethereum developers.

Source: Santiment

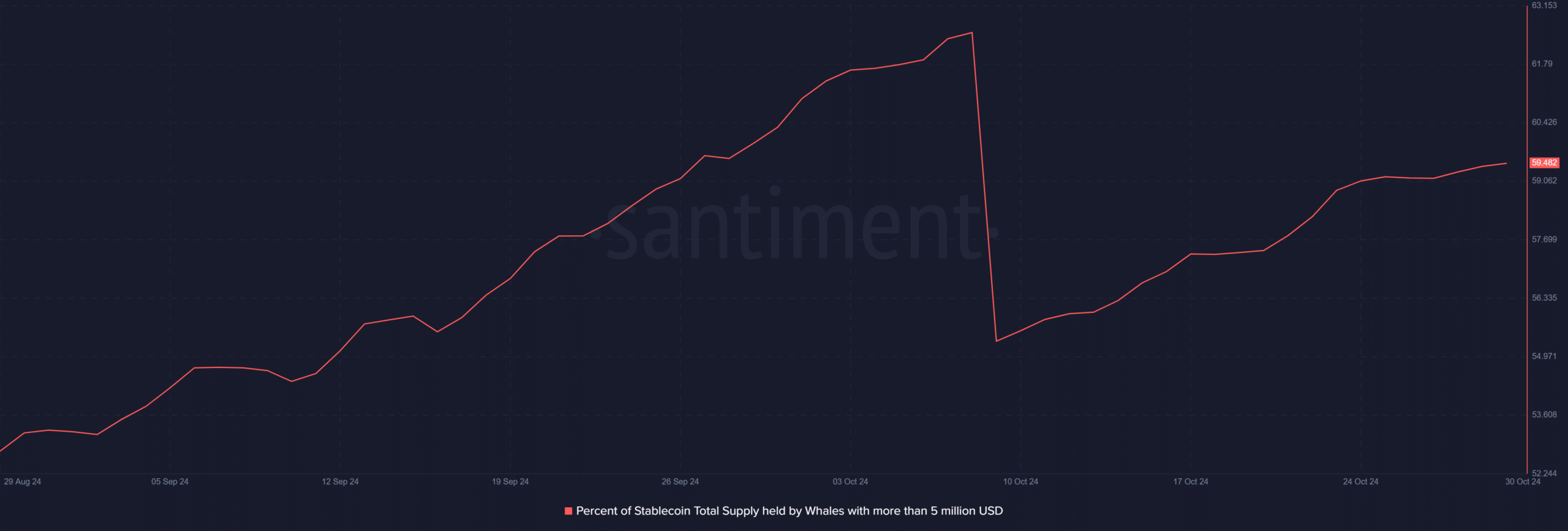

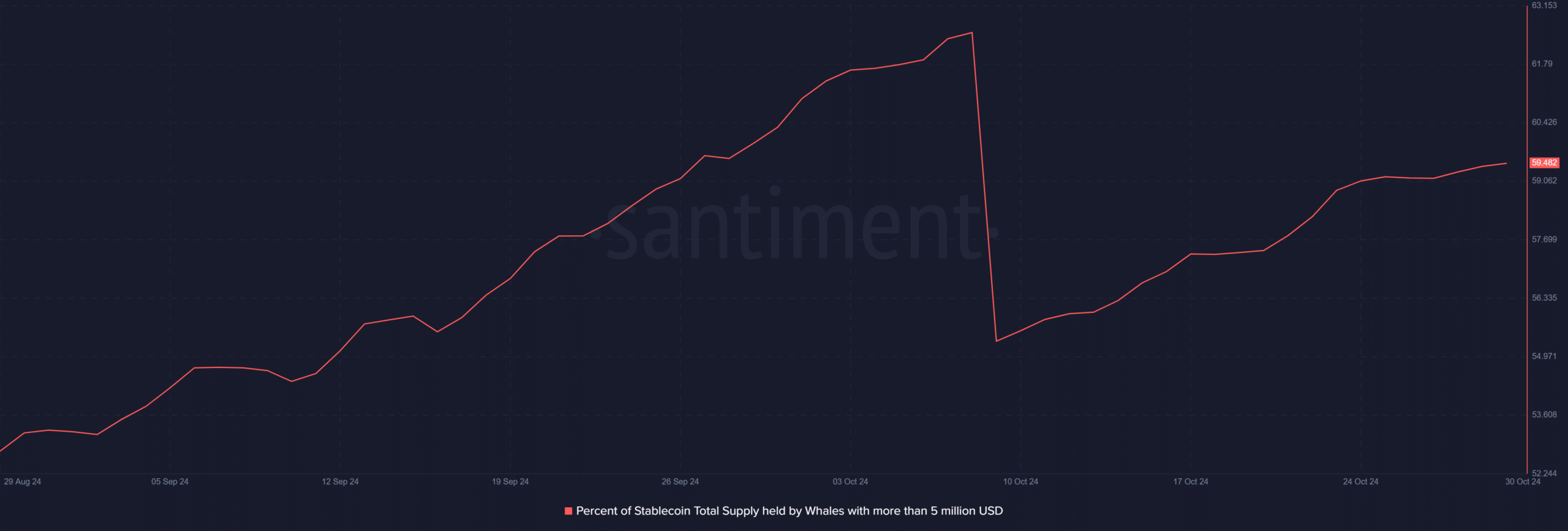

Whale activity: Is SOL attracting the biggest investors?

Ethereum and Solana show significant whale activity, with each network’s top holders controlling approximately 59.48% of their stablecoin supply.

This high concentration among large holders reflects the strong interest of large investors in both ecosystems.

Therefore, whale interest is equally strong for Ethereum and Solana, suggesting that large-scale investors view both networks as valuable assets in the blockchain landscape.

Source: Santiment

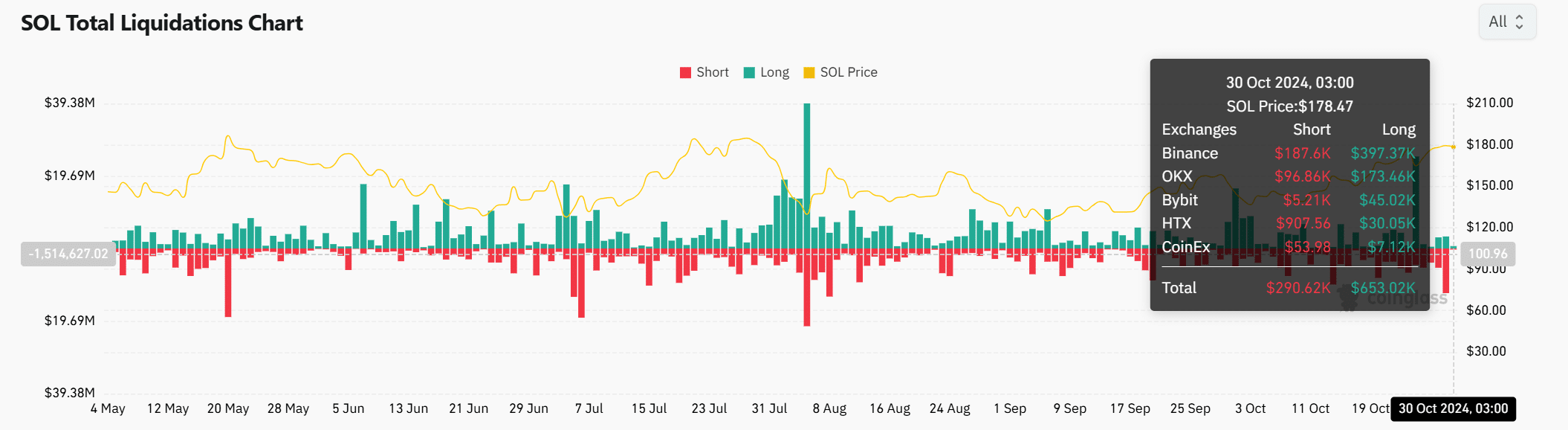

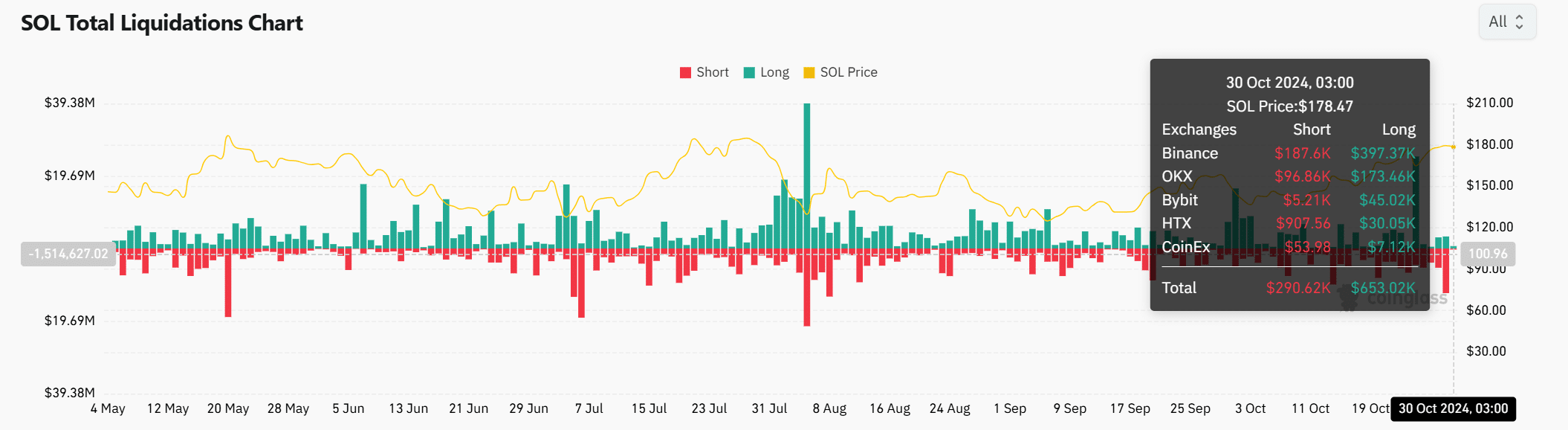

Liquidation Data: Which Network Faces the Most Volatility?

Liquidation data provides insight into leverage-based activity. Currently, Solana has experienced $653,000 in long liquidations and $290,000 in short liquidations. In comparison, Ethereum saw higher liquidation volumes, with $1.93 million in long liquidations and $3.94 million in short liquidations.

Therefore, Ethereum’s higher leverage trading activity suggests that it might experience more frequent price fluctuations, while Solana’s lower liquidation levels imply comparatively less volatility under certain conditions.

Source: Coinglass

Is your wallet green? Check out the SOL Profit Calculator

Conclusion

When it comes to social dominance, development activity, whale involvement, and liquidation data, Ethereum maintains an advantage in several metrics. However, Solana shows concentrated investment from large holders and growing interest from developers, signaling potential growth.

While Ethereum’s broader user and developer base currently solidifies its dominance, Solana’s upward trajectory makes it a competitive force in the blockchain space.