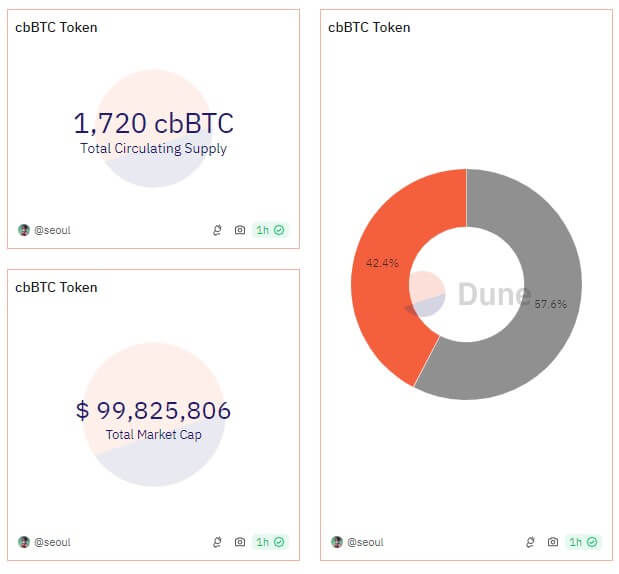

Coinbase’s new wrapped Bitcoin product, cbBTC, saw rapid adoption in its first 24 hours, with a market cap approaching $100 million.

Data from Dune Analytics shows that the circulating supply of cbBTC has reached 1,720 tokens, worth $99.8 million. Of this total, 43% is on Base, while 57% resides on Ethereum.

Growth of Basic DeFi

Industry analysts have noted that the growth of Coinbase’s cbBTC could significantly boost DeFi activities on the exchange’s Layer 2 network, Base.

Moonwell DeFi contributor Luke Youngblood highlighted the impact of the product. He noted that cbBTC’s fungibility with Bitcoin on Coinbase would allow retail BTC holdings exceeding $20 billion and institutional holdings exceeding $200 billion to seamlessly integrate into Base’s on-chain ecosystem.

Nansen CEO Alex Ale also praised the token’s rapid adoption and predicted that it would significantly increase the Base network’s total assets.

He also noted that Coinbase currently holds about 36% of the supply, while market maker Wintermute ranks among the top holders. Svanevik noted:

“(It looks like) Wintermute is the number one market maker. (It will be) a solid business for them.”

FUDs of the Sun cbBTC

Despite cbBTC’s initial success, not everyone is optimistic.

TRON founder Justin Sun has expressed skepticism, calling cbBTC a “central bank BTC” due to its lack of proof-of-reserve audits and potential government intervention.

He said:

“The cbbtc has no proof of reserves, no audits, and can freeze anyone’s balance at any time. Basically, it’s just “trust me.” Any subpoena from the US government could seize all your BTC. There’s no better representation of central bank Bitcoin than this. This is a dark day for BTC.”

Sun also claimed that integrating cbBTC into DeFi could introduce security risks, as government subpoenas could instantly freeze on-chain Bitcoin, compromising decentralization. He said:

“I am friends with many DeFi protocol founders, but integrating cbbtc will pose major security risks to decentralized finance. A single government subpoena could instantly freeze on-chain Bitcoin, making decentralization a joke.

Some have suggested that Sun’s criticism may stem from concerns that Coinbase’s cbBTC could encroach on the market share of BitGo’s WBTC.a project that Sun has ties to. Notably, its involvement with WBTC has sparked debate within the crypto community, as some are now looking for alternatives.