- Stablecoin entries and open interests have suggested increasing speculative confidence in sui

- Liquidations reset the leverage when the funding rates turned to positive, alluding to the bullish momentum

Sui (sui) Recorded the highest stable entries among all blockchains in the past 24 hours, with a net increase of $ 6.1 million. These net entries have coincided with most channels like Ethereum, Solana and the BNB chain which saw notable outings – a sign of potential capital rotation.

Such a Stablecoin movement to Su sur has alluded to growing demand and a hike in chain activity.

In addition, stablecoin entries often act like dry powder, ready to be deployed in native assets – adding potential increase. Consequently, this wave of liquidity could reflect the confidence of investors from the short -term perspectives of Sui.

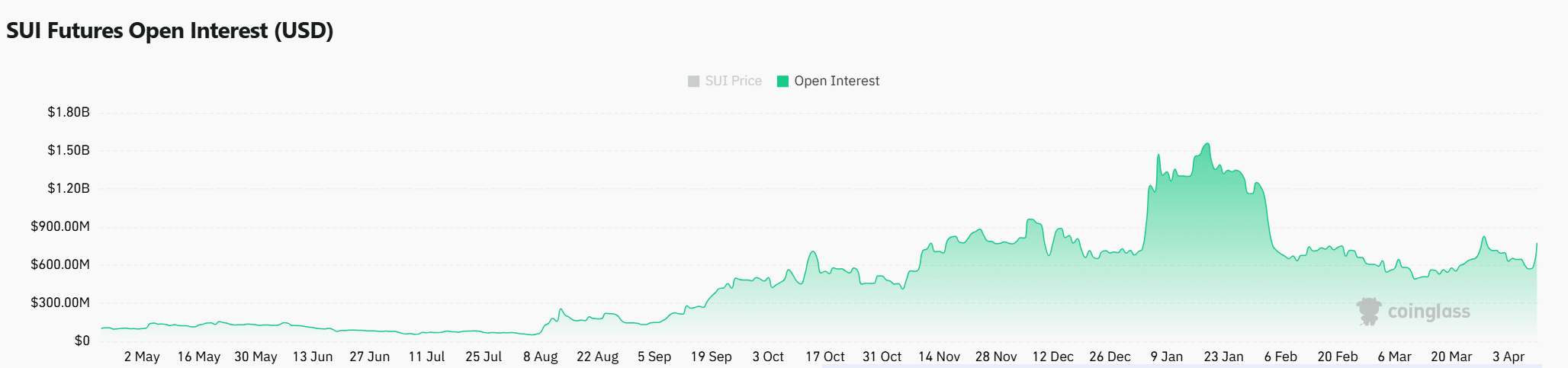

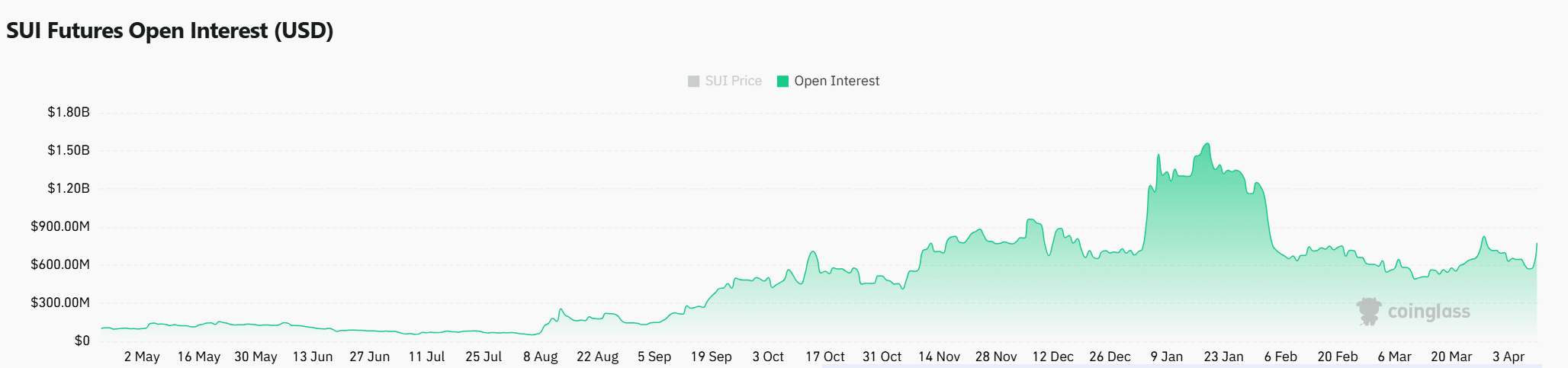

Why does open interest increase quickly?

An open interest on Sui jumped 30.64%, bringing the total to $ 785.35 million. This strong increase has highlighted the aggressive positioning on the derivative market, especially since traders were preparing for the potential price volatility. Unlike punctual entries, open interests reflect speculative intention, traders covering themselves or taking advantage of directional bets.

However, when combined with stable entries on the rise, it generally leans up. Consequently, the jump synchronized in the two measurements could mean that traders expect a decisive decision of Sui in the coming sessions.

Source: Coringlass

Action price Eyes Key Resistance After Handsmart

Suis recently formed a classic cup and handle motif on the daily graphic, a configuration often associated with the bullish continuation. At the time of the drafting of this document, SU was negotiated at $ 2.16, up 12.82% in the last 24 hours. The handle of the pattern seemed to shape in a downward corner, with a clearly marked escape point at $ 2.23.

However, buyers must still secure a solid candle above this level. If Momentum takes place and the price bursts, the following significant objective is at $ 2.80. Consequently, this scheme, combined with an increasing dynamic, could position SUP for a potential trend reversal.

Source: tradingView

Are liquidations and financing rates align with the bullish momentum?

In the past 24 hours, SU has seen $ 860.6,000 long liquidations, against only $ 269.3,000 in shorts. This imbalance suggested that overwhelmed bulls were eliminated, especially on major exchanges like Binance and OKX.

However, liquidation events often act as reset buttons, erase the excessive lever effect and prepare the ground for a more sustainable movement. If the bullish momentum refers post-liquidations, it could support a healthier price cover.

Source: Coringlass

Meanwhile, the weighted funding rate by OI of Sui has become slightly positive at 0.0087% on April 10. This suggests that traders have paid to occupy long positions, strengthening the presence of a bullish feeling despite the recent volatility.

In addition, the recovery of the funding rate after a liquidation scanning often reflects renewed confidence among market players. Therefore, if funding and entries remain high, Altcoin can be positioned for another step.

Conclusion

At the time of writing the editorial’s moment, followed showed several promising signs that suggested that a break could train. The combination of strong stablecoin entries, the rise in open interests, recovery of funding rate and a bullish cup and a manipulation model also highlighted the growing market confidence.

However, the price has not yet confirmed a decision of more than $ 2.23 – a level of critical resistance. Therefore, although the configuration can be constructive, confirmation is essential before calling a final break.