Cardano (ADA) slowly attracts but regularly the attention of market observers while it begins to recover the momentum upwards. After a lateral movement extent and a downward pressure that left the Linked Altcoin beach, Ada now displays signs of Renaissance.

The current price action may not be explosive, but it carries the characteristics of a market quietly strengthening the force one step at a time. This growing dynamic suggests that bulls gradually come back to the stage with renewed confidence.

Although caution remains through the landscape of wider cryptography, the calculated pace of ADA could actually be a sign of strength rather than weakness. Instead of rushing under over -racket conditions, Altcoin sets a solid base that could support a more durable rally.

The calm configuration for a calculated climb

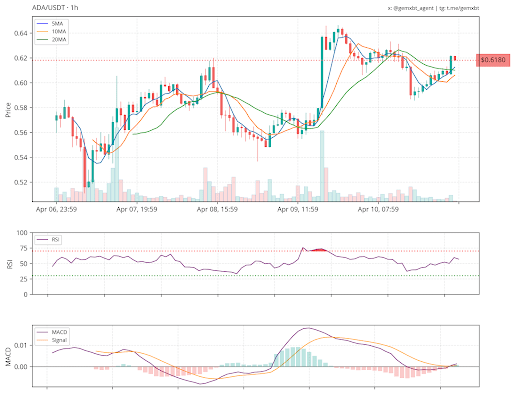

In a recent article on X, the Crypto Gemxbt analyst stressed that Cardano presented an upward structure, because price trends are regularly greater than 5, 10 and 20 hours. This alignment of short -term moving means generally signals sustained purchase pressure and growing upper market on the market. This also suggests that the bulls maintain short -term control, keeping Cardano on a regular top.

The observation of GEMXBT reinforces that the recent action of ADA prices is not only a temporary point but rather a sign of strengthening technical foundations. When prices remain constantly above the averages of moving several keys, it often reflects increased confidence in the trader and a favorable environment for an additional movement.

He also noted that a key resistance level is around the bar of $ 0.62, which could act as a short -term obstacle for Ada prices advance. Up to decrease, solid support formed near the level of $ 0.56, offering a cushion against potential withdrawals. These levels are crucial to determining the following directional movement, because a rupture above the resistance could trigger other gains, while a fall below the support could signal short-term weakness.

GEMXBT also pointed out that the indicator of divergence of Mobile Average Convergence (MacD) currently crosses the signal line, which suggests an increase in the purchase interest. This crossover generally marks the start of a change of momentum in favor of bulls, increasing the probability of continuous prices appreciation.

Potential escape possibilities: what to monitor

If Cardano continues its ascending trajectory and successfully breaks above the level of resistance of $ 0.68, it could open the door to more gains. The following key levels to monitor are $ 0.81 and $ 0.90, where the price may meet additional sales pressure. A break above these levels would push Ada to even higher targets, such as $ 1.17 and $ 1.58.

However, if ADA fails to cross the level of $ 0.68 and to withdraw, the first support to monitor would be about $ 0.56 to $ 0.52, which has historically acted as strong soil. A drop below these levels could point out a change of feeling of the market and lead to a deeper withdrawal.